Calculating Your Paycheck Salary Worksheet 1 Answers Students answers on their worksheets and during discussion can give you a sense of their understanding This answer guide provides possible answers for the Calculating the numbers in your paycheck worksheet Keep in mind that students answers may vary The important thing is for students to have reasonable justification for their

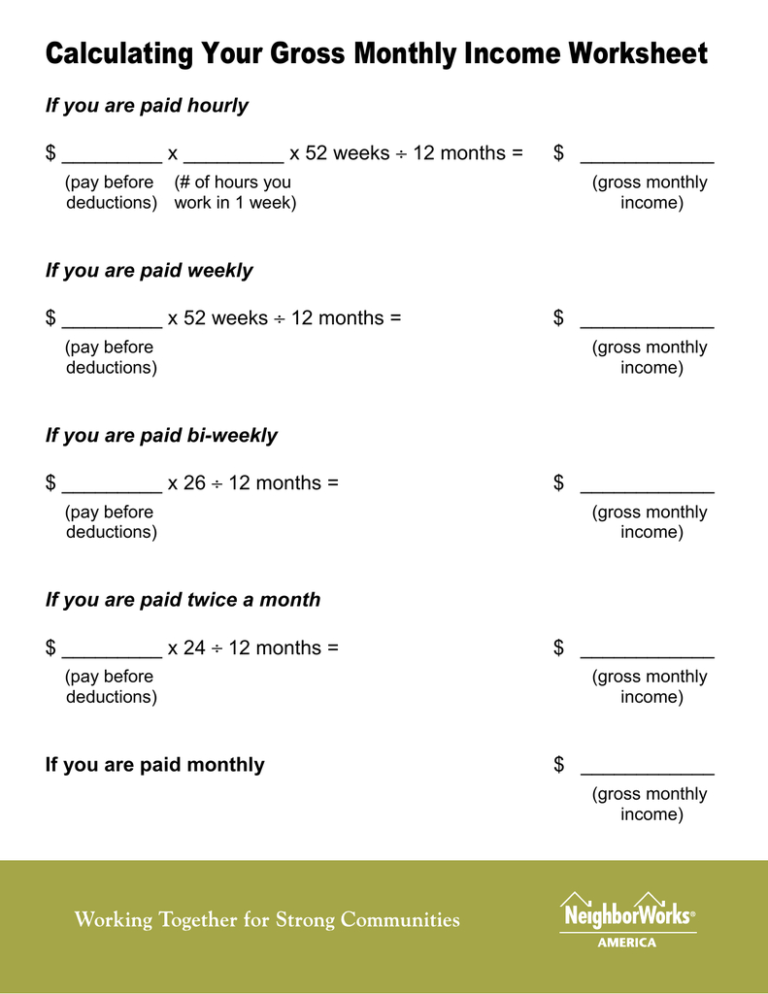

Formula for Calculating Earnings Annual Salary Total Number of Pay Periods in the Year Amount of Salary for each Pay Period Directions Read each question carefully and write your answer on the line provided 1 Ed Callahan is an executive at the local bank His annual salary is 75 530 Description Estimate your Net Take Home Pay using this Paycheck Calculator for Excel Answer questions such as How do the number of allowances affect the federal tax withholdings How much will my take home pay change if I contribute more to my 401 k Update 1 23 2024 Updated tax tables for 2024 The older W 4 worksheets are no longer included

Calculating Your Paycheck Salary Worksheet 1 Answers

Calculating Your Paycheck Salary Worksheet 1 Answers

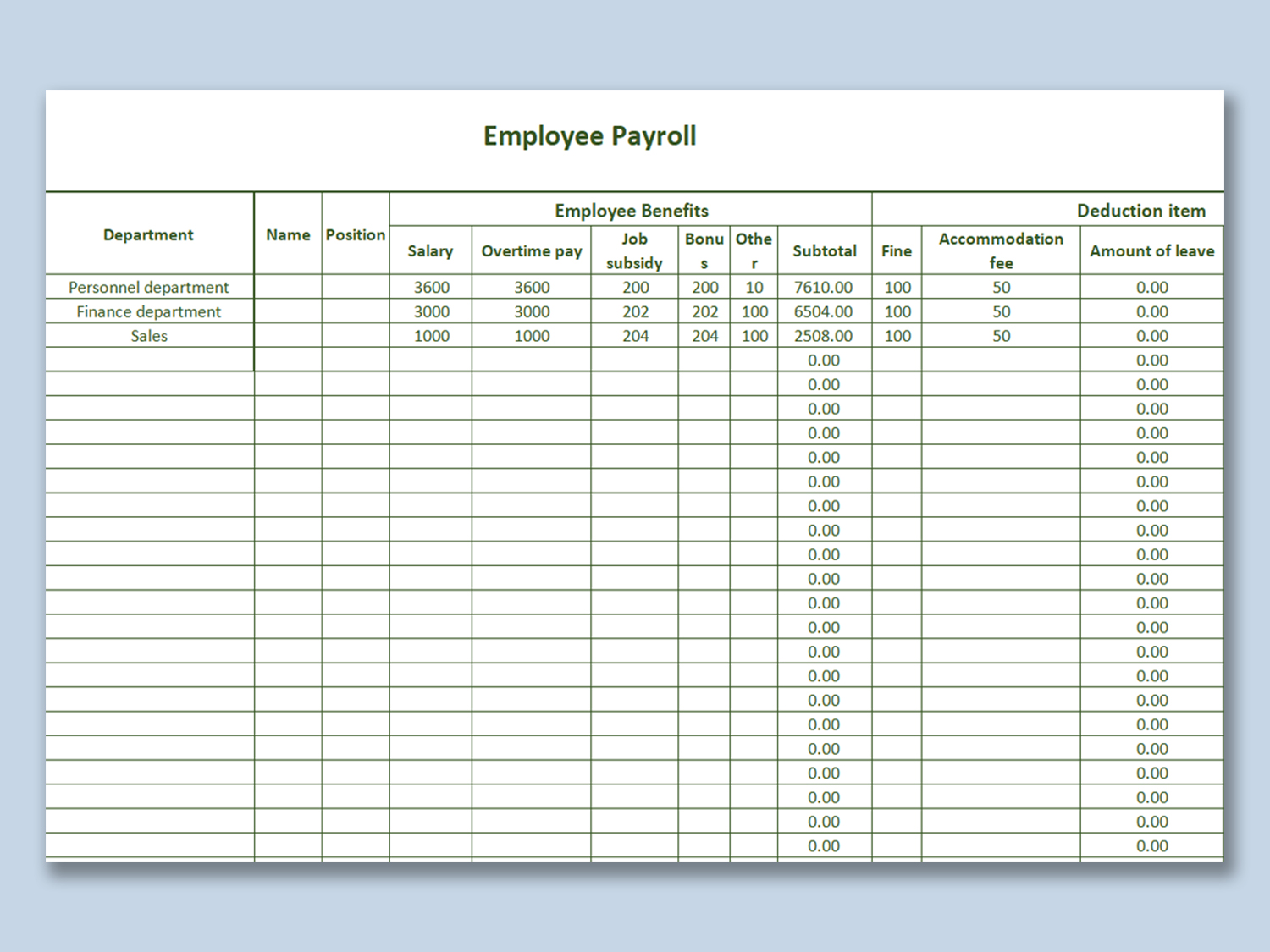

https://free-template.co/wp-content/uploads/2022/01/8955583aa7d0c677/payroll-statement-template.jpeg

Calculating Your Paycheck Weekly Time Card 1 Worksheet Answers Time

https://i0.wp.com/www.timeworksheets.net/wp-content/uploads/2022/07/salary-worksheet-1-answer-key-salary-mania.png

Where Does All Your Money Go Your Paycheck Explained

https://www.gannett-cdn.com/-mm-/1f66555fb4d7f329693b5f08f4e67628057c309f/c=0-26-2118-1223/local/-/media/2016/10/31/USATODAY/USATODAY/636135136112978940-paycheck.jpg?width=3200&height=1680&fit=crop

PAYCHECK MATH Directions In the following example employees are paid an hourly rate of 8 80 for the first 40 hours within a given week Any hours over 40 are paid at the time and a half rate which is 13 20 Calculate the gross pay in the table below The first one has been done for you Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total

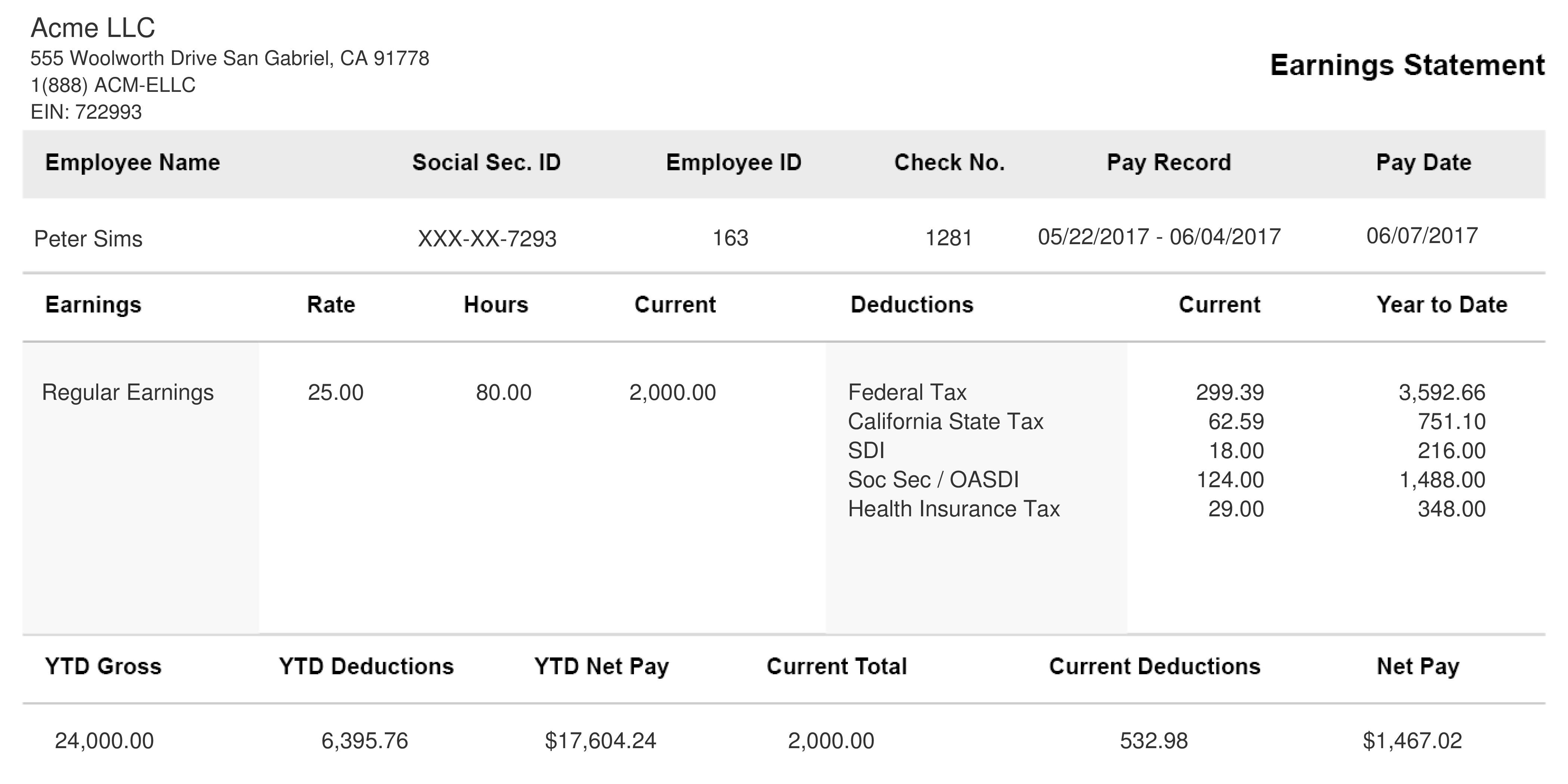

This form is a summary of a person s earnings and tax withholding for an entire year Workers receive a person alized Form W 2 from their employers around the end of January for the previous year s work The forms can arrive in the mail be provided in person or with a worker s consent received electronically Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

More picture related to Calculating Your Paycheck Salary Worksheet 1 Answers

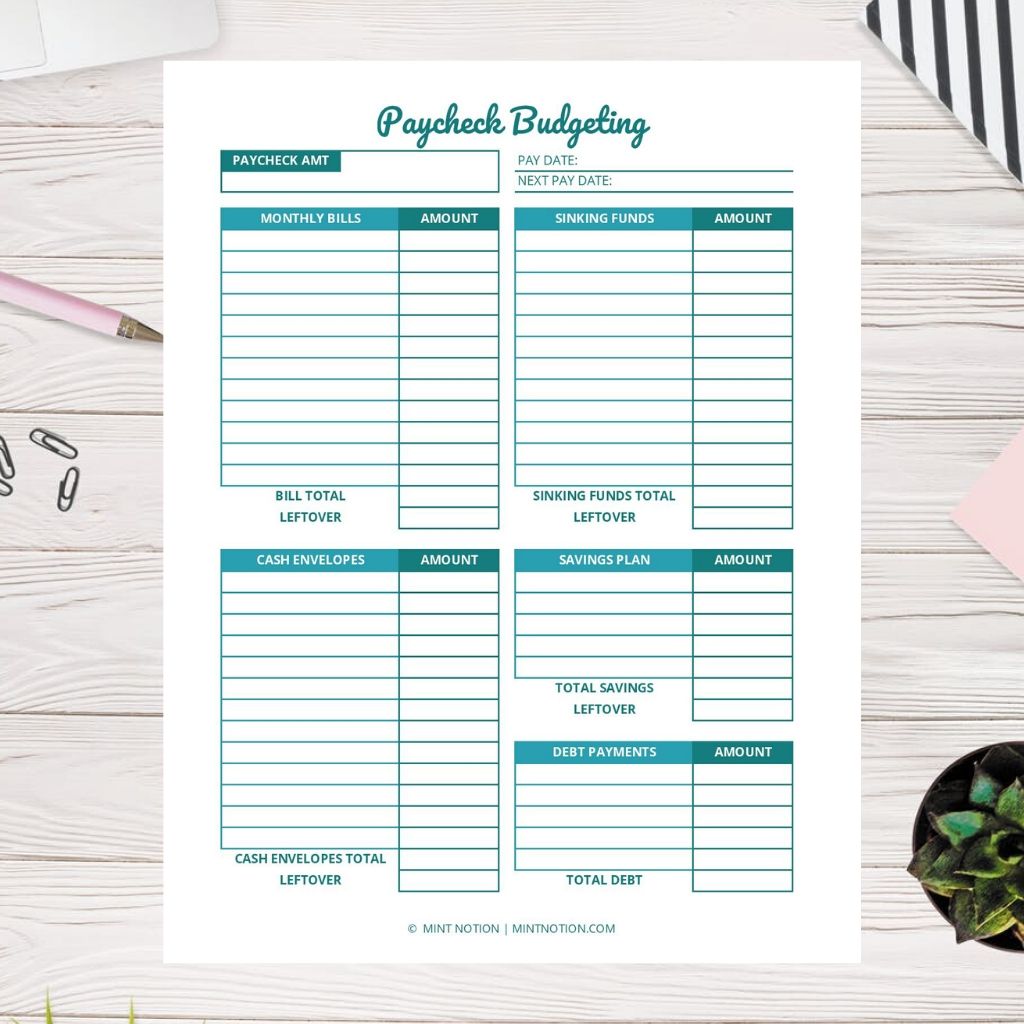

Paycheck Budgeting Printable Mint Notion

https://www.mintnotion.com/wp-content/uploads/2019/08/paycheck-budgeting-printable.jpg

Salary Pay Stub Template

https://www.vectortemplates.com/images/blogs/editor/5a55e99adf625-1.jpg

Calculating Your Paycheck Salary Worksheet 1 Answer Key Db excel

https://db-excel.com/wp-content/uploads/2019/09/calculating-your-gross-monthly-income-worksheet-1-768x994.png

Understand what types of taxes are deducted from a paycheck Calculate the difference between gross income and net income What students will do Review information on how to read a pay stub and answer questions about earnings and deductions Calculate tax withholdings deductions and the difference between gross income and net income IR 2024 45 Feb 21 2024 During the busiest time of the tax filing season the Internal Revenue Service kicked off its 2024 Tax Time Guide series to help remind taxpayers of key items they ll need to file a 2023 tax return

Some of the worksheets for this concept are Amp calculating your paycheck salary 1 key work My paycheck Amp calculating your paycheck salary 1 key work Chapter 1 lesson 1 computing wages Its your paycheck lesson 2 w is for wages w 4 and w 2 Ch 06 3g Chapter 1 gross income lesson salary work answers Answer key to understanding your paycheck Lesson 1 pdf PowerPoint pptx Lesson 2 W Is for Wages W4 and W2 Students compute the gross pay for a fictional John Dough given his hourly wage and the number of hours worked They compare gross pay to net pay They learn what FICA and federal income taxes are They learn how to complete a W 4 form and what a W 2 form is Lesson 2 pdf

Calculate Hours To Pay JannatNoorah

https://i.pinimg.com/originals/a8/26/5b/a8265b5572c08c3cb3586bf6e62773d1.png

Paycheck Budgeting Printable Wendaful Planning

https://i0.wp.com/media.wendaful.com/wp-content/uploads/2014/08/09054646/impay2.jpg?ssl=1

Calculating Your Paycheck Salary Worksheet 1 Answers - Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total