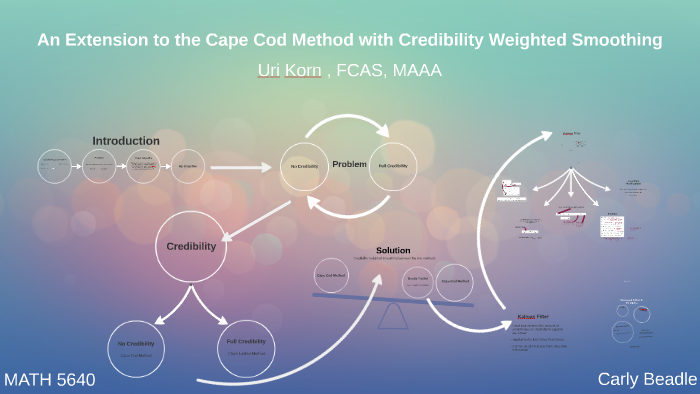

Cape Cod Method Example Central to this paper is the recently introduced Generalized Cape Cod method Many of these best practices have been shown to lead to minimum bias results The best estimate therefore will be the outcome of following the framework contained in this paper Keywords Reserving IBNR Generalized Cape Cod Chain Ladder Bornhuetter Ferguson

Cape Cod method Create a capeCod object with development triangles for reported and paid claims as well as initial expected claims values generate IBNR using ibnr and compute the unpaid claims estimation with unpaidClaims Estimation of Ultimate Claims Using Development Triangles Additive method Bornhuetter Ferguson method Bornhuetter Ferguson principle Cape Cod method chain ladder method development pattern loss development method loss reserving run off triangle VOLUME 2 ISSUE 1CASUALTY ACTUARIAL SOCIETY85 VarianceAdvancing the Science of Risk 1 Introduction

Cape Cod Method Example

:max_bytes(150000):strip_icc()/terms_c_cape-cod-method_FINAL-96784ca7831a4d96bf9890fa2025a684.jpg)

Cape Cod Method Example

https://www.investopedia.com/thmb/Si-3WT5I0PxP3ycCfev_jeiOwqQ=/750x0/filters:no_upscale():max_bytes(150000):strip_icc()/terms_c_cape-cod-method_FINAL-96784ca7831a4d96bf9890fa2025a684.jpg

An Extension To The Cape Cod Method With Credibility Weighte By Carly

https://0701.static.prezi.com/preview/v2/fw6ivexmwjghzze6eu3sba4rh36jc3sachvcdoaizecfr3dnitcq_3_0.png

M todo De Cape Cod Investor s Wiki

https://investors.wiki/es/covers/cape-cod-method.jpeg

Cape Cod method otherwise called the Stanard Buhlmann method is used in calculating ultimate losses in loss reserves Losses are projected through the Cape Cod method by measuring both loss exposure and loss development that occur in a year There are diverse volume measures that estimate the loss reserves for historical accident years a development pattern for quotas and the parameters 0 1 n with k 0 k k 1 if k 0 else form a development pattern for incremental quotas Furthermore the parameter is the expected ultimate loss ratio which because of Si n E

A stochastic claims reserving model based on the Cape Cod method The Cape Cod method is similar to the Bornhuetter Ferguson the main difference being that in the Cape Cod method the prior estimate of the ultimate claims is calculated from an input exposure measure and the actual claims development using a specified formula 3 3 Benktander Hovinen method BHM 3 4 Cape Cod method 3 5 Extended Complementary Loss Ration method ECLRM 3 6 Other methods 8 2 A credibility approach to the Chain Ladder method 8 3 Example 8 4 Literature c R Dahms ETH Zurich Spring 2021 Stochastic Reserving Last update 26 Apr 2021 6 Bootstrap for CLM

More picture related to Cape Cod Method Example

M todo Cape Cod Investor s Wiki

https://investors.wiki/pt/covers/cape-cod-method.jpeg

Cape Cod Method AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/cape-cod-method/card.png

GI Spring Conference Bootstrapping The Cape cod Method For Reserve

https://surveymonkey-assets.s3.amazonaws.com/survey/512062923/c8b0a227-9e44-49f9-98a8-02fb20703a97.jpg

The Cape Cod method is a prediction method that uses known volume measures v 0 v 1 dots v n the Cape Cod method is equivalent to the loss development method after smoothing the current losses by means of the Cape Cod ultimate loss ratio Example A Smoothed current losses loss development predictors of the future cumulative losses 1 Introduction The Cape Cod CC method was developed by B hlmann Straub Reference B hlmann and Straub 1983 A derivation of the CC method is published in Straub Reference Straub 1988 In the CC method the reserve of an accident year is the product of an estimate of the expected ultimate claim and the estimated still to come factor of the corresponding accident year

The Cape Cod or Stanard Buhlmann Stanard 1985 method is a commonly used technique where the a priori loss ratio is calculated as the weighted average of the chain ladder ultimate loss ratios across all years with the used premium as the weights 1 Introduction After the famous chain ladder method and the Bornhuetter Ferguson method Bornhuetter and Ferguson 1972 the Cape Cod reserving method hereinafter CC method B hlmann and Straub 1983 is one of the methods most used by practicing actuaries for the projection of non life paid or incurred triangles The CC method relies on very few parameters and is hence favored by

Cape Cod Method AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/cape-cod-method/card_3.png

Cleaning Cedar On Cape Cod With The Sullivan Method Dideo

https://d-hn-ca-231.dideo.ir/watermark/a2NjY2JjTFBBSk5rZnYyT1dMWURJV1lnSC9SZ2NzYVZmaWZKL3ZpL2NaNnZtMExxQ3MvSStnOTRvek5mTW1veXcwUTZGVGs1aGltZ2tRTStnRU8xVnVCOEd4L0ZHVVF3cmd5d29LbEszMWU2clVvT2hYZTU1RTF4MVZreC9DekhQSGY5di9WS2JzaGFNRDYxbnBkLzUzUkYwTGMxZEdxUk9NWkkwN3NMbHhmUEN3VDFHOFJkNGVpSVBldjBqRWIrWGlOOHdmY0lwTUc3SWZ6VkVBTkkzNUJHMkFFQjd5RGRRSWVxTTFJbFdNMWdiengwVjVUUk8wMnlLTGlmM3VyTg==

Cape Cod Method Example - A stochastic claims reserving model based on the Cape Cod method The Cape Cod method is similar to the Bornhuetter Ferguson the main difference being that in the Cape Cod method the prior estimate of the ultimate claims is calculated from an input exposure measure and the actual claims development using a specified formula