Annual Gross Salary Example To convert from your net annual income to your gross annual income you can use this simple formula Net income 1 deduction rate For example if your net income was 29 750 and you know your tax rate is 15 you can complete the equation as follows 29 750 1 0 15 29 750 0 85 35 000

For example if an employer offers you a sales position with a base salary of 50 000 plus a bonus of 2 500 your gross income for the year would be 52 500 Related Gross Pay vs Net Pay Definitions and Examples Gross pay vs W 2 pay Gross pay represents the full amount paid to an employee while a W 2 determines taxable wages To calculate your gross income you would simply subtract your expenses from your income In this example that would give you a gross income of 40 000 100 000 50 000 40 000 Your net income would be your gross income minus your expenses In this example that would give you a net income of 30 000 40 000 10 000 5 000

Annual Gross Salary Example

Annual Gross Salary Example

https://mathsgee.com/?qa=blob&qa_blobid=2784507141180379806

Vicky Works In Retail Her Annual Gross Salary Is CameraMath

https://static.cameramath.com/jkyx9y2yhe/86cbcc6bdce9e94d365c521a91fde6ae

Gross Salary Formula Salary Mania

https://i.pinimg.com/originals/2b/78/2f/2b782f415c9b3873b24d4509203c17d3.jpg

Therefore Joe s gross annual income is 75 000 25 000 3 000 200 500 103 700 This figure will be used as a base to calculate his taxes For example he will have to pay a capital gains tax on his profits from the stock market He can also claim deductions for use of his home office for some of his freelance work Gross income or gross pay is an individual s total pay before accounting for taxes or other deductions At the company level it s the company s revenue minus the cost of good sold In this

Gross Pay Calculation Example Suppose an individual has begun the process of filing their taxes with the IRS for fiscal year 2021 In 2021 the individual s annual gross salary was 200 000 along with three other sources of income Capital Gains 10 000 Dividends 2 000 Gross annual income gross monthly pay x 12 Gross annual income gross weekly pay x 52 Adjust the equation accordingly if you work fewer than 12 months or 52 weeks per year For example if

More picture related to Annual Gross Salary Example

Public Health Insurance Germany The Barmer Review

https://movein.com.de/wp-content/uploads/2022/06/Medical-prescription-rafiki.png

Average Annual Gross Salary And Split Between Salary And Incentives

https://www.researchgate.net/publication/335308956/figure/tbl6/AS:794345758261251@1566398195798/Average-annual-gross-salary-and-split-between-salary-and-incentives.png

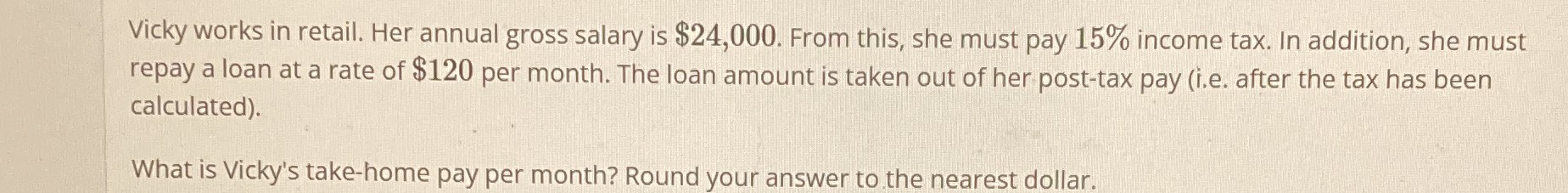

How To Calculate Net Salary Gross Salary In Excel YouTube

https://i.ytimg.com/vi/eowCuwKkybY/maxresdefault.jpg

Total annual gross income 82 475 To determine a business s annual gross income here is an example Gross revenue 250 000 Cost of goods sold 200 000 Total annual gross business income Example Assume that John earns an annual income of 100 000 from his financial management consultancy work John also earns 70 000 in rental income from his real estate properties 10 000 in dividends from shares he owns at Company XYZ and 5 000 in interest income from his savings account Gross income is the sum of all incomes

While your annual gross income is the earnings you receive in a financial year your annual net income is the total left after deductions For example someone with gross yearly pay of 100 000 and a tax rate of 25 would have an annual net income of 75 000 Example of annual gross income Suppose Chris makes 75 000 a year from a regular job On top of his yearly salary Chris earns 1 000 per year in interest from his savings account 500 per year in dividends from stock investments and 10 000 per year from rental property income The sum of these four amounts is his annual gross income

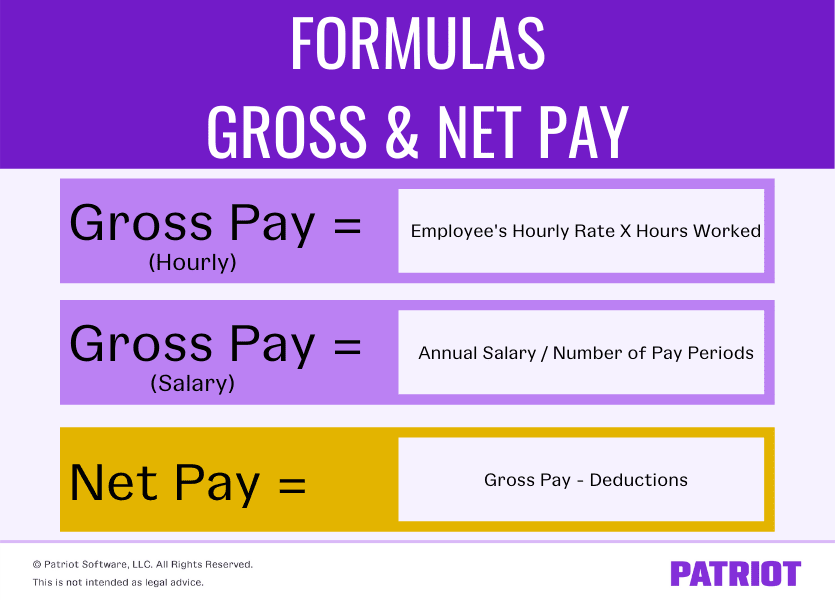

Gross Pay Vs Net Pay What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1.png

Gross Vs Net Pay What s The Difference Between Gross And Net Income

https://gusto.com/wp-content/uploads/2019/08/Gusto-paystub-example-net-pay-vs-gross-pay-1024x962.jpg

Annual Gross Salary Example - Active Income Passive Income Total income 50 000 10 000 60 000 Wally would deduct any applicable deductions and exceptions from this number 60 000 Example 2 Now let s look at a case study of a business and how gross sales impact its financial situation