Base Salary Does It Include Super What does base salary mean Base pay or base salary is the initial rate of compensation that you receive as an employee in exchange for your services Base pay is expressed in terms of an hourly rate or a monthly or yearly salary

Base salary is a fixed amount of money paid to an employee by an employer in return for work performed A base salary does not include the benefits bonuses or other potential compensation an employee might receive in addition to the base salary Find out more about base salaries including who receives one and what is and isn t included Base pay or base salary is the fixed amount of money an employee receives each pay period Learn more about base pay and how to calculate it with Paychex

Base Salary Does It Include Super

Base Salary Does It Include Super

https://images.ctfassets.net/pdf29us7flmy/c4d34bba-1dea-58d3-92ff-a535afb52613/6f00aee571b46a8818e7a4ceed3f9dfd/resized.png

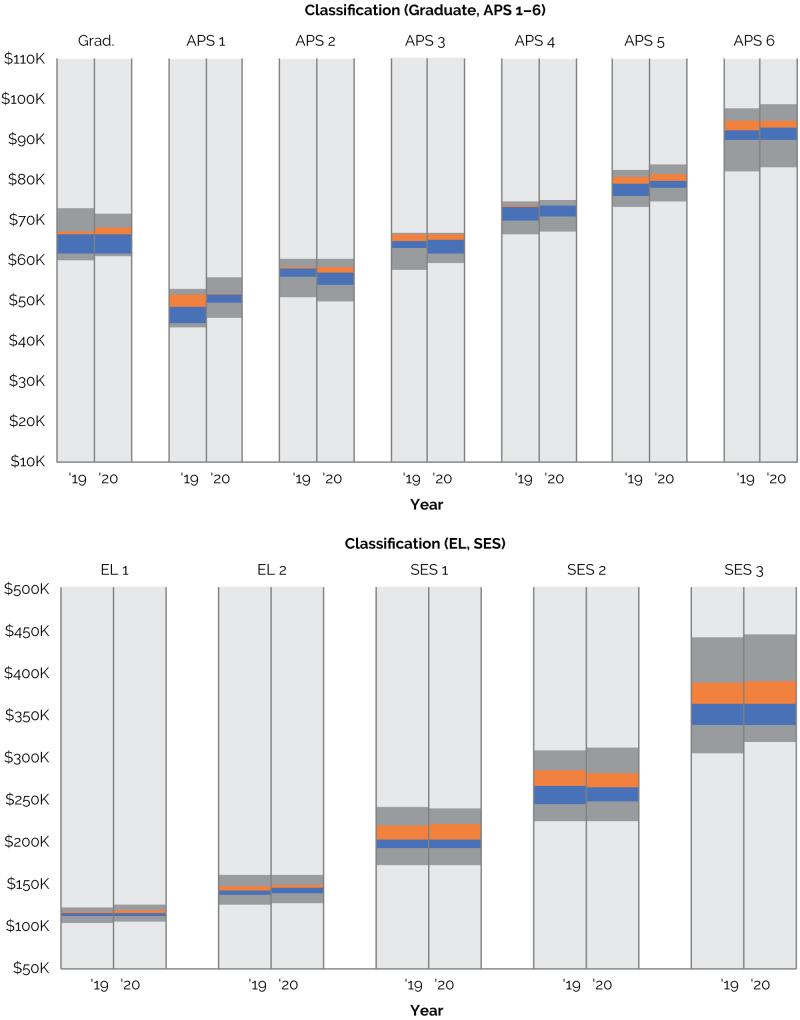

Chapter 3: Base Salary | Australian Public Service Commission

https://www.apsc.gov.au/sites/default/files/styles/full_lg/public/2021-07/21537-Figure-3.2.jpg

What is a base salary? | Breathe HR Australia

https://483440.fs1.hubspotusercontent-na1.net/hubfs/483440/towfiqu-barbhuiya-jpqyfK7GB4w-unsplash.jpg

A base salary also known as base pay is the initial compensation amount or wage employers agree to pay an employee at the start of a job before taxes and other deductions Base salary It does not include Bonus pay Incentive pay Commissions Insurance premiums paid by the employer Taxes For example say an employee has an annual salary of 75 000 and is eligible for a productivity bonus of up to 10 000 at the end of each year The employee s base salary would be 75 000 since the base salary does not include bonus pay

Base pay is an employee s standard pay rate which does not include benefits bonuses raises or other compensation Base pay can be expressed as an hourly rate or as an annual salary Next 6 months 6000 X 6 36000 After the end of six months the base salary will stand at 6 000 and the total annual base salary will work out to 51000 Comparing your base salary The Australian Bureau of Statistics ABS has a breakdown of the average salary and wage of employees by age

More picture related to Base Salary Does It Include Super

Payslip Sample Template | Paysliper

https://paysliper.com/assets/templates/image/grid1.jpg

:max_bytes(150000):strip_icc()/GettyImages-524176098-fe1797a0886b476aba557509bc4c186a.jpg)

Base Salary: What Is It?

https://www.thebalancemoney.com/thmb/KCeRMg1HJuTxl-g5LTsQk49lsgc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-524176098-fe1797a0886b476aba557509bc4c186a.jpg

Know the difference between basic salary, take-home salary, gross salary and CTC? - Times of India

https://static.toiimg.com/thumb/msid-62133820,width-1280,height-720,resizemode-4/.jpg

Typically base salary is given to an employee with the expectation of a minimum of 40 hours of work a week Base pay can be expressed as hourly monthly or yearly For example someone who earns a base salary of 25 hour can also be said to have a base monthly salary of 4 333 month or a base annual salary of 52 000 year This is the amount earned before benefits bonuses or compensation is added Base salaries are set at either an hourly rate or as weekly monthly or annual income If agreed in your contract of employment your base salary will remain consistent each payday aside from pay rises promotions or annual inflation

2 Answers Sorted by 3 Superannuation basics Superannuation or super is money put aside by your employer over your working life for you to live on when you retire from work Your employer is required to pay a minimum amount based on the current super guarantee rate of your ordinary time earnings into super What is Superannuation Superannuation is money you pay eligible workers to provide for their retirement Under the superannuation guarantee as of 1 July 2022 employers must contribute 10 5 of an employee s ordinary earnings to their superannuation fund This includes all employees over the age of 18

:max_bytes(150000):strip_icc()/financial-chart-on-chalkboard-637693846-5ad3b32f8e1b6e00375ad612.jpg)

What is a Salary Range?

https://www.thebalancemoney.com/thmb/C2lj5SVZTce0AP-UM89Mr9NfljQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/financial-chart-on-chalkboard-637693846-5ad3b32f8e1b6e00375ad612.jpg

Base Salary and Your Benefits Package | Indeed.com

https://images.ctfassets.net/pdf29us7flmy/3zEzDKAqWAKjFZMtTpMOoX/e33e1cac40b498f7717b74734a8f51b9/Base_Salary_How_Does_it_Fit_Into_Your_Entire_Compensation_Package__social.png

Base Salary Does It Include Super - When employers are talking about a salary they are referring to your base starting salary Salary packages typically include your base salary as well as additional benefits incentives or rewards such as superannuation annual and sick leave car allowance or bonuses