Aia Claims Based Pricing AIA customers that had AIA Max Essential A policies would have been converted to AIA Max VitalCare upon policy anniversary from 1 April 2021 With the claims based pricing for AIA Max VitalCare consumers can get up to 25 discount off their Standard Level premiums if no claims are made

With the claims based pricing for AIA Max VitalCare consumers can get up to 25 per cent discount off their Standard Level premiums if no claims are made There is also no increase in the premium Claims Based Pricing On the flip side claims based pricing is the new entrant bringing a fresh perspective to the table Here s the low down AIA Great Eastern Prudential are doing it in Singapore Features and Benefits At first glance claims based pricing plans might seem like any other insurance policy But delve deeper and you

Aia Claims Based Pricing

Aia Claims Based Pricing

https://static.businesstimes.com.sg/s3fs-public/styles/article_img_retina/public/image/2021/03/29/rk_Prudential_290321.jpg?itok=SUOqekgz

Statements Of Post AIA Claims Disclosure

https://s2.studylib.net/store/data/005324830_1-dd61e10a554106f69f0791dd22eb4dce-768x994.png

Mohommed Fahim Senior Executive Life Claims Administration AIA Sri

https://media-exp1.licdn.com/dms/image/C4E03AQHXcTvFAG9TUw/profile-displayphoto-shrink_800_800/0/1657704344973?e=2147483647&v=beta&t=MmPSMBHpOmL7Qnap-c3lEStbwBbDfCVvPfx9j8COCqo

Explore the advantages and disadvantages of claims based pricing in insurance policies Understand how claims based pricing can impact premiums coverage and overall insurance costs This is a rider that you purchase IN ADDITION to your AIA HealthShield Gold Max A policy Benefits Reduces co payment charges to 5 Follow Singapore MORE insurers are launching claims based pricing for Integrated Shield IP riders in an effort to shore up their underwriting results and eventually dampen future premium hikes Purchase this article more in Banking Finance China central bank studies plan to narrow rate corridor warns on bond risks Aug 09 2024 08 32 PM

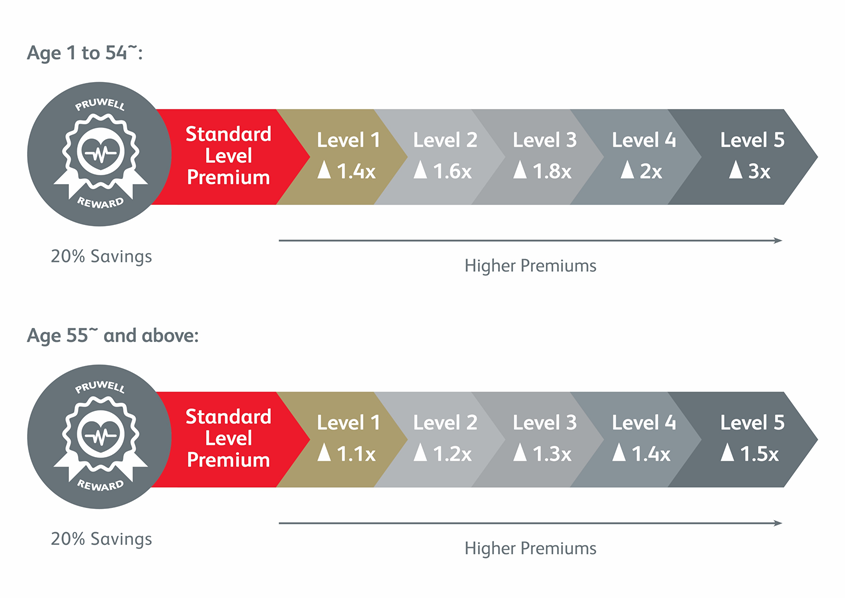

The following claims return rate table shows how long it takes each insurer to process Integrated Shield Plan IP claims with positive payouts Please note that the durations below do not apply to rider claims Insurer Median Claims Processing Duration days 1 75th Percentile Claims Processing Duration days 2 AIA The effects of claims based premium pricing and PRU Well Reward was reflected in customer s premiums on their renewal from 1 April 2022 onwards Our unique claims based premium pricing mechanism rewards our customers for staying healthy and modest usage of healthcare services Enjoy Premium Discounts with PRUWell Reward

More picture related to Aia Claims Based Pricing

Claims based pricing Prudential Singapore

https://www.prudential.com.sg/-/media/project/prudential/images/products/health-protection/medical/claims-based-pricing/revised_claim_based_structure.png

Download Tata Aia Life Insurance Company Limited Is A Joint Tata Aia

https://www.nicepng.com/png/detail/385-3852469_tata-aia-life-insurance-company-limited-is-a.png

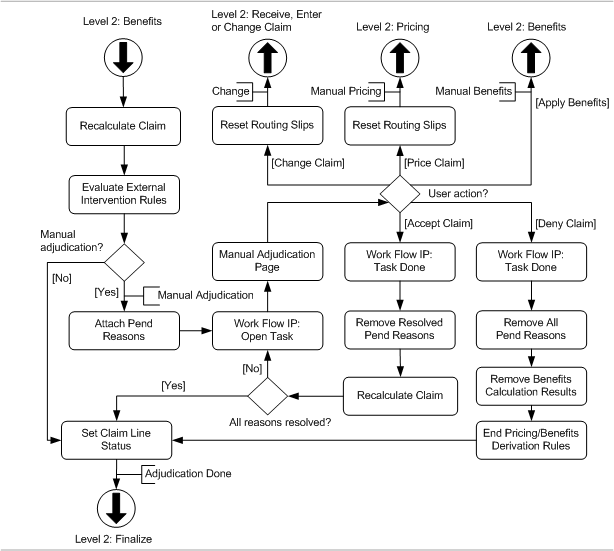

Adjudication Oracle Health Insurance Claims Adjudication And Pricing

https://docs.oracle.com/en/industries/insurance/health-insurance-components/claims-3.21.1/operations/claims-flow/_images/adjudication-1.png

You will also get to enjoy pre negotiated outpatient consultation fees with our AQHP specialist as an AIA HealthShield customer For requests submitted on Mondays to Fridays between 8 45am to 5 30pm Excludes Public Holidays We will try our best to arrange an appointment with your preferred specialist within 3 working days 5 co payment S 3 000 cap at S 3 000 per policy year AIA Max VitalHealth A will cover the remaining S 20 150 AIA Max VitalHealth A will only cover the deductible in excess of S 2 000 and co insurance subject to a 5 co payment As there is a co payment cap of S 3 000 Tom needs to pay a total of S 5 000

Claims based pricing Premiums will not rise year on year and will remain as stipulated in your policy contract s schedule of premiums unless you make a claim which will increase as stipulated in the claims multiplier table However if you re willing to pay a bit more for ultra comprehensive coverage AIA Healthshield Gold Max A has This innovative approach to insurance pricing is gaining traction and it s essential for you to get the low down on it At its core claims based pricing is pretty straightforward Think of it like a reward system The fewer claims you make the lower your premiums could be It s a bit like those no claims discounts you might have heard

![]()

Vitality AIA Dynamic Pricing 30s On Vimeo

https://i.vimeocdn.com/filter/overlay?src0=https:%2F%2Fi.vimeocdn.com%2Fvideo%2F1294354117-5ba3ecdff13602ee5e929d83a0f0b98a2fa5293e9b0d9f5b6_1280x720&src1=https:%2F%2Ff.vimeocdn.com%2Fimages_v6%2Fshare%2Fplay_icon_overlay.png

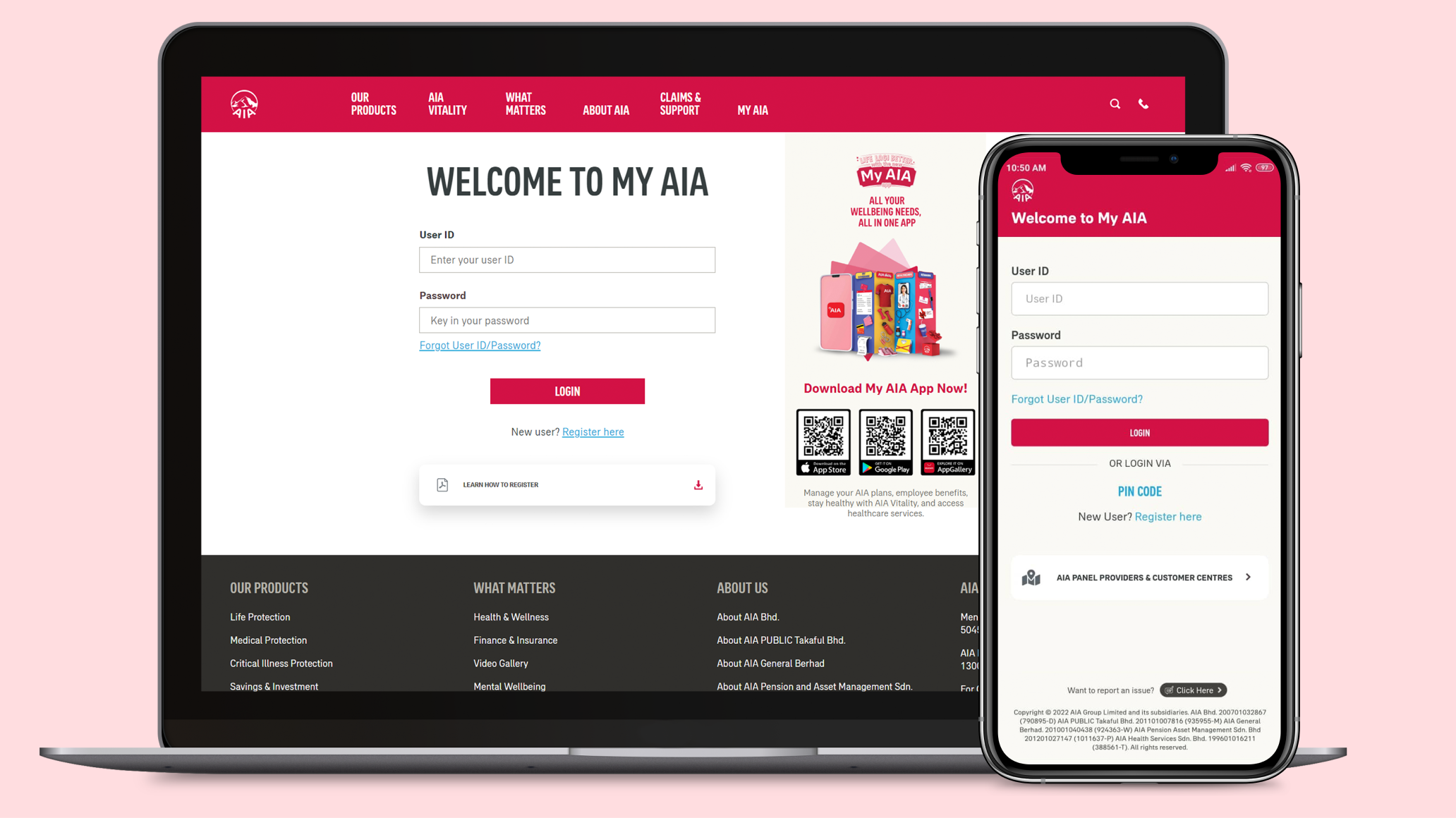

My AIA Online Payment AIA Malaysia

https://www.aia.com.my/content/dam/my/en/images/premium-payments/AIA 1.png

Aia Claims Based Pricing - The effects of claims based premium pricing and PRU Well Reward was reflected in customer s premiums on their renewal from 1 April 2022 onwards Our unique claims based premium pricing mechanism rewards our customers for staying healthy and modest usage of healthcare services Enjoy Premium Discounts with PRUWell Reward