Calculating A Paycheck Worksheet The Tax Withholding Estimator doesn t ask for personal information such as your name social security number address or bank account numbers We don t save or record the information you enter in the estimator For details on how to protect yourself from scams see Tax Scams Consumer Alerts Check your W 4 tax withholding with the IRS Tax

Using the Paycheck Calculator Use the worksheet corresponding to the W 4 form old 2019 or older Enter your Gross Pay for monthly semi monthly biweekly or weekly pay periods Federal taxes are calculated using tables from IRS Publication 15 FICA Social Security Tax and Medicare are calculated based on the percentage of your Students answers on their worksheets and during discussion can give you a sense of their understanding This answer guide provides possible answers for the Calculating the numbers in your paycheck worksheet Keep in mind that students answers may vary The important thing is for students to have reasonable justification for their

Calculating A Paycheck Worksheet

Calculating A Paycheck Worksheet

https://i.pinimg.com/originals/99/e6/80/99e680a3d7490bec83ebddee8aeb92a3.jpg

Calculating Wages Worksheet For Students Pdf CUALACT

https://i2.wp.com/images.template.net/wp-content/uploads/2017/09/Paycheck-Worksheet-Pay-Stub-Template.jpg

Tax Calculator Per Paycheck LeilaniAgniva

https://i.pinimg.com/originals/10/c1/d2/10c1d20efc22d163f6c75100a408fafd.png

PAYCHECK MATH Directions In the following example employees are paid an hourly rate of 8 80 for the first 40 hours within a given week Any hours over 40 are paid at the time and a half rate which is 13 20 Calculate the gross pay in the table below The first one has been done for you If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

II TUDENT WORKSHEET 1 of 2 Calculating the numbers in your paycheck Name Date Class BUILDING BLOCKS STUDENT WORKSHEET Calculating the numbers in your paycheck Knowing how to read the pay stub from your paycheck can help you manage your money The taxes and deductions on your pay stub may not always be easy to understand For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay

More picture related to Calculating A Paycheck Worksheet

Calculating Gross Pay Worksheets

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/solved-create-a-worksheet-to-calculate-the-ges-for-hour-858x970.png

Copy The Salaries Worksheet To A New Workbook

https://www.pdffiller.com/preview/40/586/40586107/large.png

Federal Tax Estimator 2022 FinbarAtharv

https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&w=2560&ssl=1

The federal tax withholding calculator or W 4 calculator helps you determine how much federal income tax should be withheld from your pay It considers your filing status income dependents and more to estimate your yearly tax and suggest W 4 allowances Adjusting these allowances can influence your paycheck s tax withholding to closely Step 1 Gross income First we need to determine your gross income If you are salaried your annual salary will be your gross income If you are paid hourly you must multiple the hours days and weeks The following is the formula for both cases Annual salary Annual salary Gross income

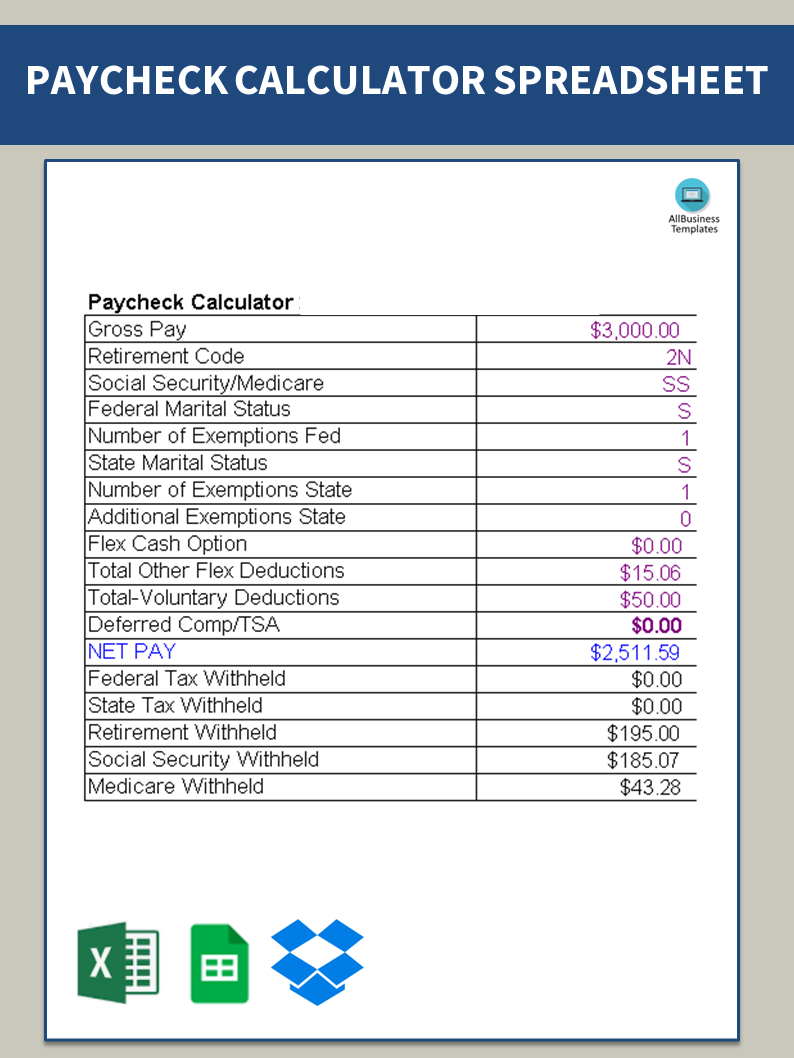

Pay Check Calculator requires the details of the latest tax rates imposed by the government to calculate the correct taxes The sheet has three main sections first one is used to show the Gross Pay second one for calculating your pay check and a third one is a graphical representations of the pay check This template makes use of Federal Tax This form is a summary of a person s earnings and tax withholding for an entire year Workers receive a person alized Form W 2 from their employers around the end of January for the previous year s work The forms can arrive in the mail be provided in person or with a worker s consent received electronically

Paycheck Calculator Gratis

https://www.allbusinesstemplates.com/thumbs/f0a24925-2125-45c5-bfb3-9b9edc3853a7.png

Paycheck Budgeting Worksheet EDITABLE Personal Finance Organizing

https://i.pinimg.com/originals/6b/3c/79/6b3c79e7336823d505fafec5dfbd2910.jpg

Calculating A Paycheck Worksheet - PAYCHECK MATH Directions In the following example employees are paid an hourly rate of 8 80 for the first 40 hours within a given week Any hours over 40 are paid at the time and a half rate which is 13 20 Calculate the gross pay in the table below The first one has been done for you