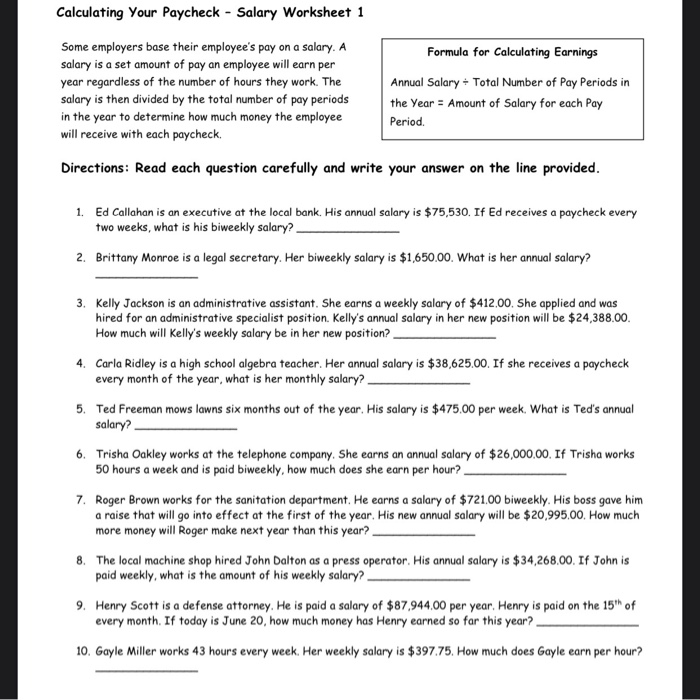

Calculating Your Paycheck Salary Worksheet 1 Quizlet Formula for Calculating Earnings Annual Salary Total Number of Pay Periods in the Year Amount of Salary for each Pay Period Directions Read each question carefully and write your answer on the line provided 1 Ed Callahan is an executive at the local bank His annual salary is 75 530

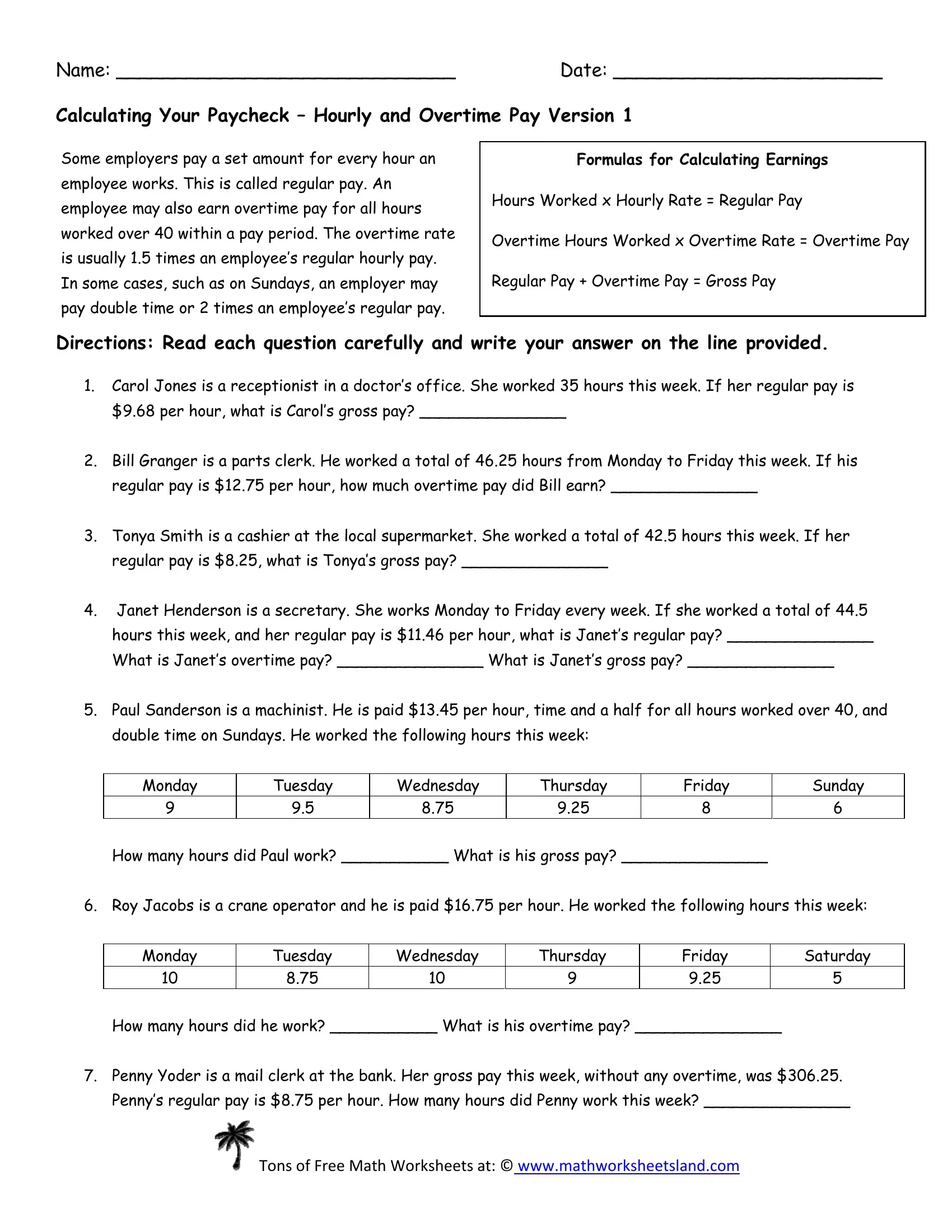

1 Calculating Gross Pay You earned 12 50 per hour and worked a total of 40 hours per week You are paid every 2 weeks You are paid 2 times every month Gross Pay is 1000 per paycheck 2 Gross Pay is what you earned no taxes have been deducted yet 12 50 x 40 hours 500 per week 500 x 2 weeks 1000 per 2 weeks 1 paycheck 3 How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

Calculating Your Paycheck Salary Worksheet 1 Quizlet

Calculating Your Paycheck Salary Worksheet 1 Quizlet

https://o.quizlet.com/qALfJexvFrk1crKVmdkH6g_b.png

Weekly bi Weekly Paycheck Budget Template Printable digital Etsy

https://i.etsystatic.com/13056682/r/il/2db4a0/3287227308/il_fullxfull.3287227308_l5dh.jpg

Calculating Salary Worksheet PDF Form FormsPal

https://formspal.com/pdf-forms/other/calculating-salary-worksheet/calculating-salary-worksheet-preview.webp

For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are Tax rate on taxable income from up to 10 0 10 275 12 10 276 41 775 22

Unlimited companies employees and payroll runs for 1 low price All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and payroll needs If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

More picture related to Calculating Your Paycheck Salary Worksheet 1 Quizlet

Calculating Your Paycheck Salary Worksheet 1 Answers

https://briefencounters.ca/wp-content/uploads/2018/11/calculating-your-paycheck-salary-worksheet-1-answers-with-adams-middle-school-of-calculating-your-paycheck-salary-worksheet-1-answers-768x1024.jpg

Calculating Gross Pay Worksheet

https://media.cheggcdn.com/study/1f8/1f8b432d-5284-4b1d-a49f-7dba79ead1bf/image.png

Calculating Your Paycheck Salary Worksheet 1 Answer Key Reading

https://i.pinimg.com/736x/e6/a0/ed/e6a0edde7d4a04ec281ba06552d73e51.jpg

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions You can enter your current payroll information and deductions and then

Activity duration 45 60 minutes National Standards for Personal Financial Education 2021 Earning income 8 5 8 6 8 7 12 6 12 7 12 9 These standards are cumulative and topics are not repeated in each grade level This activity may include information students need to understand before exploring this topic in more detail Last updated December 1 2023 Calculate the gross amount of pay based on hours worked and rate of pay including overtime Summary report for total hours and total pay Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more

Calculating Gross And Weekly Wages Worksheet Answers Printable Word

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/calculating-straighttime-pay-pdf-1.jpg

How Much Does An Employer Pay In Payroll Taxes Tax Rate

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Calculating Your Paycheck Salary Worksheet 1 Quizlet - For Hourly Employees Your gross income is calculated by multiplying your hourly wage by the number of hours worked For example if you make 20 per hour and work 40 hours per week your weekly gross income would be 800 which is 20 x 40 Additional Earnings If you receive bonuses commissions or overtime pay these are added to your