Can I Do My Own Payroll For Free Step 1 Collect your tax information Before running payroll for the first time you ll need to set up an Employer Identification Number EIN with the Internal Revenue Service IRS Your EIN is a unique number that identifies your business The application is free and you can access it online by mail or by phone

Keep reading for a step by step breakdown of how to do payroll for your business 1 Get An Employer Identification Number EIN To run payroll you ll need to establish an Employer Identification Number EIN for your business as it is illegal to pay employees without an EIN An EIN or business tax ID is a nine digit number used to According to the wage bracket table the tentative withholding amount is 256 Step 3 Next you ll account for additional tax credits like your employee s dependents Look at your employee s W 4 and line 3 of Step 3 This is where your employee claims their dependents

Can I Do My Own Payroll For Free

Can I Do My Own Payroll For Free

https://free-template.co/wp-content/uploads/2022/01/8955583aa7d0c677/payroll-statement-template.jpeg

How To Run Payroll In QuickBooks Online Standard Payroll

https://digitalasset.intuit.com/IMAGE/A4Kg2rw2C/pay-date-employee-toggle-prepare-payroll-standard-payroll.gif

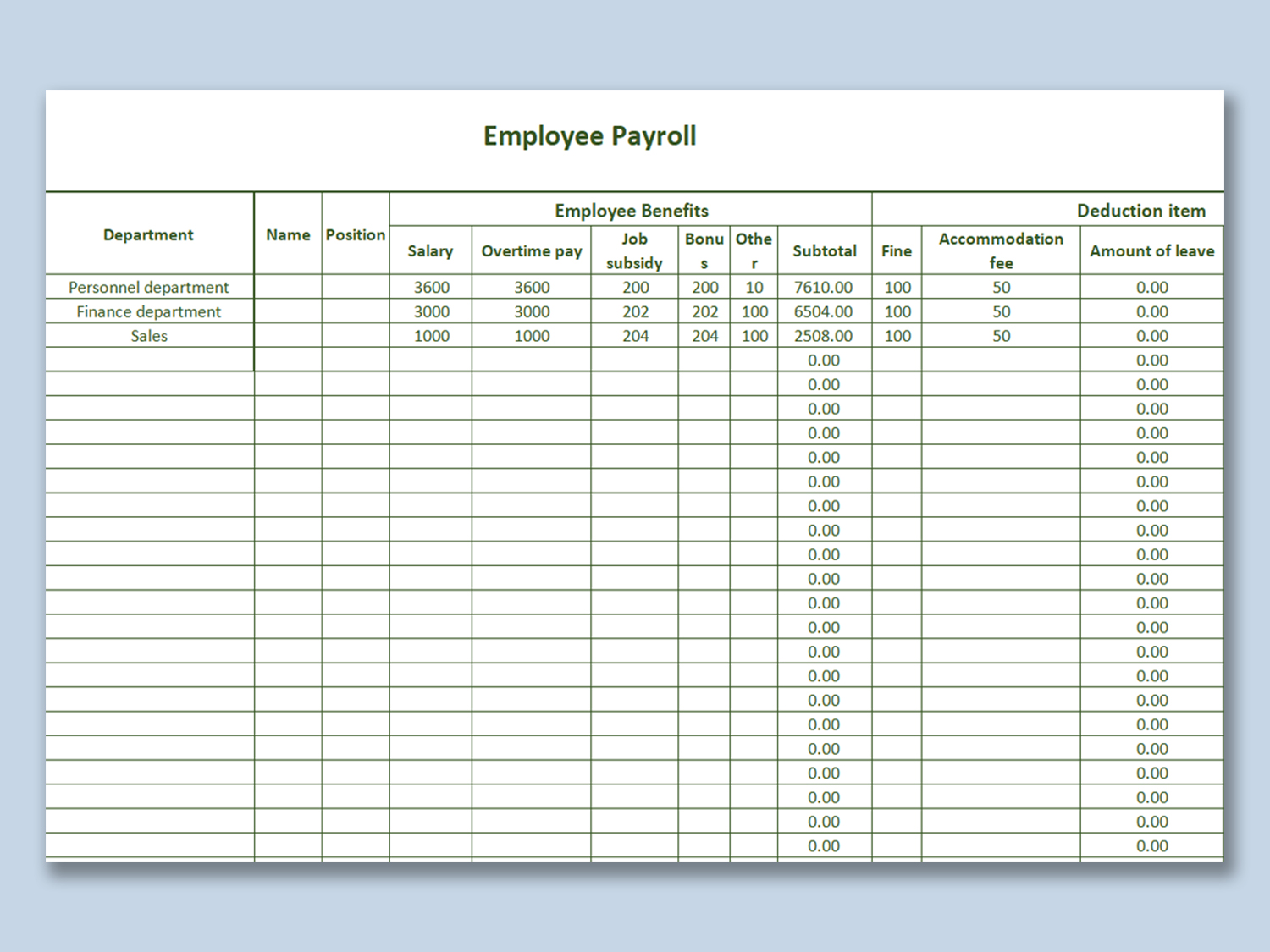

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/1cf53f8084dd3be6/payroll-statement.jpeg

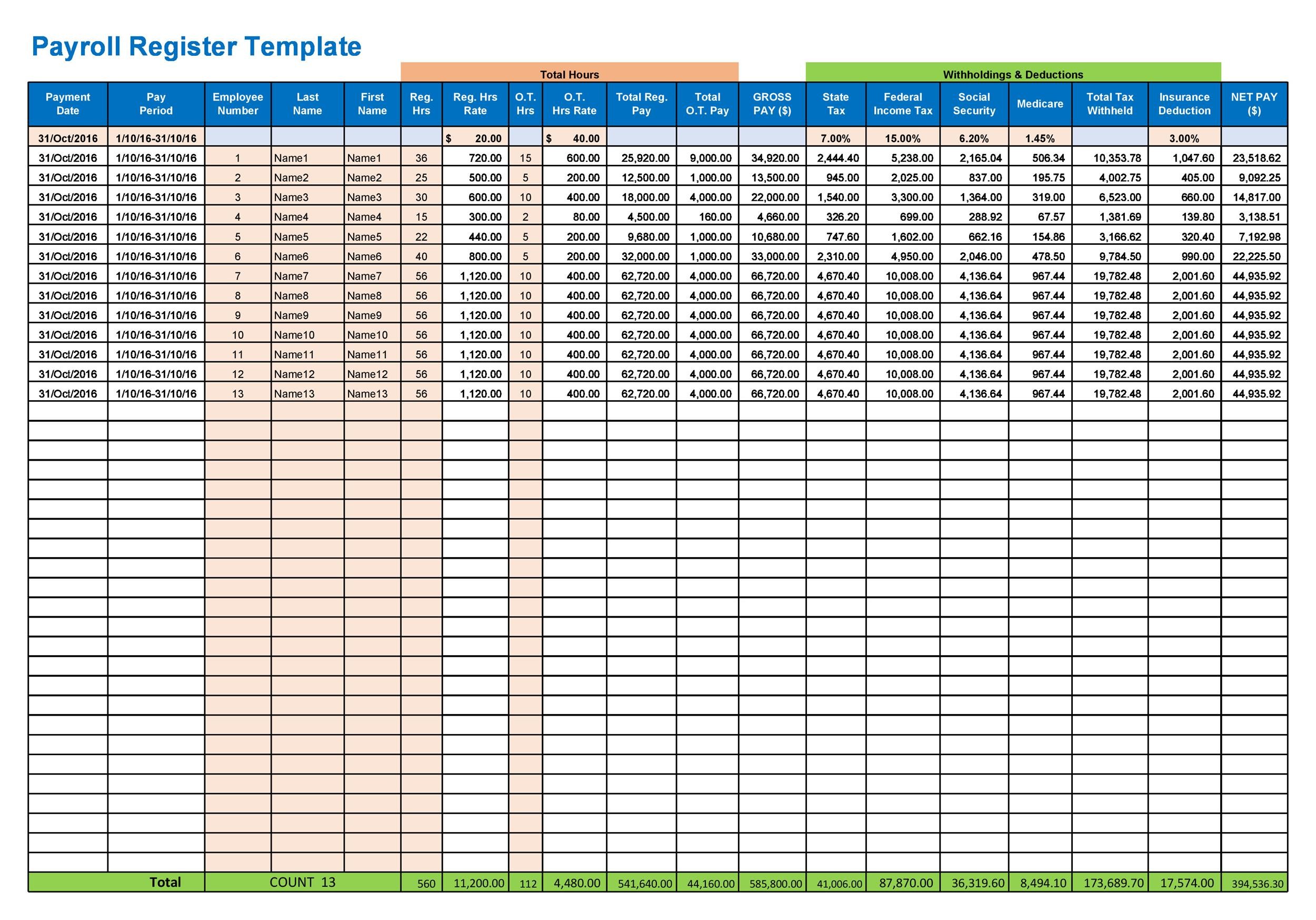

Published Date April 30 2024 Key takeaways To complete payroll manually start by gathering information about each employee s pay benefits deductions and tax witholding Tread carefully You ll also need a thorough understanding of federal state and local labor laws and tax codes You can use a payroll record book spreadsheet or To use a paycheck calculator you simply enter the information on your employee s W 4 You then list the employee s gross wages and select which state you re filing from to calculate state income tax if your state has one which some don t The calculator automatically calculates the amount to deduct 6

For instance let s say an employee has worked 85 hours in a biweekly pay period at a rate of 10 per hour If your standard pay period is 80 hours you would calculate as follows Regular pay 80 hours x 10 800 Overtime pay 5 hours x 15 75 Gross pay 800 75 875 The service works as a partner to a small business It can often save precious resources like time and money Besides leaving you free to run your business a good service will make your payroll accurate and on time This kind of service can do more than handle payroll Other processes these services may cover include Tax withholding Tax filing

More picture related to Can I Do My Own Payroll For Free

Can I Do My Own Payroll Milestone

https://www.milestone.inc/wp-content/uploads/2022/09/Can_I_do_my_own_payroll_-1024x569.jpg

The Comprehensive Guide To Workday Payroll Management System And Its

https://s3.amazonaws.com/contents.newzenler.com/1134/library/60995ab08f294_1620662960_payroll-analytics.jpeg

These Good Payroll Practices Will Get You Through Year end Easier

https://blog.roihs.com/hubfs/Payroll.jpeg#keepProtocol

Get an employer identification number 2 Find out your state s business requirements 3 Understand the difference between independent contractors and employees 4 Determine the payroll Rippling is an easy to use payroll software for small businesses looking to save time and consolidate systems Guaranteed 100 error free payroll set it to run on auto pilot or do it yourself in less than 90 seconds Automated tax and compliance filings with the right federal state and local agencies

Or you can just follow this step by step guide which covers these nine steps Gathering W 4 forms plus your EIN Consulting employee timesheets Creating a payroll schedule Calculating base pay Calculating gross pay overtime PTO and other bonuses Calculating tax withholdings Planning for and make tax payments You can do payroll for your small business yourself if you have the right knowledge time and a sturdy calculator While this is not the recommended option it still is an option When it comes to manual payroll there are three main phases run payroll pay payroll taxes and file quarterly and annual tax forms

Self Employment Ledger Forms Beautiful Printable Payroll Ledger

https://i.pinimg.com/736x/d3/8f/db/d38fdbaf5b96b162a042ab30842629ff.jpg

Can I Do My Own Payroll For My Daycare Business

https://www.childcarebiz.com/assets/components/phpthumbof/cache/can-i-do-my-own-payroll-for-my-daycare-business.76fffd892ab62e070f26dc5b4a962c2e.jpg

Can I Do My Own Payroll For Free - The service works as a partner to a small business It can often save precious resources like time and money Besides leaving you free to run your business a good service will make your payroll accurate and on time This kind of service can do more than handle payroll Other processes these services may cover include Tax withholding Tax filing