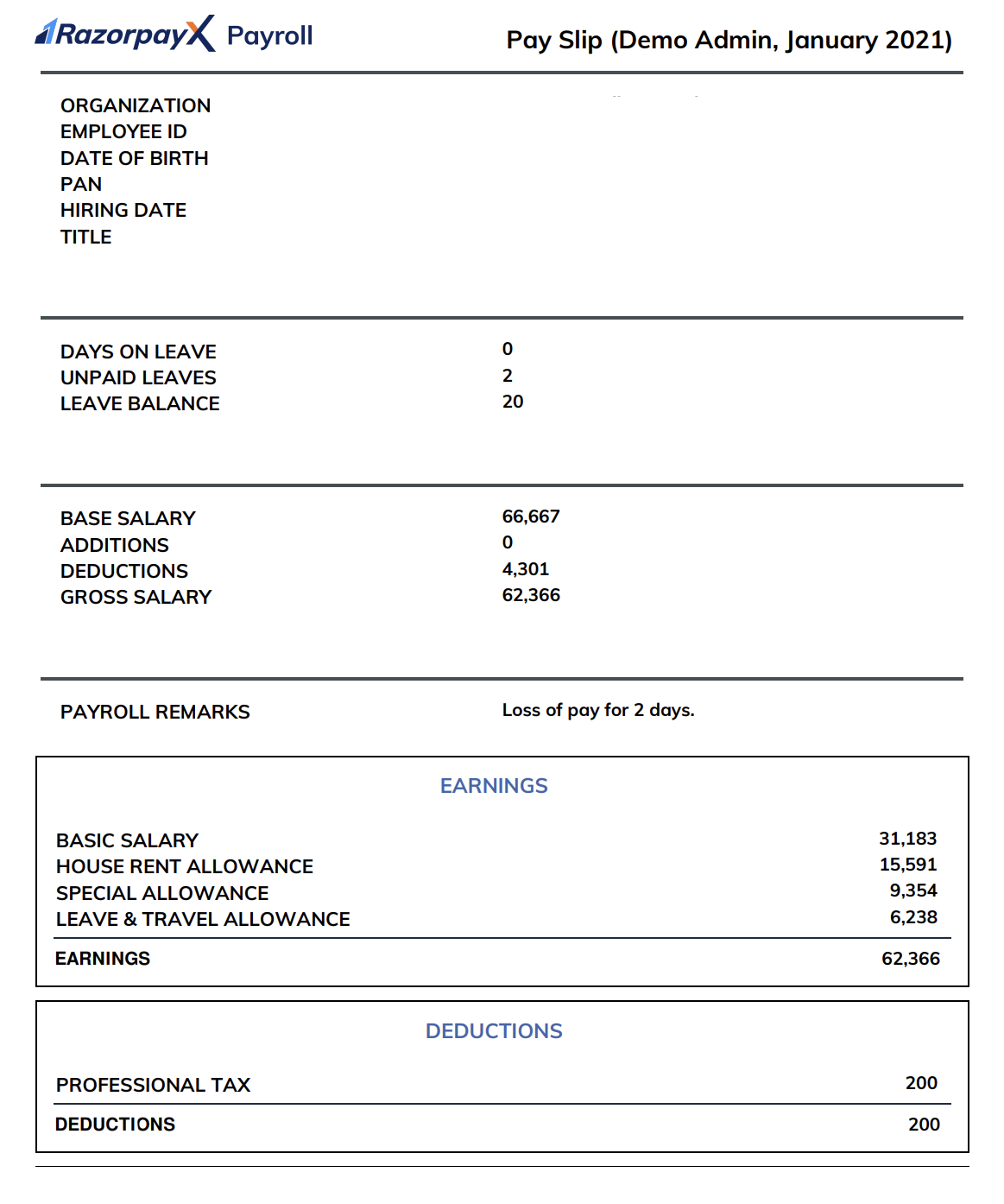

Does Annual Salary Include Allowances Gross salary includes the basic salary and allowances before deductions like professional tax TDS provident fund etc The basic salary is the base income of the fixed component of the whole compensation offered to employees

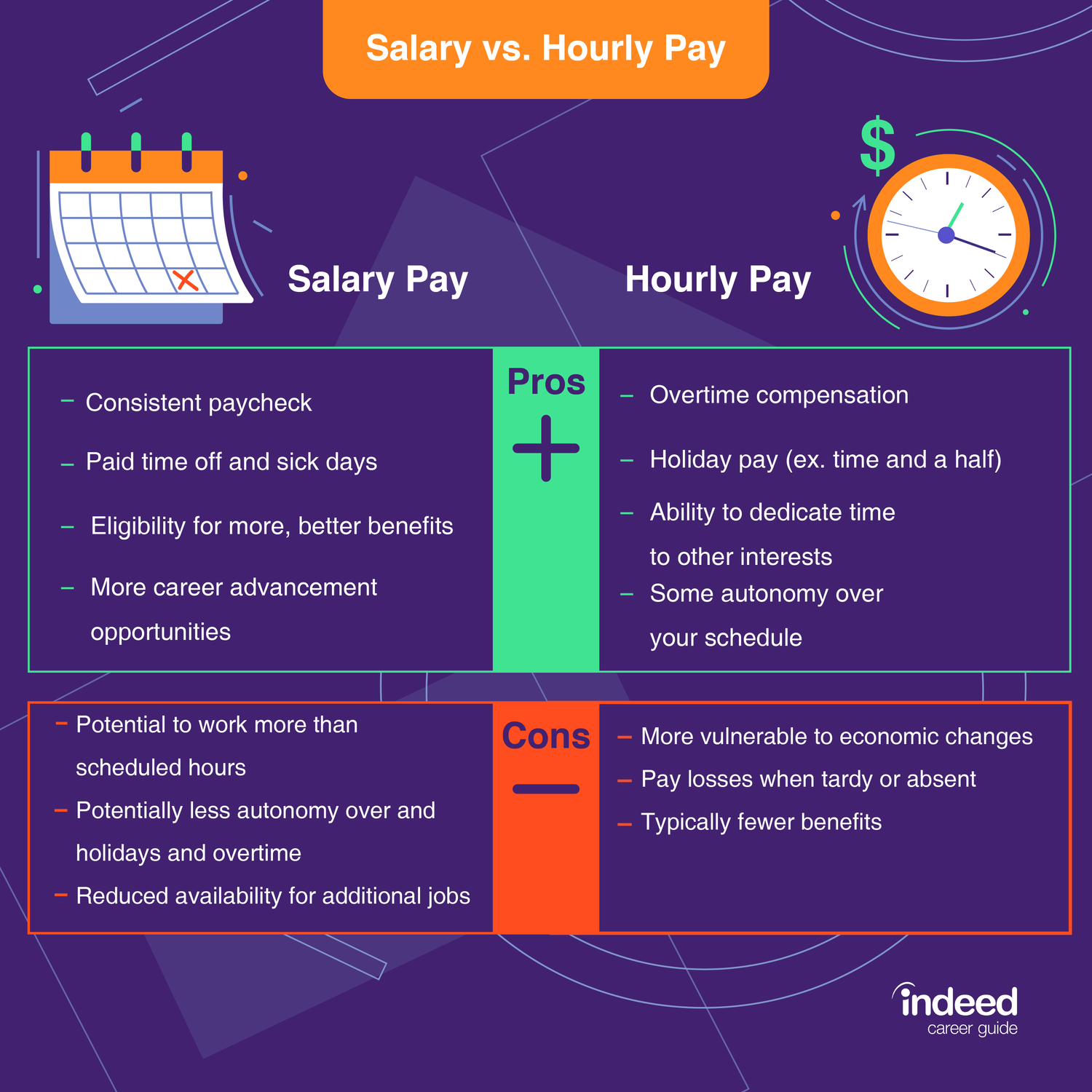

Salary is the fixed regular payment typically paid on a monthly or biweekly basis but often expressed as an annual sum made by an employer to an employee especially a professional or white collar worker Allowance on the other hand refers to a sum of money allotted regularly often for a specific purpose such as a travel or food expense and is not necessarily payment for work done Hi everyoneI 39 m in sales line currently being paid base salary and allowance petrol phone For example basic is 2400 Allowance is 750 So in future if I wanna change to desk job basic salary Will my allowance be considered and included as basic salary Like 2400 750 3150 Means I try to ask for 3500 next job Instead of asking from basic 2400 to 2800 Thanks in advance

Does Annual Salary Include Allowances

:max_bytes(150000):strip_icc()/WitholdingAllowance_INV-93a2e67b5dd84226a71523911b15bd2f.jpg)

Does Annual Salary Include Allowances

https://www.investopedia.com/thmb/ir5kVr8f_oN8F5r2yFCS072xrms=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/WitholdingAllowance_INV-93a2e67b5dd84226a71523911b15bd2f.jpg

Base Salary and Your Benefits Package | Indeed.com

https://images.ctfassets.net/pdf29us7flmy/c4d34bba-1dea-58d3-92ff-a535afb52613/6f00aee571b46a8818e7a4ceed3f9dfd/resized.png

Gross Salary Simplified: Meaning, Components & Calculation - RazorpayX Payroll

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2021/02/Screenshot-2021-03-04-at-4.20.13-PM.png

These allowances can vary widely depending on the organization industry and specific terms of employment They are often provided to compensate employees for certain expenses hardships or as incentives for specific tasks or roles Common types of salary allowances include 1 Housing Allowance 2 Transport Allowance 3 Meal Allowance 4 How many tax allowances should you claim on IRS form W 4 It all depends on your own tax situation as well as what is deemed your tax liability How many allowances you are eligible for can also change over time While the process of figuring out how many allowances you should claim can feel overwhelming we are here to help

Allowances These can include housing transport or other benefits depending on the employment contract Deductions such as taxes health insurance and employee contributions to retirement plans are not included in the gross salary Annualised salaries or annualised wage agreements are commonly used by employers to simplify the wage payment process for employees that would otherwise be paid under a Modern Award

More picture related to Does Annual Salary Include Allowances

Can someone pls help me to find the in-hand salary... | Fishbowl

https://dslntlv9vhjr4.cloudfront.net/posts_images/tu0HgLmo4Gevu.jpg

Employee compensation in the United States - Wikipedia

https://upload.wikimedia.org/wikipedia/commons/0/0f/Wages_in_the_United_States.webp

:max_bytes(150000):strip_icc()/salaries-and-benefits-of-congress-members-3322282-v3-5b5624da46e0fb0037e1976a.png)

Salaries and Benefits of US Congress Members

https://www.thoughtco.com/thmb/4wzW7vTaXzjbcjk_61WkkDzzNcg=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/salaries-and-benefits-of-congress-members-3322282-v3-5b5624da46e0fb0037e1976a.png

Allowances and deductions are essential elements of an employee s salary structure influencing both take home pay and overall job satisfaction These components ensure compliance with statutory requirements while offering financial benefits to employees 02 Checking your contributions against the annual allowance When working out how much of your annual allowance you have used for a particular tax year you need to include all contributions made by you your current employer or someone else to any pension plans or schemes you belong to This includes

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/presidents-salary-4579867-2022-3436207244a34c4fb2277161a9f923c4.jpg)

How Much Does the President Make During and After Office?

https://www.thebalancemoney.com/thmb/QnWbBW-6swWkeJ4FpNRkCP3s07o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/presidents-salary-4579867-2022-3436207244a34c4fb2277161a9f923c4.jpg

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

Allowance for Doubtful Accounts: Methods of Accounting for

https://www.investopedia.com/thmb/1Uhb-KF8ngEOBgDEOcGeKZMMH-U=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png

Does Annual Salary Include Allowances - How many tax allowances should you claim on IRS form W 4 It all depends on your own tax situation as well as what is deemed your tax liability How many allowances you are eligible for can also change over time While the process of figuring out how many allowances you should claim can feel overwhelming we are here to help