Calculate Paycheck After Taxes Kentucky Use ADP s Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

Use our paycheck tax calculator If you re an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from Calculate your take home pay after federal Kentucky taxes Updated for 2023 tax year on Dec 05 2023 What was updated Tax year Job type Salary hourly wage Overtime pay State Filing status Self employed Pay frequency Additional withholdings Pre tax deduction s Post tax deduction s Select the tax es you are exempted from

Calculate Paycheck After Taxes Kentucky

Calculate Paycheck After Taxes Kentucky

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-mn.jpeg

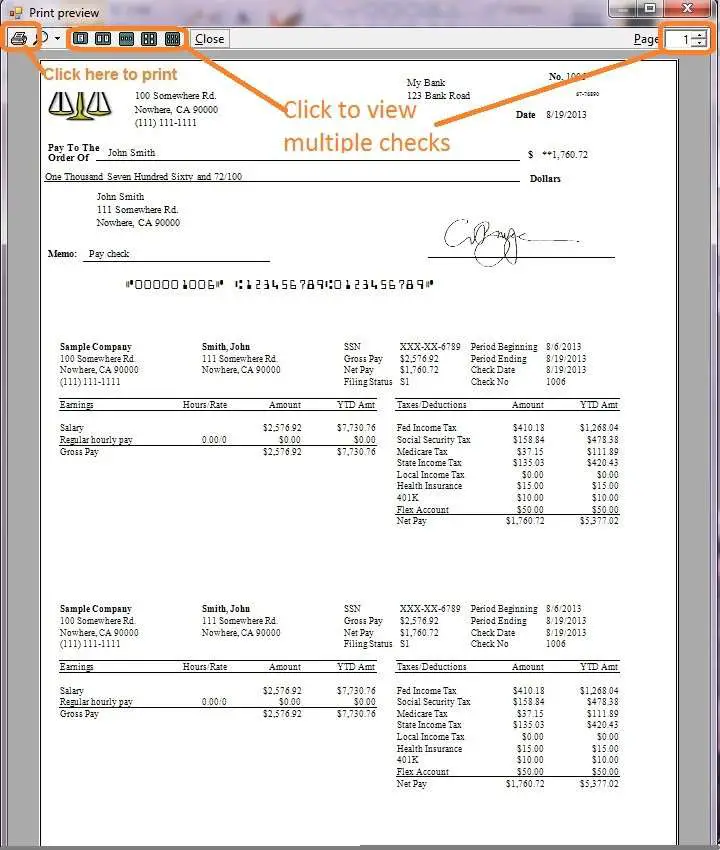

Fica Payroll Tax Calculator BinkyZhuri

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/calculate-payroll-taxes-income-tax-brackets-chart-inforgraphic-us.png

Determine Paycheck After Taxes CharmaneDelia

https://i.pinimg.com/474x/4a/5e/eb/4a5eeb4afc3cdac30ad4c73730449e9b.jpg

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis Switch to salary calculator Kentucky paycheck FAQs Kentucky payroll State Date State Kentucky Overview of Kentucky Taxes Kentucky has a flat income tax of 5 That rate ranks slightly below the national average At the same time cities and counties may impose their own occupational taxes directly on wages bringing the total tax rates in some areas to up to 8 75 Both sales and property taxes are below the national average

Use PayCalculation s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and your average monthly expenses 55 573 Bi Weekly Paycheck Taxable Income 0 00 Federal Tax 0 00 State Tax 0 00 Social Security Tax 0 00 Medicare Tax 0 00 Use Gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in Kentucky We ll do the math for you all you need to do is enter the applicable information on salary federal and state W 4s deductions and benefits

More picture related to Calculate Paycheck After Taxes Kentucky

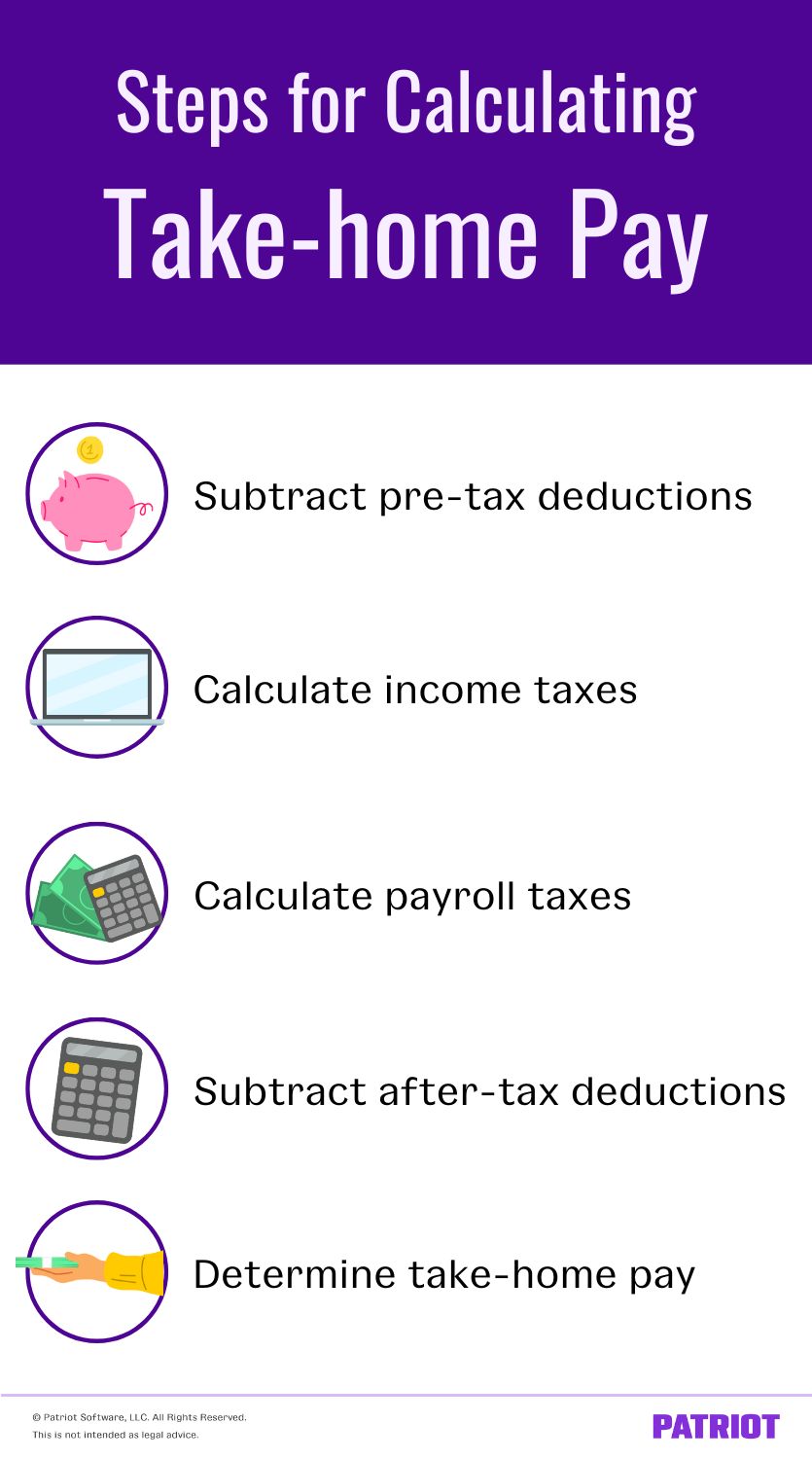

How To Calculate Payroll Taxes In California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-california-tax.jpeg

Payroll Tax Rates 2023 Guide Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/09/Payroll_Tax_Rates_-_article_image.jpg

IRS Taxes Kentucky Derby Wins But Can You Deduct Losses

https://s3.amazonaws.com/ocn-media/e0e52608-f4df-40b6-899a-5bb4a66ac500.jpeg

Kentucky Paycheck Calculator Easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget Last reviewed on January 29 2023 Optional Criteria See values per Year Month Biweekly Week Day Hour Results Income Before Tax Take Home Pay Total Tax Average Tax Rate US Dollar Net Pay The Kentucky Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Kentucky State Income Tax Rates and Thresholds in 2024 Details of the personal income tax rates used in the 2024 Kentucky State Calculator are published below the calculator

This complimentary straightforward and easy to use Kentucky paycheck calculator will estimate your take home salary It supports hourly salary revenue and multiple income frequencies It also computes Federal FICA Medicare and withholding surcharges for all 50 states Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2022 2023 standard deduction determined by your

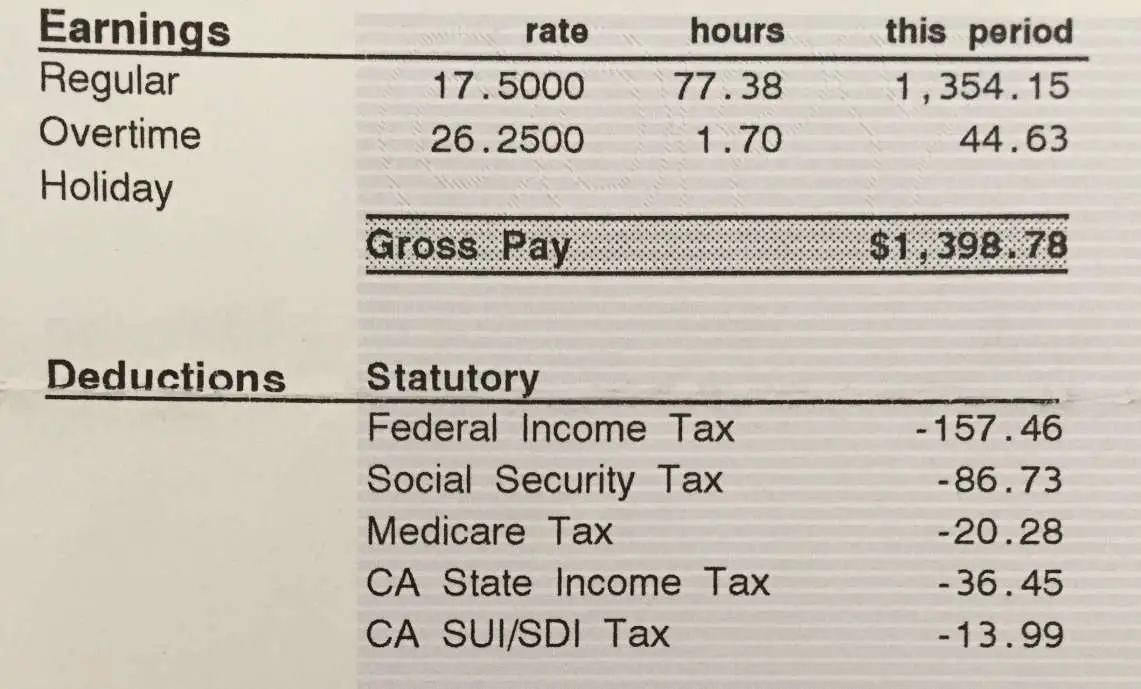

Take home Pay Definition Steps To Calculate Extra Just Another

https://www.patriotsoftware.com/wp-content/uploads/2022/09/take-home-pay.jpg

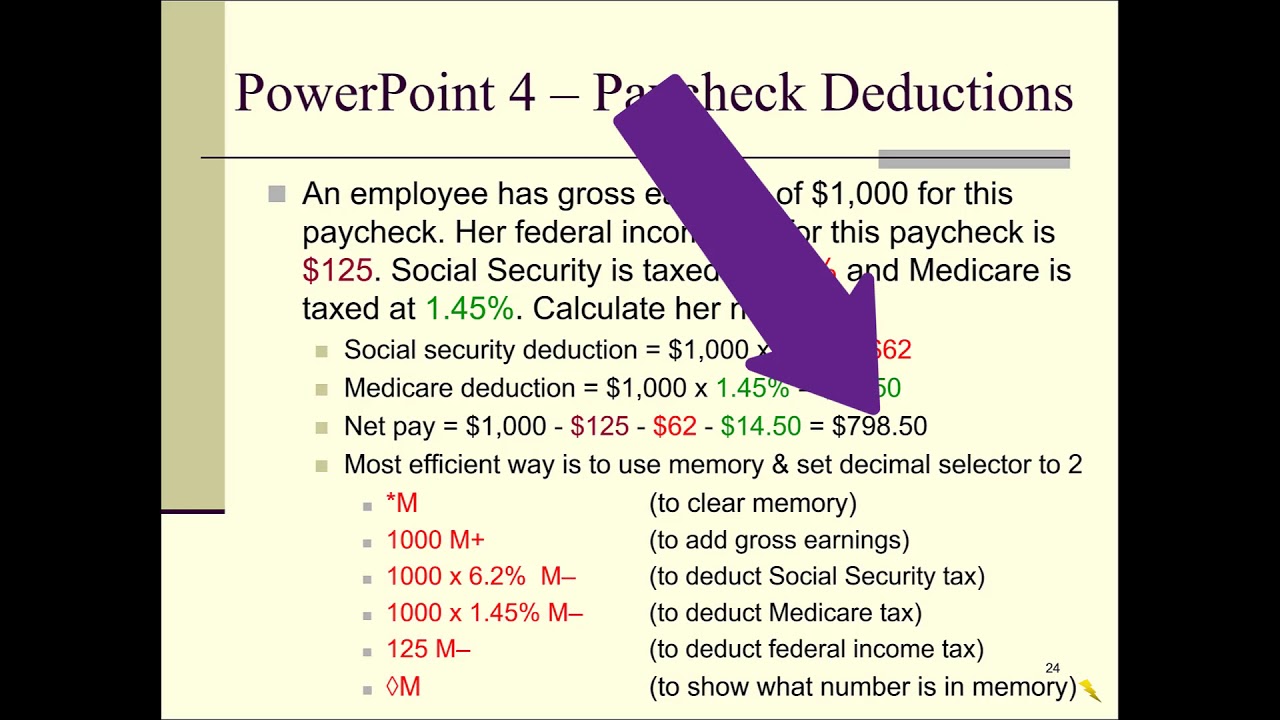

Calculate Paycheck Deductions Net Pay With A Desktop Calculator YouTube

https://i.ytimg.com/vi/Omxh157P-8U/maxresdefault.jpg

Calculate Paycheck After Taxes Kentucky - Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis Switch to salary calculator Kentucky paycheck FAQs Kentucky payroll State Date State Kentucky