Can I Do My Own Company Payroll 3 Hire someone to do it at your business If you d rather keep payroll in house as opposed to outsourcing and onboarding a vendor but don t want to do it yourself you can hire someone to do it at your company or delegate payroll to an existing employee Ideally you would hire someone with payroll experience but you could also train an

Here are the eight essential steps to run payroll on your own 1 Set the Process Up If you are running payroll manually the process will be important to ensure that you don t overlook any Keep reading for a step by step breakdown of how to do payroll for your business 1 Get An Employer Identification Number EIN To run payroll you ll need to establish an Employer Identification Number EIN for your business as it is illegal to pay employees without an EIN An EIN or business tax ID is a nine digit number used to

Can I Do My Own Company Payroll

Can I Do My Own Company Payroll

https://digitalasset.intuit.com/IMAGE/A4Kg2rw2C/pay-date-employee-toggle-prepare-payroll-standard-payroll.gif

Can I Do My Own Payroll Milestone

https://www.milestone.inc/wp-content/uploads/2022/09/Can_I_do_my_own_payroll_-1024x569.jpg

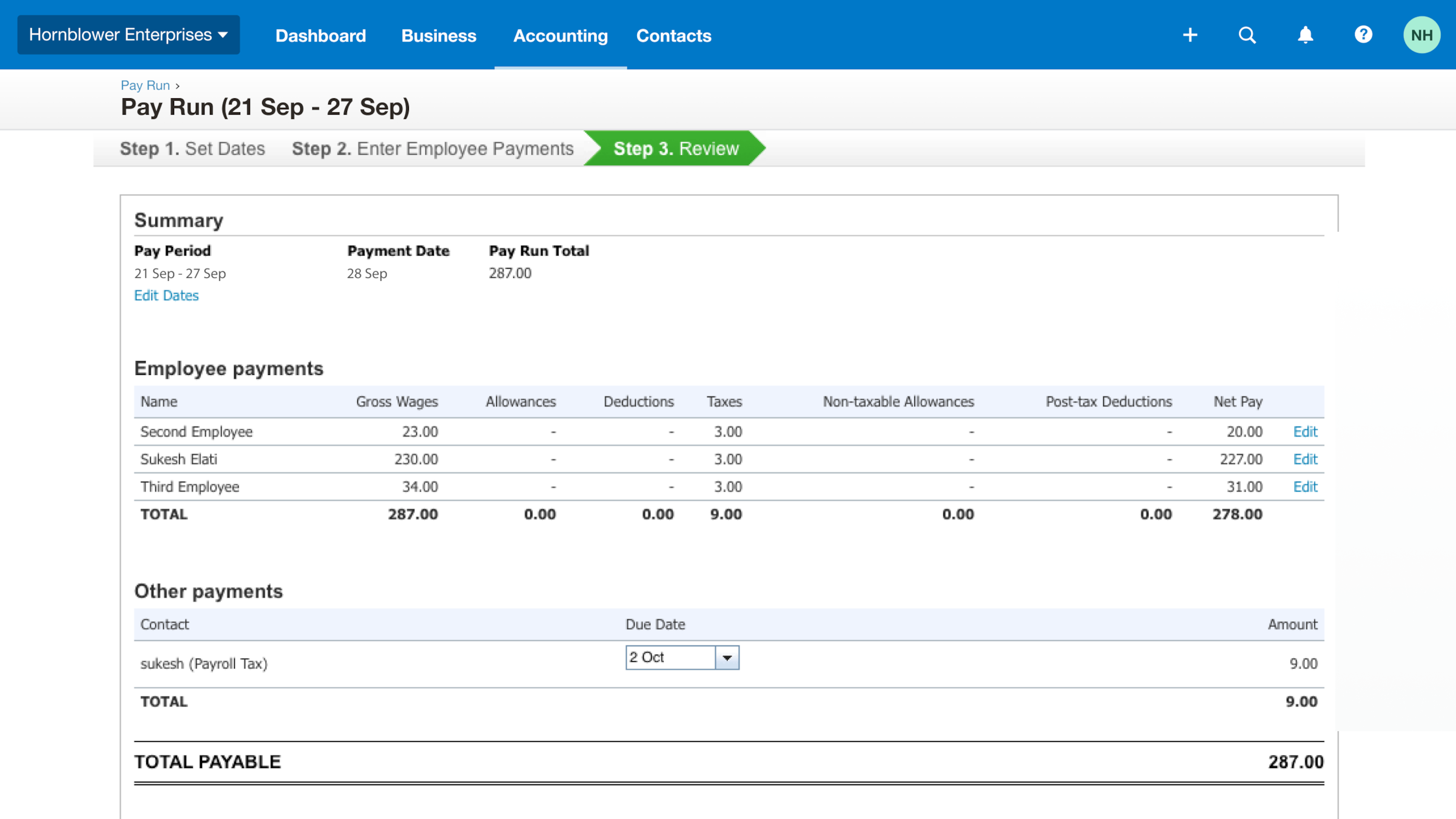

Online Pay Runs Basic Online Payroll Software Xero CA

https://www.xero.com/content/dam/xero/pilot-images/features/payroll/Pay runs - video placeholder.1646877480769.png

Gain confidence in your business future with our weekly simple solutions newsletter 2 Set a pay schedule Once you have an EIN you can start programming your payroll software to pay employees on a regular basis Of course to do so you first need to decide how often you plan to pay employees Get an employer identification number 2 Find out your state s business requirements 3 Understand the difference between independent contractors and employees 4 Determine the payroll

With Square Payroll you can find copies of your tax filings in your dashboard Alternative 2 Hire an accountant Summary Hiring an accountant is the most expensive option but it s reliable If you don t want to learn how to do payroll yourself for your company or use a payroll service consider hiring an accountant Obtain a Federal Employer Identification Number FEIN This is assigned by the IRS and is used to identify a business entity You need this 9 digit number to pay federal taxes hire employees open bank accounts and apply for business licenses and permits You can do this online on the Depending on your business structure and location you

More picture related to Can I Do My Own Company Payroll

5 Occasions When Small Businesses Should Outsource Their Payroll

https://cdn2.hubspot.net/hubfs/2242316/Imported_Blog_Media/payroll.jpg

How To Quickly Start Your Own Business

https://www.hoffman-info.com/wp-content/uploads/2021/01/start-own-business.jpg

Start Your Own Business Corporate Vision Magazine

https://www.corporatevision-news.com/wp-content/uploads/2020/04/Start-Your-Own-Business.jpg

4 Ways To Pay Yourself From an LLC Here are four main ways you can receive payments from your LLC 1 Pay Yourself as a W 2 Employee For many LLC owners the most advantageous way to receive Rippling is an easy to use payroll software for small businesses looking to save time and consolidate systems Guaranteed 100 error free payroll set it to run on auto pilot or do it yourself in less than 90 seconds Automated tax and compliance filings with the right federal state and local agencies

Step 7 Open a payroll bank account Many businesses choose to open a bank account separate from their business account just for the purpose of payroll If you do so use this account only for paying employees and fulfilling tax obligations This will allow you to keep more accurate records of your payroll transactions You can do payroll for your small business yourself if you have the right knowledge time and a sturdy calculator While this is not the recommended option it still is an option When it comes to manual payroll there are three main phases run payroll pay payroll taxes and file quarterly and annual tax forms

The Problem With doing Your Own Research

https://thinkingispower.com/wp-content/uploads/2021/03/Do-you-own-research-cover.png

Bookkeeping FAQs Books In Order

https://www.booksinorder.net.au/wp-content/uploads/2021/12/BIO-Bookkeeping-Accounting-Logo-ColourPNG.png

Can I Do My Own Company Payroll - The service works as a partner to a small business It can often save precious resources like time and money Besides leaving you free to run your business a good service will make your payroll accurate and on time This kind of service can do more than handle payroll Other processes these services may cover include Tax withholding Tax filing