Does A Single Member Llc Pay Franchise Tax In Texas See Franchise Tax Rule 3 586 for a list of some activities considered to be doing business in Texas Entities Not Subject to Franchise Tax The following entities do not file or pay franchise tax sole proprietorships except for single member LLCs

Updated May 5 2022 Texas single member LLC filing requirements include paying a franchise tax and possibly state employment taxes Single member LLCs in Texas are not required to file an annual report Introduction to Texas Single Member LLCs The Texas secretary of state will charge a one time fee of 300 8 10 if you pay with a credit card to register an LLC No annual maintenance costs There are no annual fees to keep LLC in good standing The LLC does have to pay a franchise tax if it has substantial revenue the franchise tax threshold changes

Does A Single Member Llc Pay Franchise Tax In Texas

Does A Single Member Llc Pay Franchise Tax In Texas

https://www.signnow.com/preview/585/610/585610015/large.png

What s A Single Member LLC How Do I Pay Myself As The Owner Of One

https://www.deskera.com/blog/content/images/2022/03/Untitled-design--40-.png

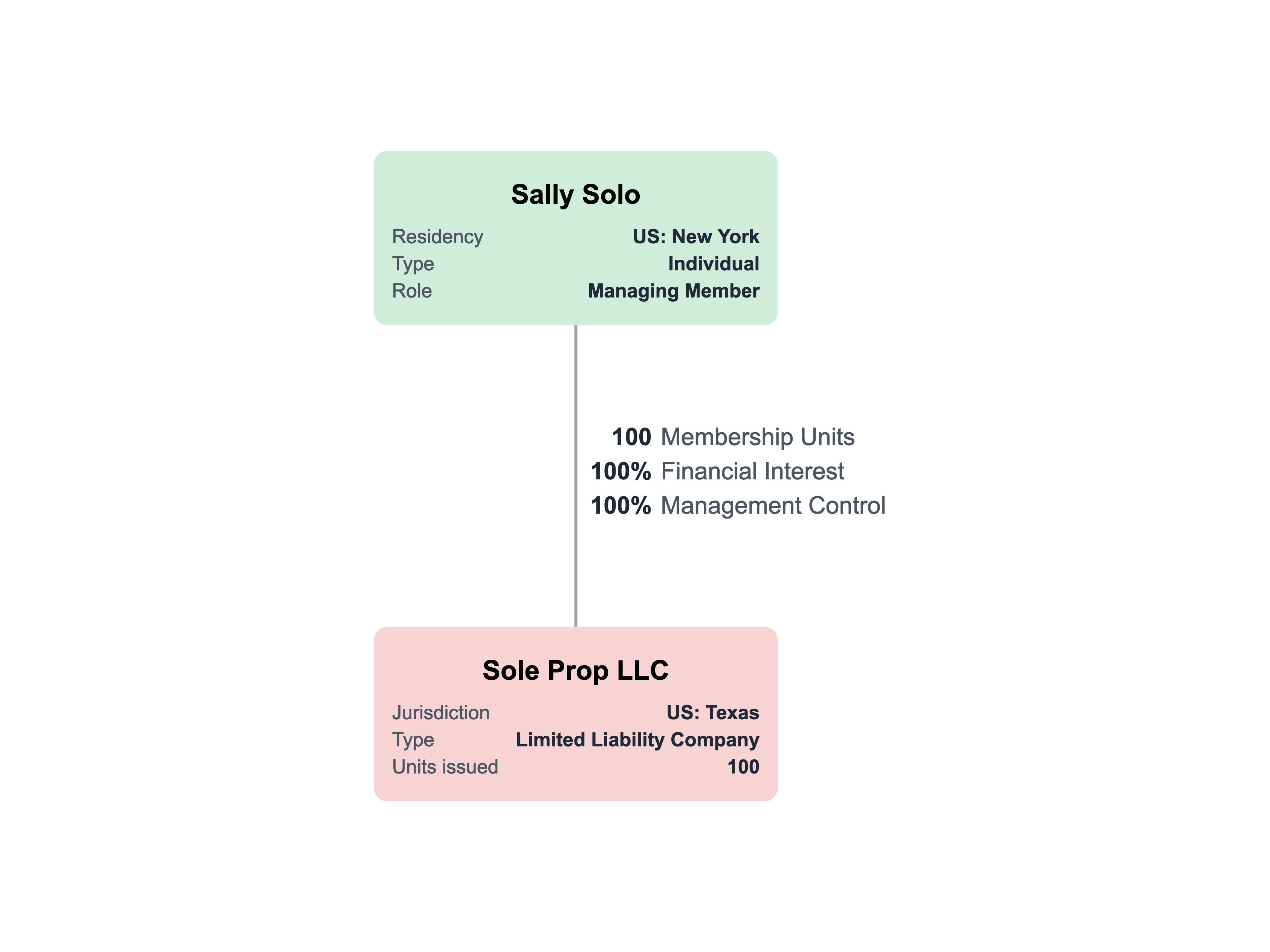

Single Member LLC Org Chart Template

https://lexchart.com/content/images/size/w1750/2022/08/llc-single-member_4x3-1.png

What is the franchise tax rate Most LLCs don t pay franchise tax but still have to file Here are the 2 most common scenarios for Texas LLCs Most LLCs fall into this 1st category Established LLCs fall into this 2nd category SHARE Deal alert Northwest will form your LLC for 39 60 discount See details A single member LLC that is a disregarded entity that does not have employees and does not have an excise tax liability does not need an EIN It should use the name and TIN of the single member owner for federal tax purposes

According to Porter States will tax an LLC relative to the amount of sales payroll or assets that are owned in that state In other words if federal income is 100 and the company has 50 Tax Conclusion There are several different types of taxes that an LLC operating in Texas may need to pay including franchise tax sales tax and employer related taxes such as Social Security Medicare taxes FUTA and SUTA

More picture related to Does A Single Member Llc Pay Franchise Tax In Texas

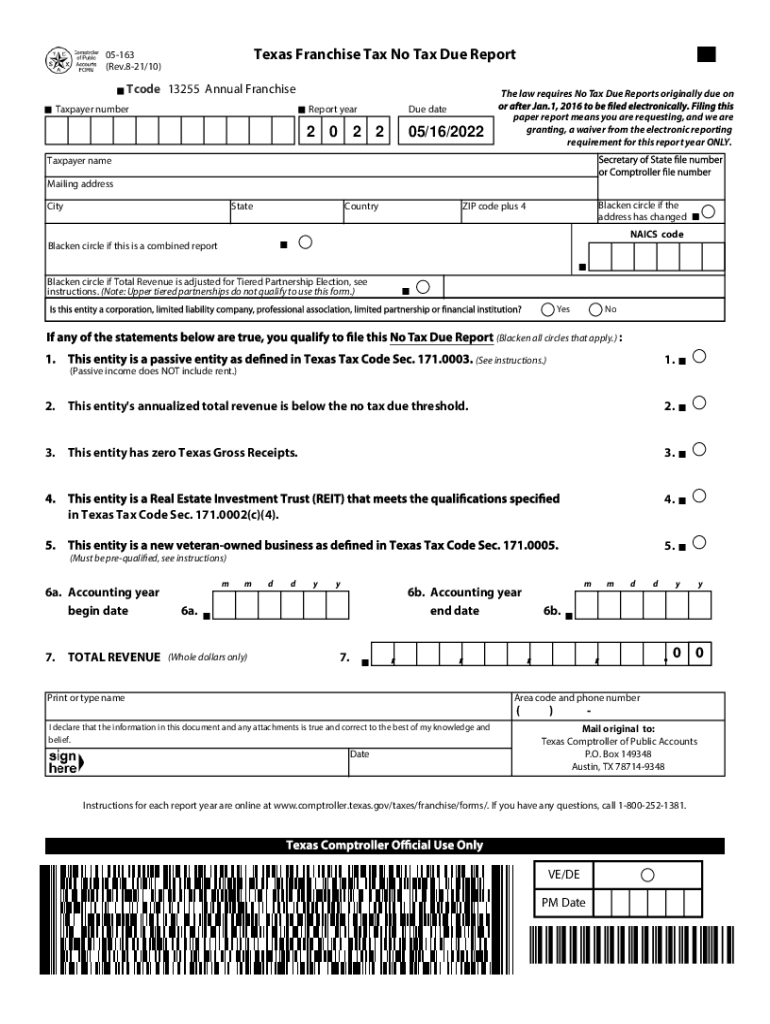

How To File Texas Franchise Tax No Tax Due Report

https://i.pinimg.com/originals/3e/98/d1/3e98d18e23331bba7376cc1df4846084.jpg

How To Pay Franchise Tax In Delaware 10 Steps with Pictures

https://www.wikihow.life/images/thumb/8/8a/Pay-Franchise-Tax-in-Delaware-Step-5-Version-2.jpg/aid2415890-v4-728px-Pay-Franchise-Tax-in-Delaware-Step-5-Version-2.jpg

Employment Tax Liability And Disregarded Entities

https://info.wealthcounsel.com/hs-fs/hubfs/blog/10-2016/AdobeStock_93977019.jpeg?width=3072&name=AdobeStock_93977019.jpeg

Texas imposes a franchise tax on taxable entities for the privilege of doing business in the state The franchise tax is calculated based on the LLC s revenue with some sort of deduction The franchise tax must be paid by any entity that meets the threshold for that year For example in 2022 and 2023 the threshold was 1 23 million Despite being one of only nine states in the US to not impose state income tax Texas does enforce a statewide franchise tax that functions more like an income tax for businesses in practice This privilege tax which is levied against businesses earning more than 1 23 million in annual revenue is applied at a rate of 0 375 for

Texas LLC Taxes Texas LLCs are taxed as pass through entities by default which means that the LLC itself doesn t pay income tax Instead the profits and losses of the LLC are passed on to the LLC owners called members and reported as income on their individual tax returns 32 101 et seq must pay the minimum franchise tax currently 150 No SPECIAL REPORT STATE TAX NOTES JANUARY 8 2018 157 California Yes a LLC LLP pays tax on but no tax on single member LLC SMLLC owned by another entity subject to tax in the District 250 minimum or on professional firms where 80 of income

Why Does My Single Member LLC Need An Operating Agreement YouTube

https://i.ytimg.com/vi/ucb4o2sooCU/maxresdefault.jpg

LLC Taxation Options Which Is Best For Your Business Venn Law Group

https://vennlawgroup.com/wp-content/uploads/2023/04/LLC-Taxation-Options-Blog-Image-792x1024.jpeg

Does A Single Member Llc Pay Franchise Tax In Texas - According to Porter States will tax an LLC relative to the amount of sales payroll or assets that are owned in that state In other words if federal income is 100 and the company has 50