Anne Arundel County Income Tax The Office of Finance is responsible for billing and collecting most of Anne Arundel County s taxes Review the information below to learn about the type of taxes and supporting programs offered by the county Tax Information Business Personal Property Tax Current Tax Rates Real Property Tax

Information on how to pay your County Tax Utility Bills online by phone by mail or in person Pay Real Estate Taxes Anne Arundel County has enacted several local property tax credits for the benefit of the owners of real property located within our jurisdiction Finance 410 222 1748 FY 2025 Property Tax Rates July 1 2024 June 30 2025 All rates shown are per 100 of assessment Real Property County Rate State Rate Municipality Rate Total Anne Arundel County 0 983 Anne Arundel County excluding the City of Annapolis and the Town of Highland Beach

Anne Arundel County Income Tax

Anne Arundel County Income Tax

https://delta.creativecirclecdn.com/severna/original/20210519083821-4432-AdobeStock_116388997.jpeg

Anne Arundel County Maryland Map 1911 Rand McNally Annapolis Glen

https://i.pinimg.com/originals/a8/32/18/a832184bea3063eca97ab18722a99664.jpg

Anne Arundel County Announces High School Graduation Plans WTOP News

https://wtop.com/wp-content/uploads/2021/04/GettyImages-168116618.jpg

Residents of Anne Arundel County pay a flat county income tax of 2 56 on earned income in addition to the Maryland income tax and the Federal income tax Nonresidents who work in Anne Arundel County pay a local income tax of 1 25 which is 1 31 lower than the local income tax paid by residents Anne Arundel Co The local tax rates for calendar year 2024 are as follows For taxpayers with filing statuses of Single Married Filing Separately or Dependent the local tax rates are as follows 0270 of Maryland taxable income of dollar 1 through dollar 50 000 0281 of Maryland taxable income in excess of dollar 50 001 through 400 000 and

INCOME TAX RATE The local income tax is computed without regard to the impact COUNTY RATES Local tax is based on taxable income and not on Maryland state Anne Arundel see below Baltimore County 3 20 Calvert 3 00 Caroline 3 20 Carroll 3 03 Cecil 2 75 The state and local income tax withholding formula for Maryland has changed to include the following changes The tax table for Anne Arundel County has changed for Single and Married filers The flat tax rate for the following counties have changed Calvert 3 20 Cecil 2 74 St Mary s 3 20 All other information remains the same

More picture related to Anne Arundel County Income Tax

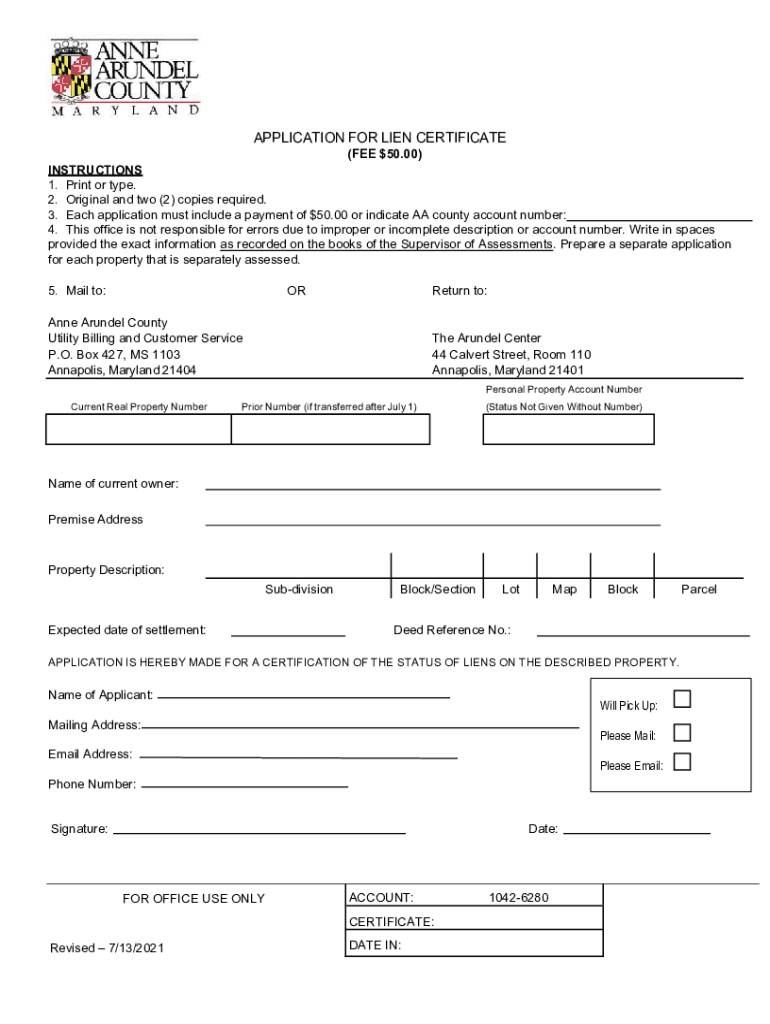

2021 2024 Form MD Application For Lien Certificate Anne Arundel

https://www.pdffiller.com/preview/571/296/571296227/large.png

Anne Arundel County Tax Lien Certificates Prosecution2012

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2021/04/anne-arundel-county-tax-lien-certificates.jpg

County Executive Steve Schuh Announces Anne Arundel County Income Tax

http://www.trbimg.com/img-5575bf1a/turbine/ph-ac-cn-income-tax-cut-0609-20150608

Anne Arundel County and Frederick County both use graduated tax rates Anne Arundel County In 2025 Anne Arundel County s tax rates are 2 7 2 94 and 3 2 but the tax brackets used depend on an individual s filing status For individuals who are single dependent or married filing separately the 2 7 rate applies Arundel Center 44 Calvert Street Annapolis MD 21401 410 222 7000 Arundel Center North 101 North Crain Highway 1st Floor Glen Burnie MD 21061 410 222 1144 Heritage Complex Building 2664 2664 Riva Road Annapolis MD 21401 When paying by check or money order please make payable to Anne Arundel County Click on the link for locations

[desc-10] [desc-11]

2020 Most Diverse Places To Live In Anne Arundel County MD Niche

https://d33a4decm84gsn.cloudfront.net/search/2020/places-to-live/counties/anne-arundel-county-md_1910.jpg

The Highest And Lowest Income Areas In Anne Arundel County MD

https://images.bestneighborhood.org/map/household-income/household-income-map-anne-arundel-county-md.webp

Anne Arundel County Income Tax - Anne Arundel Co The local tax rates for calendar year 2024 are as follows For taxpayers with filing statuses of Single Married Filing Separately or Dependent the local tax rates are as follows 0270 of Maryland taxable income of dollar 1 through dollar 50 000 0281 of Maryland taxable income in excess of dollar 50 001 through 400 000 and