Adjustment Examples Here are some of the most common types of adjusting entries you can expect to make 1 Accrued expenses Accrued expenses or accrued liabilities are those that you incur in a pay period but pay for at a later date This can happen with recurring bills like utilities or payroll For example your employees may work throughout the month but

Adjusting entries also known as end of period adjustments are journal entries that are made at the end of an accounting period to adjust the accounts to accurately reflect the revenues and expenses of the current period The preparation of adjusting entries is the fifth step of the accounting cycle that starts after the preparation of the Example adjusting entry In your general ledger the adjustment looks like this First during February when you produce the bags and invoice the client you record the anticipated income For the sake of balancing the books you record that money coming out of revenue Then when you get paid in March you move the money from accrued

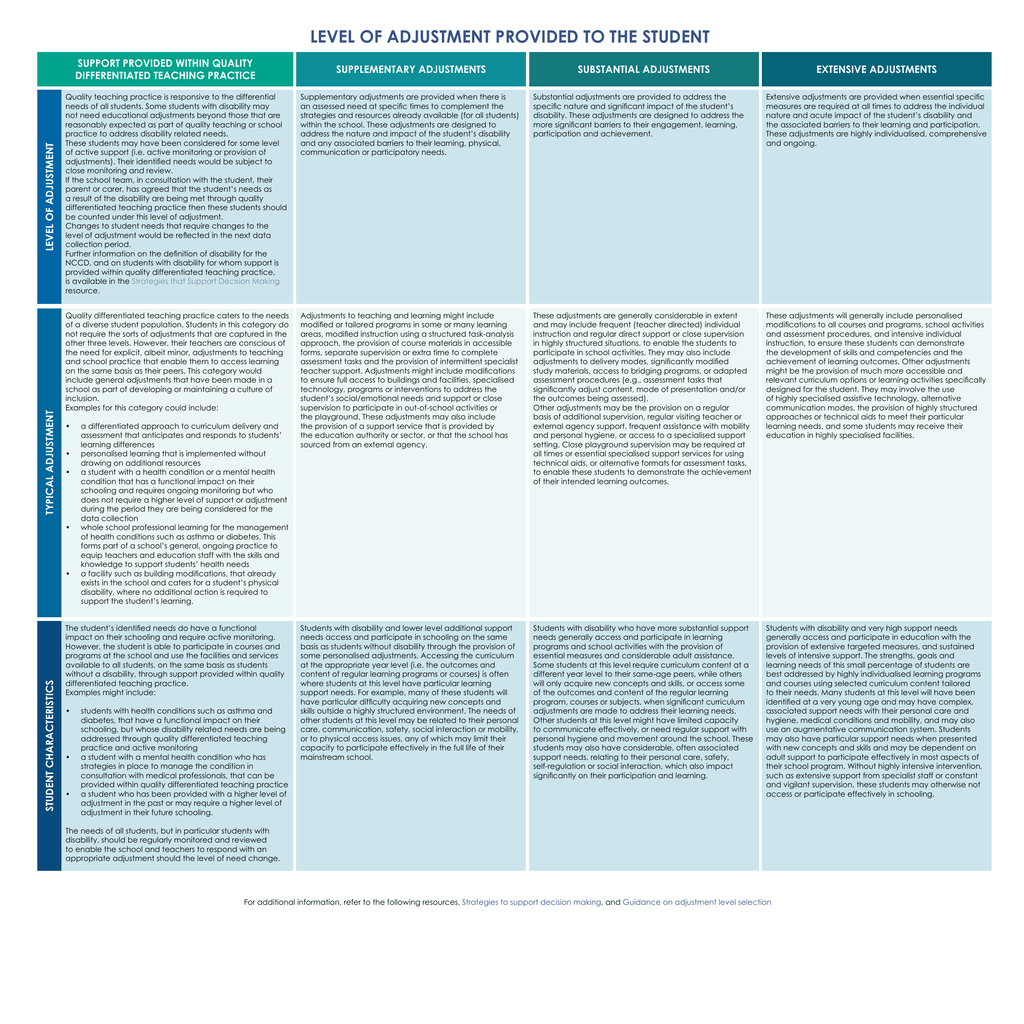

Adjustment Examples

Adjustment Examples

https://s2.studylib.net/store/data/018052767_1-eef0825e5f49929fc9c80c009632b233.png

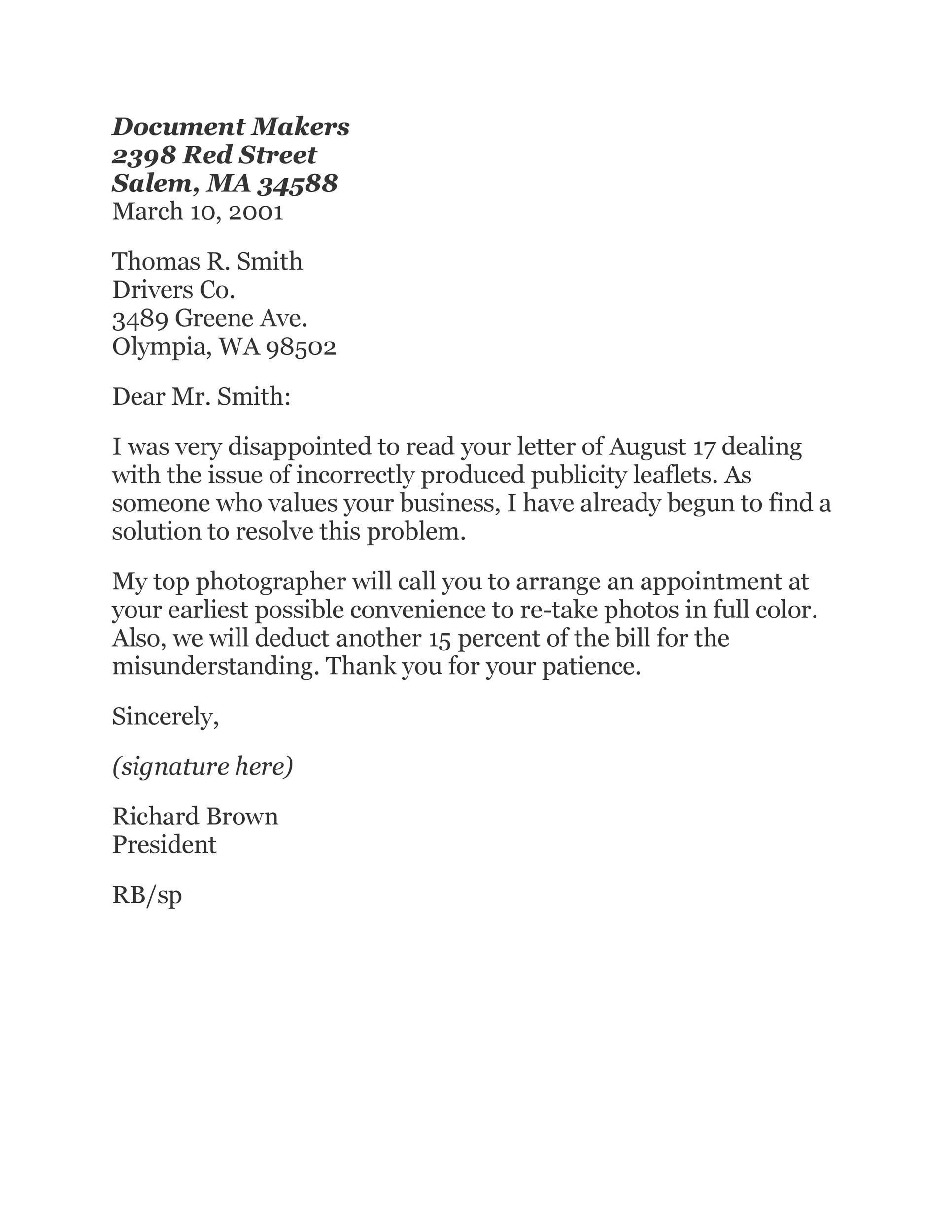

41 Editable Adjustment Letter Templates Examples TemplateLab

https://templatelab.com/wp-content/uploads/2019/01/adjustment-letter-15.jpg

41 Editable Adjustment Letter Templates Examples TemplateLab

http://templatelab.com/wp-content/uploads/2019/01/adjustment-letter-10.jpg?w=790

Adjusting entries also called adjusting journal entries are journal entries made at the end of a period to correct accounts before the financial statements are prepared This is the fourth step in the accounting cycle Adjusting entries are most commonly used in accordance with the matching principle to match revenue and expenses in the period in which they occur Types of Adjusting Journal Entries 1 Accrual example An accrued revenue is the revenue that has been earned goods or services have been delivered while the cash has neither been received nor recorded A typical example is credit sales The revenue is recognized through an accrued revenue account and a receivable account

Adjusting Journal Entry An adjusting journal entry is an entry in financial reporting that occurs at the end of a reporting period to record any unrecognized income or expenses for the period Examples include adjusting prepaid expenses and unearned revenue ensuring accurate financial reporting that aligns with the timing of economic activities Prepare estimate and provisions adjustments Certain adjusting entries involve estimating amounts for expenses such as depreciation or bad debt The methods used for estimation are straight

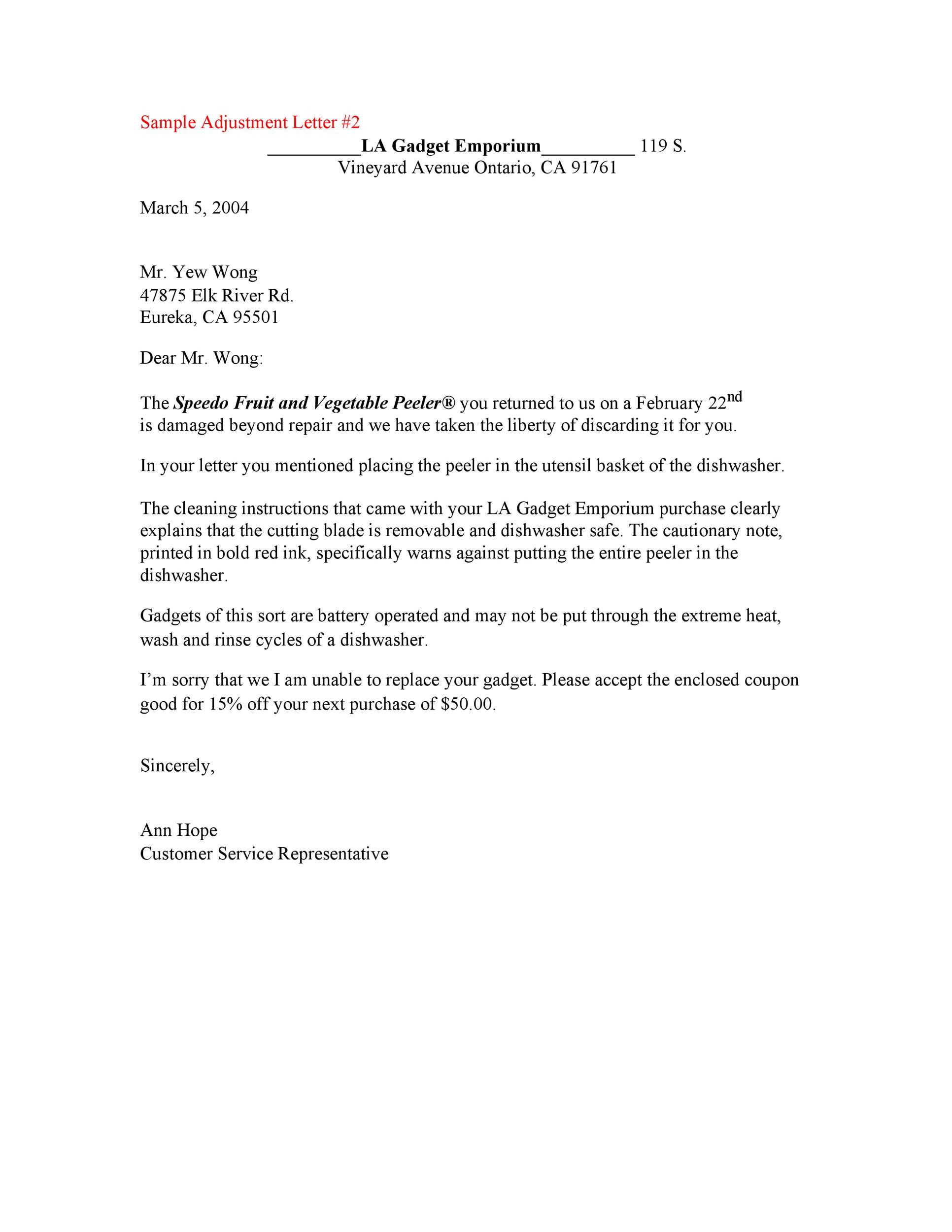

More picture related to Adjustment Examples

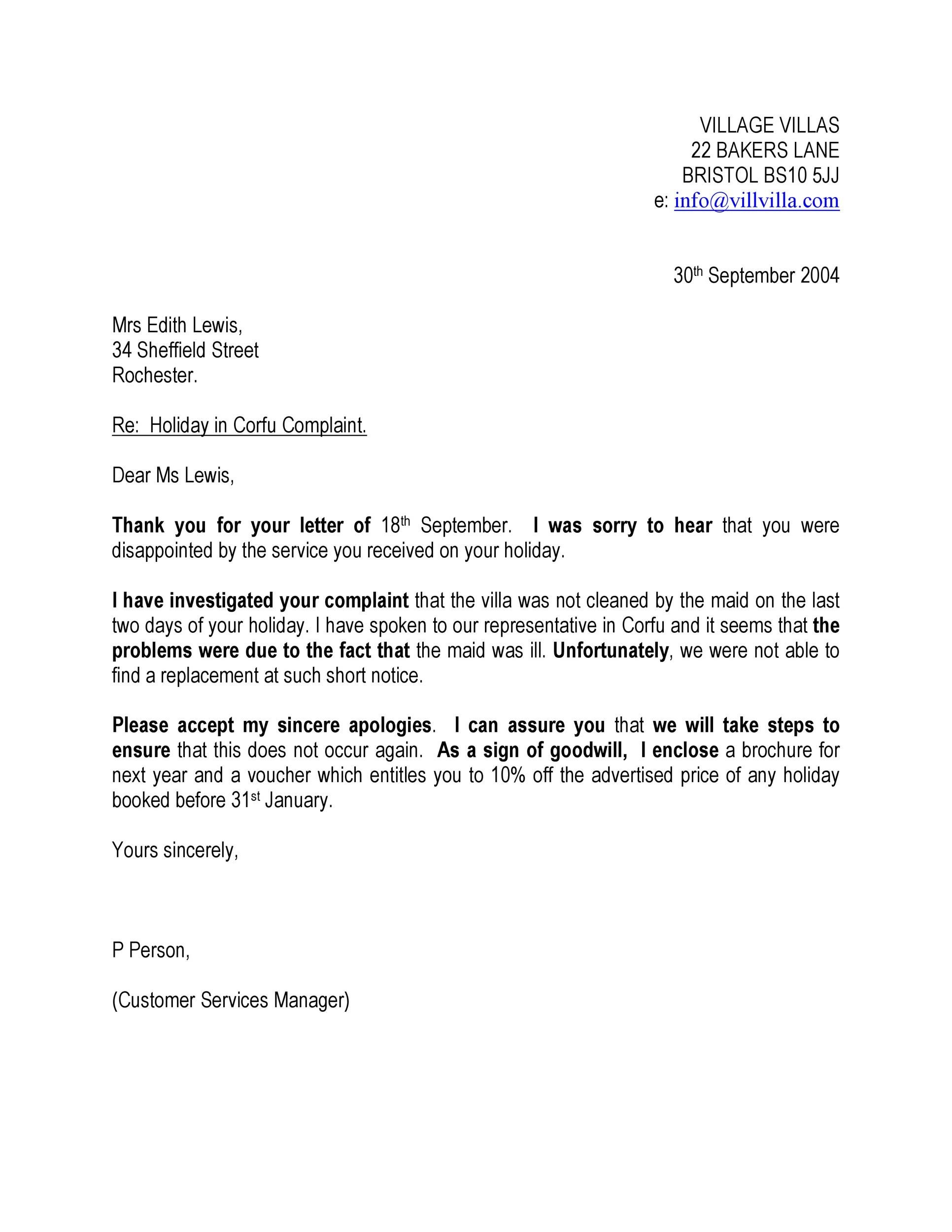

41 Editable Adjustment Letter Templates Examples TemplateLab

https://templatelab.com/wp-content/uploads/2019/01/adjustment-letter-01.jpg

41 Editable Adjustment Letter Templates Examples TemplateLab

http://templatelab.com/wp-content/uploads/2019/01/adjustment-letter-32.jpg?w=395

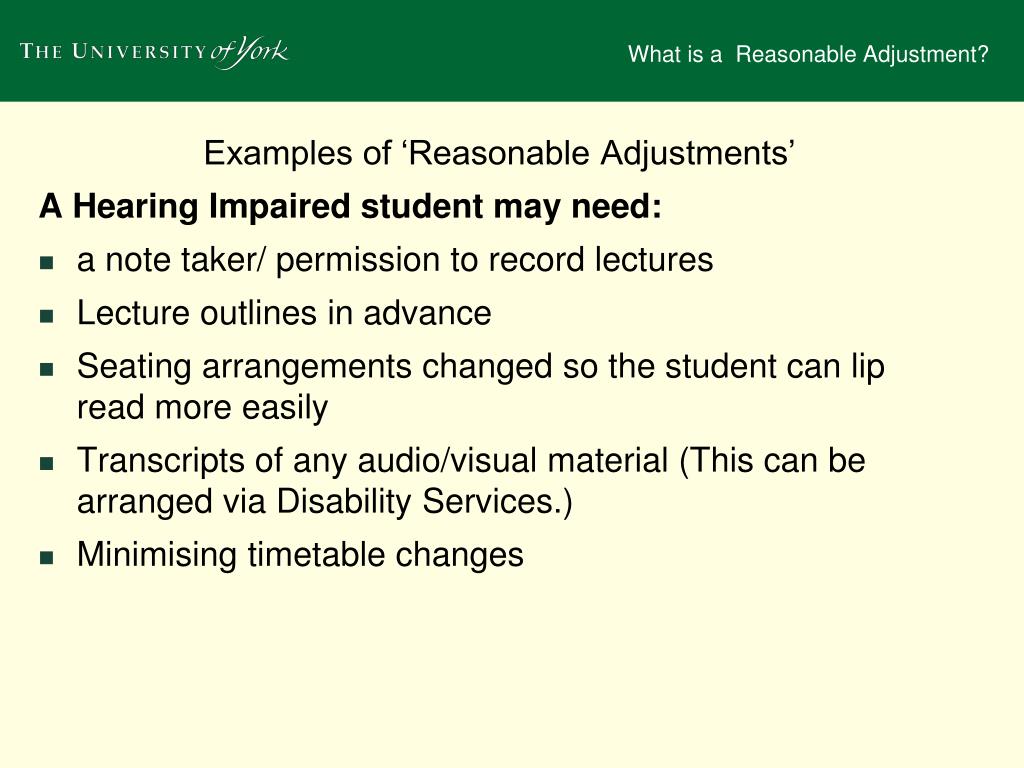

PPT What Is A Reasonable Adjustment PowerPoint Presentation Free

https://image3.slideserve.com/6531361/what-is-a-reasonable-adjustment3-l.jpg

Adjusting entries helps ensure that financial statements reflect the true financial position and performance of a business by aligning income and expenses with the appropriate accounting periods They ensure compliance with Generally Accepted Accounting Principles GAAP or International Financial Reporting Standards IFRS particularly the The adjusting entries examples below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of adjusting entries In each case the adjusting entries examples show the debit and credit account together with a brief narrative

Interest Expense Adjusting Entries If a business has debt finance one of the adjusting journal entries will be for interest accrued but not paid at the and of an accounting period Suppose for example a business has a debt of 50 000 with interest at 8 paid on the 10th of each month One example of adjusting entries for estimates is inventory reserve Over time a company s accountant may observe that a certain percentage of inventory on hand consistently becomes unsellable due to damage loss or obsolescence As a result an adjusting entry to establish or change an inventory reserve improves the accuracy of inventory

Anchoring Adjustments Causes Examples Lesson Study

https://study.com/cimages/videopreview/bvlmxc0o16.jpg

What Are Statement Of Adjustments Conveyancing Depot

https://www.conveyancingdepot.com.au/wp-content/uploads/2021/08/SOA-3.jpg

Adjustment Examples - For example the employee is paid for the prior month s work on the first of the next month The financial statements must remain up to date so an adjusting entry is needed during the month to show salaries previously unrecorded and unpaid at the end of the month Let s say a company has five salaried employees each earning 2 500 per month