Anne Arundel County Payroll Tax Rate Anne Arundel County 2 457 2 457 City of Annapolis 1 467 1 940 3 407 Town of Highland Beach 2 382 1 000 3 382 Anne Arundel County excluding the City of Annapolis and the Town of Highland Beach Public utility operating real property is subject to a 0 280 State Tax per 100 of the full assessed value Services Departments

1 800 MD TAXES 1 800 638 2937 or 410 260 7980 from Central Maryland Three attachments accompany this memorandum the first is the local tax rate used by the Central Payroll Bureau to compute the local portion of the combined state tax The second attachment provides a translation of the alpha code that appears in the County code box that is Anne Arundel County Income Tax Residents of Anne Arundel County pay a flat county income tax of 2 56 on earned income in addition to the Maryland income tax and the Federal income tax Nonresidents who work in Anne Arundel County pay a local income tax of 1 25 which is 1 31 lower than the local income tax paid by residents

Anne Arundel County Payroll Tax Rate

Anne Arundel County Payroll Tax Rate

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Pay Anne Arundel County Water Bill Utility And Tax Bill Payment

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2022/09/fgghfghf.png?fit=1200%2C675&ssl=1

Anne Arundel Utility And Tax Bill Payment Information Anne Arundel County

https://www.aacc.edu/media/college/cashier/Step-8.jpg

Tax Information The Office of Finance is responsible for billing and collecting most of Anne Arundel County s taxes Review the information below to learn about the type of taxes and supporting programs offered by the county Services The local tax rates for taxable year 2024 are as follows For taxpayers with filing statuses of single married filing separately and dependent taxpayer the local tax rates are as follows 0270 of Maryland taxable income of 1 through 50 000 0281 of Maryland taxable income of 50 001 through 400 000 and

INCOME TAX RATE The local income tax is computed without regard to the impact of the state tax rate The state rates and rate brackets are Anne Arundel 2 81 Baltimore County 3 20 Calvert 3 00 Caroline 3 20 Carroll 3 03 Cecil 3 00 Charles 3 03 Dorchester 3 20 Frederick 2 96 Garrett 2 65 Harford 3 06 Anne Arundel County property tax bills are mailed to the mailing address per the property records maintained by the Maryland Department of Assessments and Taxation If you ve moved you will need to update the mailing address by calling the Maryland Department of Assessments and Taxation at 410 974 5709

More picture related to Anne Arundel County Payroll Tax Rate

Coshocton Tax Lodging Fill Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/47/570/47570554/large.png

How To Reduce Payroll Taxes For Self Employed Individuals Crypto

https://cryptofinancestudio.com/wp-content/uploads/2021/09/self-employment-taxes-852x568-1.jpg

Katarzyna Kasia Polak Lynn CPA LinkedIn

https://media.licdn.com/dms/image/C4D03AQE_dXu3QpIyug/profile-displayphoto-shrink_800_800/0/1661825606939?e=2147483647&v=beta&t=pTCs1wrKATKdZcE1uy8w-gFauBw0NczBoNxmU5c8Iaw

Calculate Withholding If you are withholding tax from a nonresident employee who works in Maryland but resides in a local jurisdiction that taxes Maryland residents enter the county in which the employee works For more information see Nonresidents Who Work in Maryland The Comptroller s Web Services Center is available 24 hours a day 7 Of the counties with flat tax rates only Cecil County s rate changed to 2 75 from 2 8 the office said on its website Anne Arundel County and Frederick County both use graduated tax rates The 2024 withholding guide uses the same 10 percentage methods based on local tax rates as in 2023 The only change was that the standard deduction

Maryland Paycheck Quick Facts Maryland income tax rate 2 00 5 75 Median household income 98 461 U S Census Bureau Number of cities with local income taxes 1 plus every Maryland county If adopted the legislation would raise the maximum top local income tax rate from 3 2 percent to 3 7 percent beginning in 2026 and allow counties to impose this rate on taxable income of 250 000 or above for single filers 300 000 or above for married individuals filing joint returns Until quite recently all local income taxes in Maryland

Pamela Beidle Anne Arundel Tax Increases Will Pay For Needed Services

https://www.capitalgazette.com/resizer/znX2rRxuYTYHiXPP2zYTm8z36pU=/1200x0/top/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/TDV6TESELNAALJIO32NF6WKQMQ.jpg

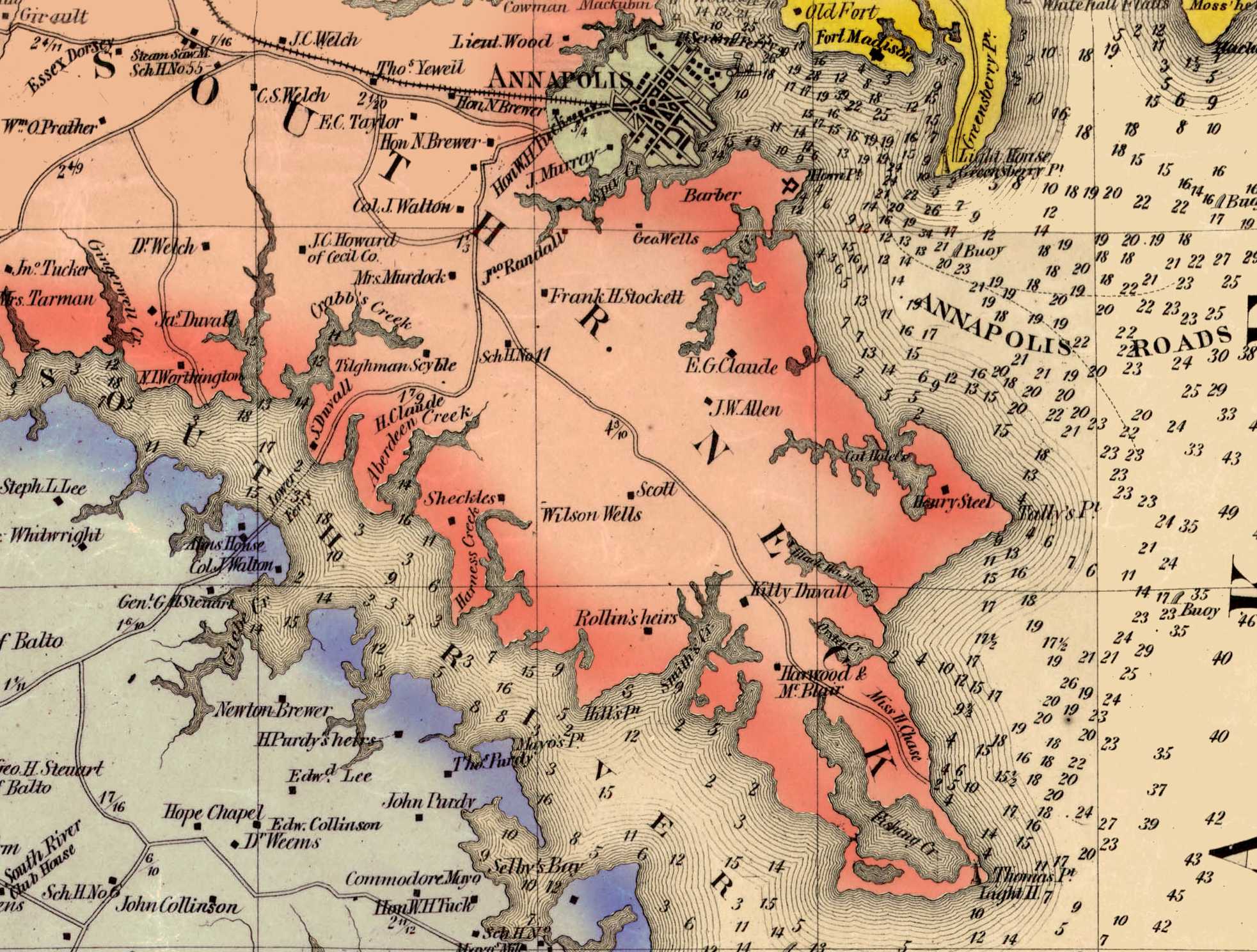

Martenet s 1860 Map Of Anne Arundel County Maryland

https://press.martenet.com/anne_arundel_map/images/Arundel_detail.jpg

Anne Arundel County Payroll Tax Rate - Each table associated with a local taxing area either matches or closely approximates that local tax rate without going below the actual rate For lump sum distributions and annual bonuses see the percentage method tables Anne Arundel County 0281 0270 ast 0281 ast Baltimore City 032 0320 Baltimore County 0 032 0320 Calvert