Can Exempt Employees Be Paid Overtime A Computer professional employees who satisfy the applicable duties test may be paid a salary or an hourly wage to qualify for exemption from overtime under the FLSA If you pay an exempt computer professional employee a salary the final rule will require that it meet or exceed the amounts listed above

Unless specifically exempted employees covered by the Act must receive overtime pay for hours worked in excess of 40 in a workweek at a rate not less than time and one half their regular rates of pay There is no limit in the Act on the number of hours employees aged 16 and older may work in any workweek The Act does not require overtime pay Insights for Employers Returning to the question yes you can provide overtime pay to exempt employees based upon an hourly daily or shift rate without jeopardizing their exempt status However you must ensure that the employee still receives a guaranteed salary of at least 455 per week and that the guaranteed salary is

Can Exempt Employees Be Paid Overtime

Can Exempt Employees Be Paid Overtime

https://ml9krkqstdts.i.optimole.com/AdZTnpk.7El0~61403/w:auto/h:auto/q:mauto/https://engageforsuccess.org/wp-content/uploads/2021/10/exempt-employees-1.jpg

Exempt V Non Exempt California Overtime Wages Law Simplified

https://sacemploymentlawyer.com/wp-content/uploads/2016/11/overtime-law.jpg

Can Employees Be Paid Quarterly What Is Quarterly Pay

https://www.patriotsoftware.com/wp-content/uploads/2018/06/can-employees-be-paid-quarterly.jpg

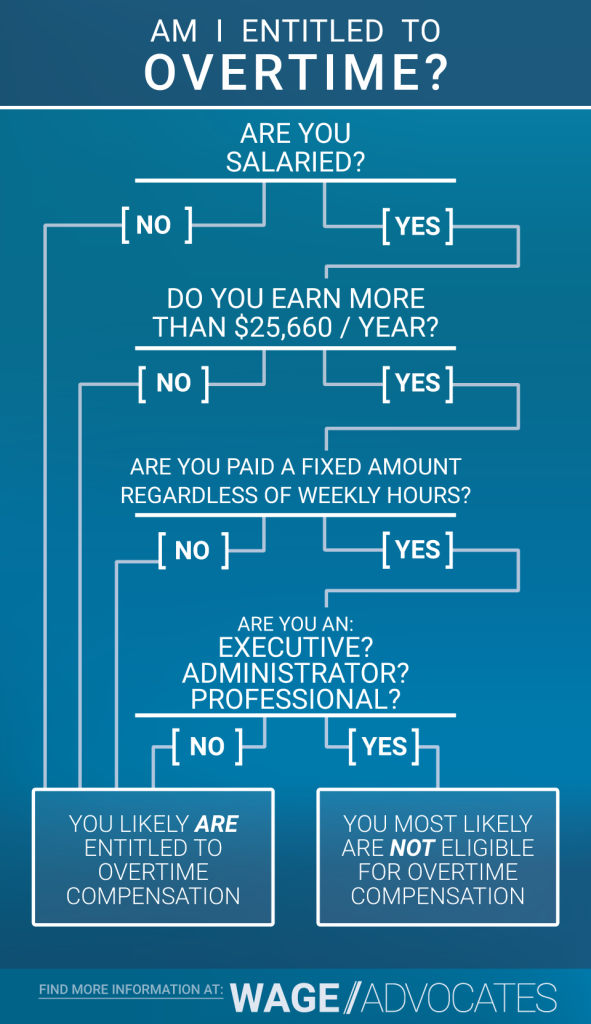

Some workers are specifically exempt from the FLSA s minimum wage and overtime protections including bona fide executive administrative or professional employees This exemption typically referred to as the EAP exemption applies when 1 An employee is paid a salary 2 The salary is not less than a minimum salary threshold amount Exempt employees do not need to be paid for any workweek in which they perform no work If the employer makes deductions from an employee s predetermined salary i e because of the operating requirements of the business that employee is not paid on a salary basis

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one half their regular rates of pay There is no limit in the Act on the number of hours employees aged 16 and older Effective Jan 1 2020 the Department of Labor DOL increased the minimum weekly pay for exempt employees making more people eligible for overtime pay Exempt employees who make less than 684 a week or 35 568 a year must receive overtime pay Non exempt employees are already paid overtime if they work at least 40 hours per week

More picture related to Can Exempt Employees Be Paid Overtime

Salaried Non Exempt Workers In Pennsylvania To Be Paid Time and a Half

https://www.wwdlaw.com/wp-content/uploads/2020/01/01-Salaried-Non-Exempt-Workers-in-Pennsylvania-to-be-Paid-Time-and-a-Half-for-Overtime-1.jpg

Knowledge Work Vs Manual Work The Fair Labor Standards Act Is

https://wholeangel.files.wordpress.com/2021/07/exempt-vs-non-exempt-flsa.jpg?w=1024

What Are The Maximum Hours A Company Can Have An Exempt Employee Work

https://i0.wp.com/lawkm.com/wp-content/uploads/2017/07/shutterstock_492204451.jpg?fit=1000%2C667&ssl=1

Under the FLSA employees are generally required to pay an overtime premium of 1 5x the employee s regular rate of pay per hour if the employee works more than 40 hours per week unless the employee qualifies as exempt from overtime To be exempt from overtime under federal law most workers must qualify as a bona fide executive Overtime Exemptions Under the FLSA The FLSA Section 13 a 1 exemptions are often referred to as the white collar exemptions To be exempt from overtime a position must meet the following

The new overtime rule salary threshold increases to 43 888 on July 1 2024 and increases again to 58 656 as of Jan 1 2025 Unless exempt employees covered by the Fair Labor Standards Act Even if an employee initially satisfies the tests for exempt status you can later jeopardize this classification with improper pay practices Here are 9 mistakes to avoid when paying your exempt employees 1 Docking salary for poor performance such as an employee who failed to deliver an important project on time

Who Is Entitled To Overtime Pay Wage Hour Laws

http://wageadvocates.com/wp-content/uploads/2015/09/SideInfographicAm-I-Eligible-591x1024.png

Know Your Rights Non Exempt Vs Exempt Employees

https://cdn.lifehack.org/wp-content/uploads/2017/04/25032727/non-exempt.001.jpeg

Can Exempt Employees Be Paid Overtime - Employee Coverage FLSA exempt employees as defined in 5 U S C 5541 2 who work full time part time or intermittent tours of duty are eligible for title 5 overtime pay Employees in senior level SL and scientific or professional ST positions who are paid under 5 U S C 5376 are not excluded from the definition of employee in 5 U S C