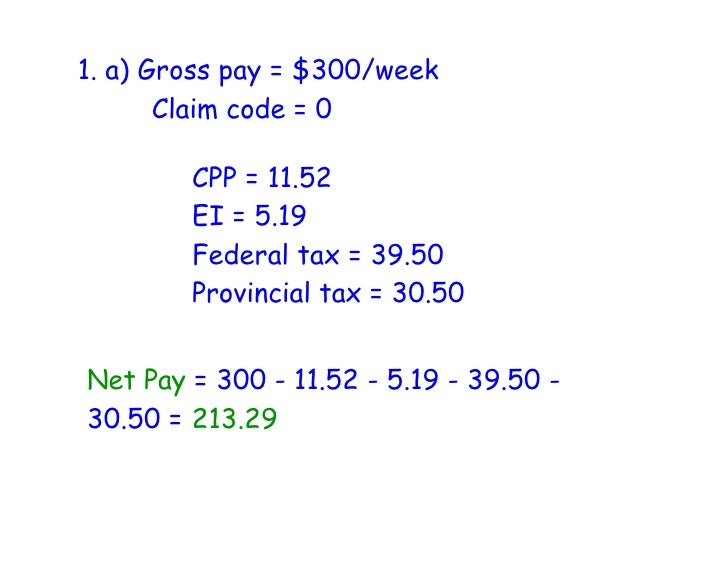

Calculating Net Pay Worksheet Answers Point out that John had no overtime or holiday pay this period so total pay for this period and year to date are also 360 4 Refer the students to the Net Pay line at the bottom of Handout 2 1 Point out that net pay is the amount that John actually received Discuss the following Why did John earn 360 and receive only 310 06

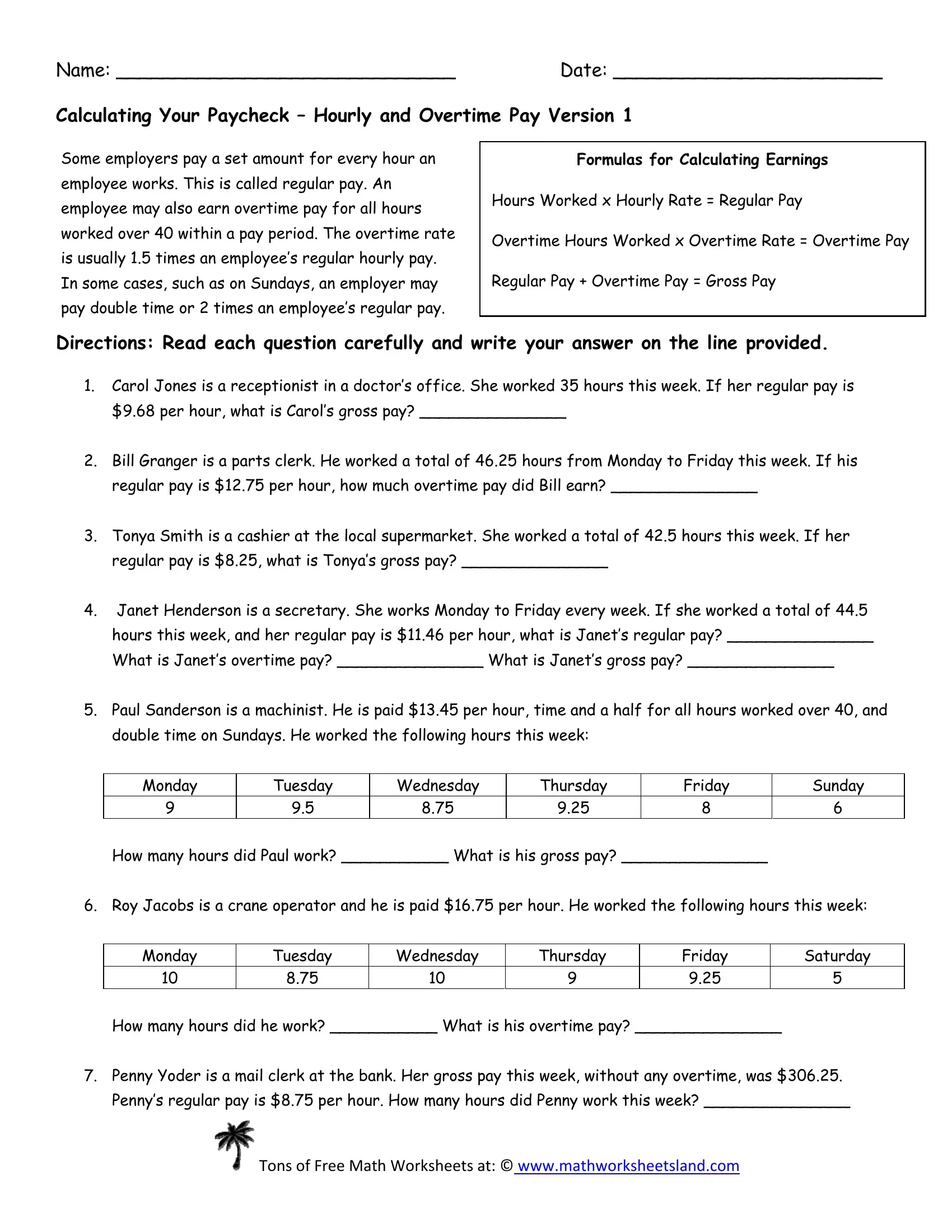

Answer the following questions based on your calculations 1 Brandon Smith is a single man who has just graduated with a computer technician certificate and started Help the Fullers calculate their net pay based on these deductions Fuller Payroll Deductions Jerome Annette Federal income tax 25 Social Security tax 6 2 Medicare tax 1 Students answers on their worksheets and during discussion can give you a sense of their understanding This answer guide provides possible answers for the Calculating the numbers in your paycheck worksheet Keep in mind that students answers may vary The important thing is for students to have reasonable justification for their

Calculating Net Pay Worksheet Answers

Calculating Net Pay Worksheet Answers

https://www.paycheckplus.ie/mvk21/wp-content/uploads/2021/06/Emplyee-Net-Pay.jpg

Calculating Net Pay Worksheet

https://image.slidesharecdn.com/calculatingnetpayassignment5-100225153503-phpapp01/95/calculating-net-pay-assignment-5-2-728.jpg?cb=1267112109

30 Calculating Net Force Worksheet

https://i2.wp.com/s1.studyres.com/store/data/010222049_1-762dca0dd8bd32ed8e8978000f63f471.png

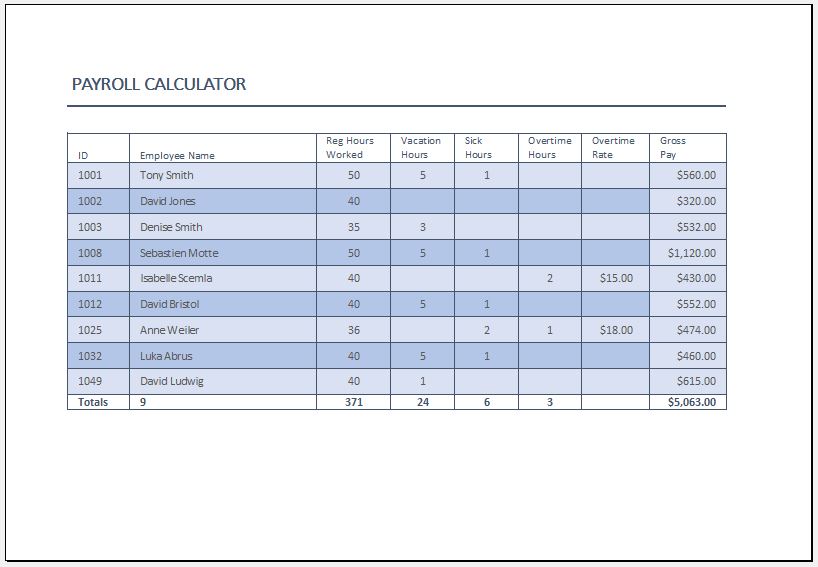

The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions Here s a rundown of the withholding amounts we calculated

Calculate Joe s Medicare deduction which is 1 45 of his gross pay Add all of Joe s deductions together to figure out the total amount taken out of each paycheck Joe s deductions include the following 25 00 Medical Subtract the total deductions from Joe s gross pay to determine his net pay To do this simply subtract your deductions from your gross pay Use the following formula to calculate your net pay Net pay gross pay deductions Example You earn a yearly salary of 25 000 This amount is your gross pay Monthly you make a gross pay of about 2 083

More picture related to Calculating Net Pay Worksheet Answers

Calculating Net Pay Worksheet 17 Paycheck Tax Calculator Free To Edit

https://i0.wp.com/study.com/cimages/videopreview/what-is-net-pay-definition-how-to-calculate__122792.jpg

Calculating Salary Worksheet PDF Form FormsPal

https://formspal.com/pdf-forms/other/calculating-salary-worksheet/calculating-salary-worksheet-preview.webp

Calculating Your Paycheck Salary Worksheet 1 Answers

https://briefencounters.ca/wp-content/uploads/2018/11/calculating-your-paycheck-salary-worksheet-1-answers-with-adams-middle-school-of-calculating-your-paycheck-salary-worksheet-1-answers-768x1024.jpg

Review information on how to read a pay stub and answer questions about earnings and deductions Calculate tax withholdings deductions and the difference between gross income and net income Download activity cfpb building block activities calculating numbers your paycheck worksheet pdf cfpb building block activities how to read pay stub Net pay is the amount of money employees earn after payroll deductions are taken away from gross pay These includes taxes benefits wage garnishments and other deductions In simple terms net

1 Explain to students they will be completing worksheets to calculate gross net pay and practice reading a pay stub 2 Distribute the Sample Pay Stub Reading a Pay Stub and Calculating Monthly Gross Net Pay worksheets and pencils to students 3 Review the answers with students after they have completed the worksheets Employee Pay Benefits Review Worksheet Calculating Net Pay Directions For each of the examples below calculate their net pay 1 Sandra earns 13 50 per hour and works 32 hours a What is her Gross Pay 13 50 32 432 b Calculate her deductions Deduction Of Gross Pay Amount Taken Out Federal Tax 15 64 80 Social Security 6 2 26 78

Lululemon Employee Average Salary Calculator

https://www.xltemplates.org/wp-content/uploads/2017/09/Net-salary-calculator.jpg

Calculating Net Pay Worksheet 17 Paycheck Tax Calculator Free To Edit

https://i1.wp.com/d2vlcm61l7u1fs.cloudfront.net/media/63f/63fb9803-3049-4705-aba0-1387ad9aefb0/phpNRcY4D.png

Calculating Net Pay Worksheet Answers - 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions Here s a rundown of the withholding amounts we calculated