Do State Employees Pay Into Social Security Disability In 2018 one quarter of state and local government employees approximately 6 5 million workers were not covered by Social Security on their current job The Social Security Act of 1935 excluded all federal state and local government employees from coverage because of constitutional ambiguity over the federal government s authority to impose Federal Insurance Contributions Act payroll

However only people who receive a pension based on work not covered by Social Security may see benefit increases Most state and local public employees about 72 percent work in Social Security covered employment where they pay Social Security taxes and are not affected by WEP or GPO State and local government employees may be covered for Social Security and Medicare either by mandatory coverage or under a Section 218 Agreement between the state and the Social Security Administration Under some circumstances an employee may be excluded from Social Security or Medicare or both Some employers may not properly apply the terms of coverage to their employees This leads to

Do State Employees Pay Into Social Security Disability

Do State Employees Pay Into Social Security Disability

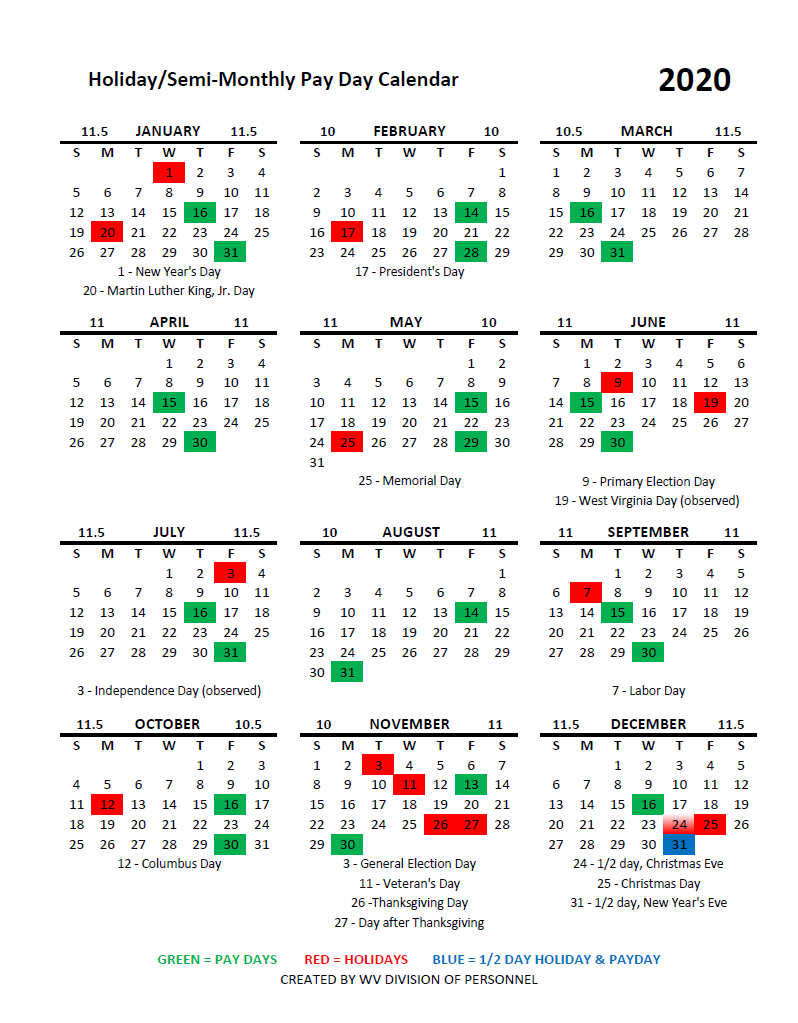

https://payrollcalendar.net/wp-content/uploads/2020/10/State-of-West-Virginia-Payroll-2020.png

Social Security Max 2024 Withholding Rate Dacey Dorette

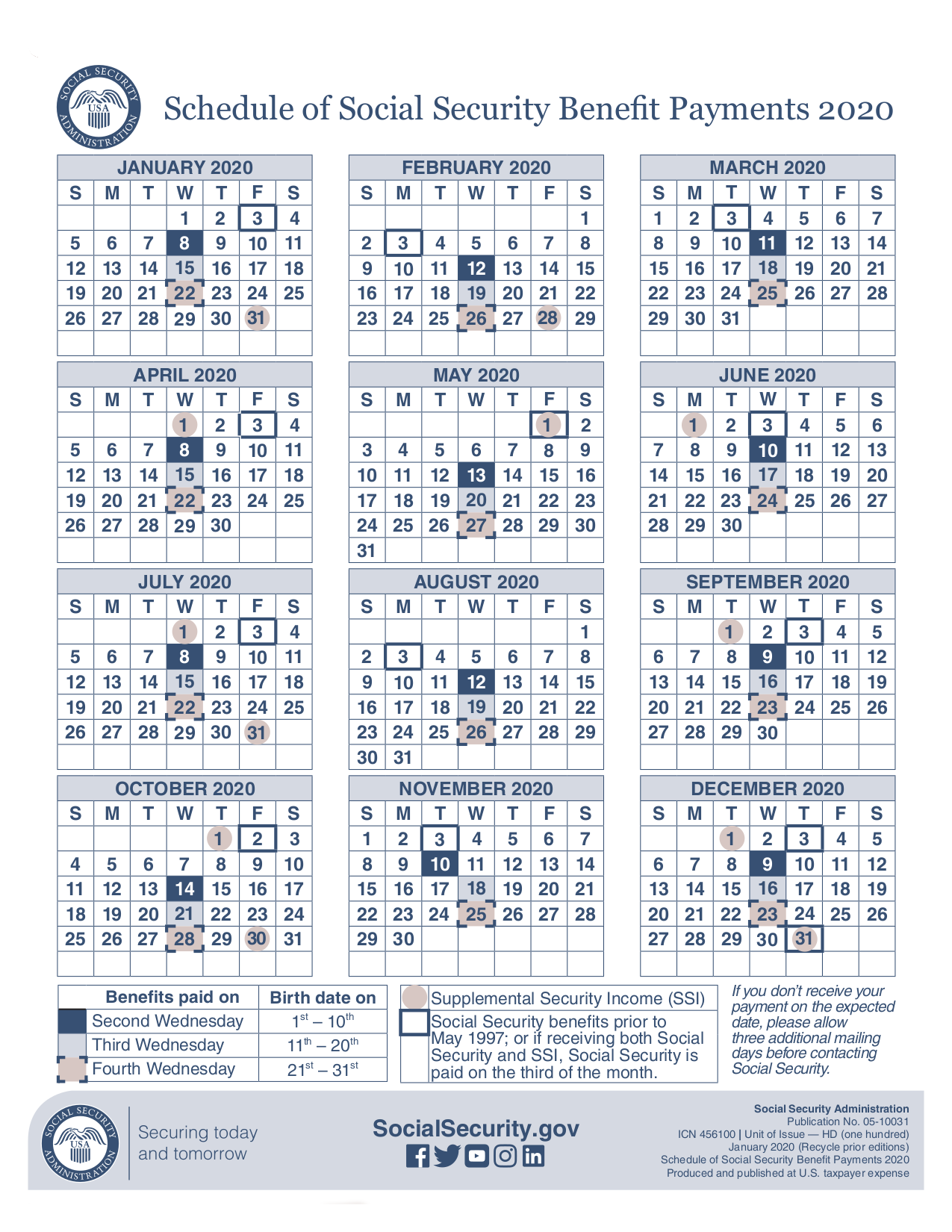

https://i.pinimg.com/originals/33/55/6b/33556ba693ff68b3c911e28dfacf40c0.png

Social Security March 2025 Payments Eden Sanaa

https://brendanconley.com/wp-content/uploads/2020/09/Social-Security-Disability-2020.png

The classes of state or local government employees listed below do not pay into Social Security These employees will participate in Medicare unless they have continuous employment with the same employer since March 31 1986 Some federal state or local government employees don t pay into the Social Security system Learn more here

If you re eligible to receive a pension from an employer s who didn t withhold Social Security taxes from your earnings the Windfall Elimination Provision WEP and Government Pension Offset GPO may reduce your Social Security benefit For example teachers and most safety personnel such as firefighters and police officers don t pay into Social Security About one fourth of public employees do not pay Social Security taxes on the earnings from their government jobs Historically Social Security did not require coverage of government employment because some government employers had their own retirement systems In addition there was concern over the question of the federal government s right to impose a tax on state governments

More picture related to Do State Employees Pay Into Social Security Disability

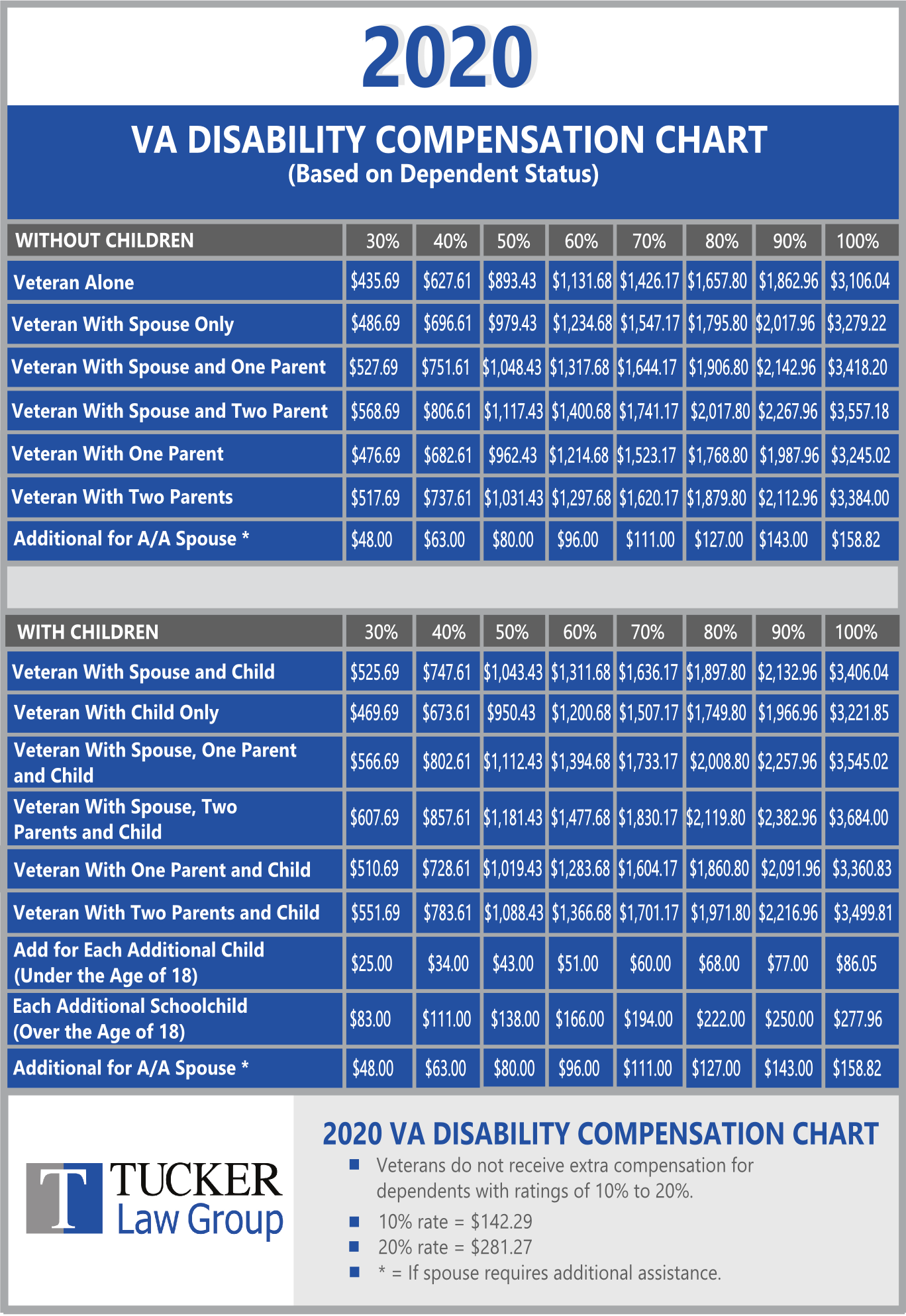

Va Benefits By State 2023

https://tuckerdisability.com/wp-content/uploads/2020/02/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1.png

2025 Va Compensation Rate Tables Imran Gemma

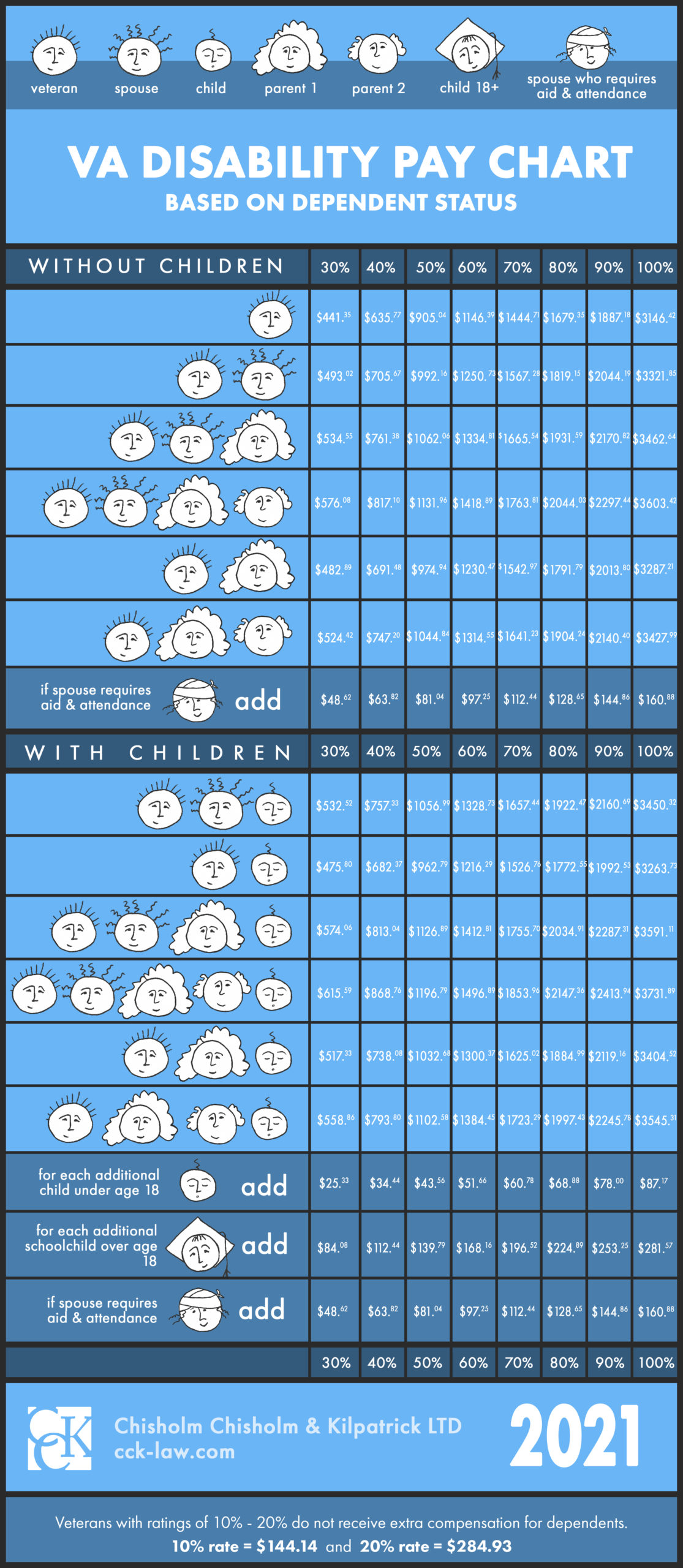

https://i.pinimg.com/originals/6a/b7/51/6ab751f3fda67136e4521bd069913c7b.jpg

2025 Va Compensation Rate Tables Imran Gemma

https://military-paychart.com/wp-content/uploads/2020/12/2021-va-disability-pay-chart-and-rates-cck-law.jpg

If you receive a public pension from the government you can now collect full Social Security benefits as well as your pension due to the Social Security Fairness Act Both employers and employees who do not participate in Social Security do not pay the Social Security portion of the FICA tax 6 2 percent of payroll each Public pension benefits for non Social Security eligible employees usually are higher than those of other public employees to compensate for the absence of Social Security benefits

[desc-10] [desc-11]

2025 Va Disability Pay Chart Lila Mariyah

https://vaclaimsinsider.com/wp-content/uploads/2022/10/2023-VA-Disability-Pay-Chart-2048x1229.jpg

Va Salary Scale 2023

https://www.dmeinterns.org/wp-content/uploads/2020/03/C86BA657-2D79-4FE0-8020-59CBE78047E8_1_201_a-2.jpeg

Do State Employees Pay Into Social Security Disability - If you re eligible to receive a pension from an employer s who didn t withhold Social Security taxes from your earnings the Windfall Elimination Provision WEP and Government Pension Offset GPO may reduce your Social Security benefit For example teachers and most safety personnel such as firefighters and police officers don t pay into Social Security