80 000 Salary After Taxes Ontario Marginal Tax Rate 29 65 Average Tax Rate 19 08 Comprehensive Deduction Rate 25 47 80 000 00 a year is how much per hour What is the minimum wage in Ontario in 2024 Net Pay 59 627 89

Summary If you make 52 000 a year living in the region of Ontario Canada you will be taxed 14 043 That means that your net pay will be 37 957 per year or 3 163 per month Your average tax rate is 27 0 and your marginal tax rate is 35 3 This marginal tax rate means that your immediate additional income will be taxed at this rate What is 80 000 a year after taxes in Ontario Calculate your take home pay with CareerBeacon s income tax calculator for the 2023 tax year

80 000 Salary After Taxes Ontario

80 000 Salary After Taxes Ontario

https://kalfalaw.com/wp-content/uploads/2021/09/Marginal-Tax-Rates-2020_Ontario.png

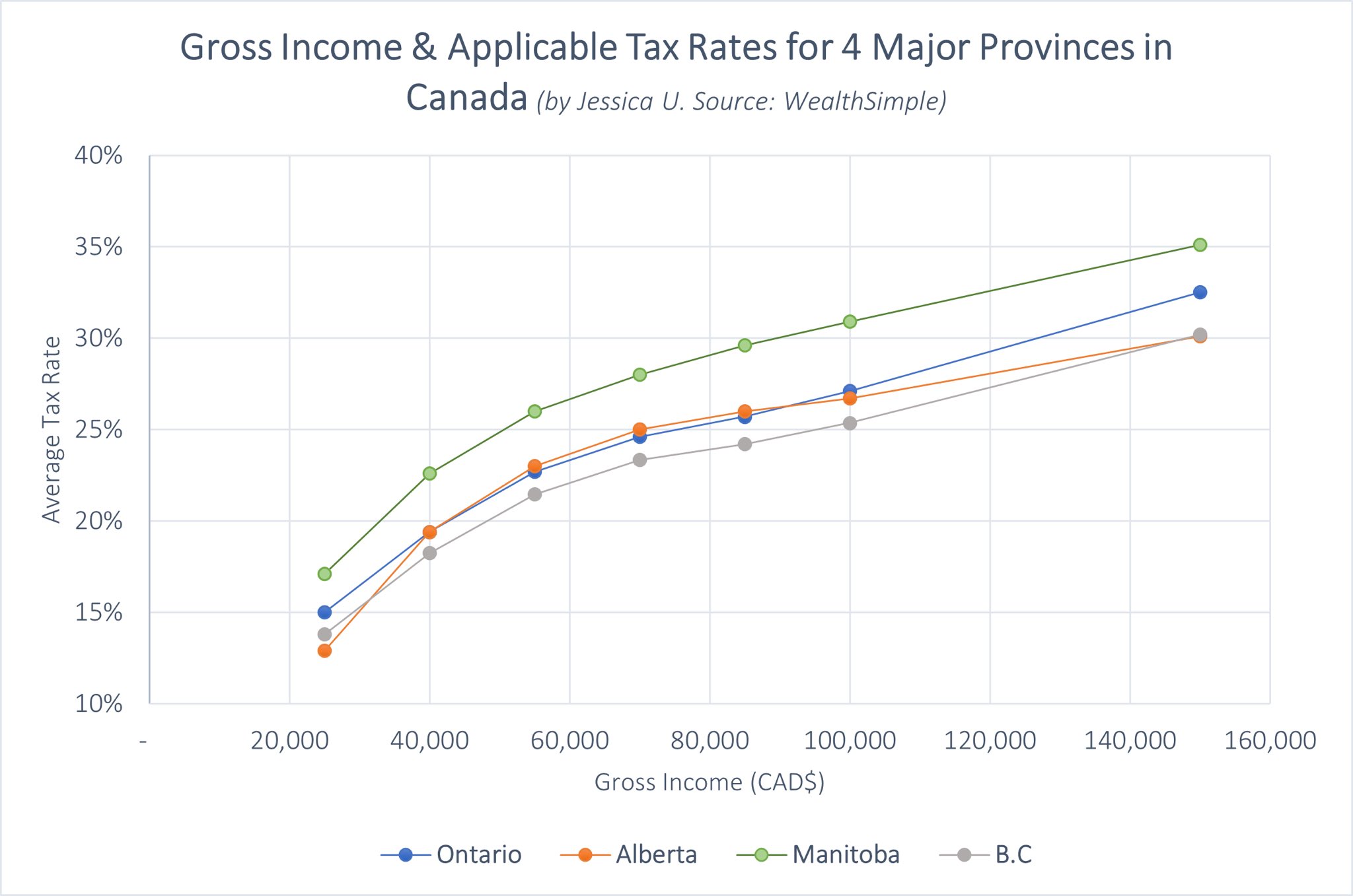

Jessica Ayodele on Twitter: "Gross Income & Applicable Taxes in Canada 🇨🇦 First, whatever salary your potential employer offers you is your GROSS income & taxes will always apply. An $85K annual

https://pbs.twimg.com/media/FSejQrfXwAAXLWW.jpg:large

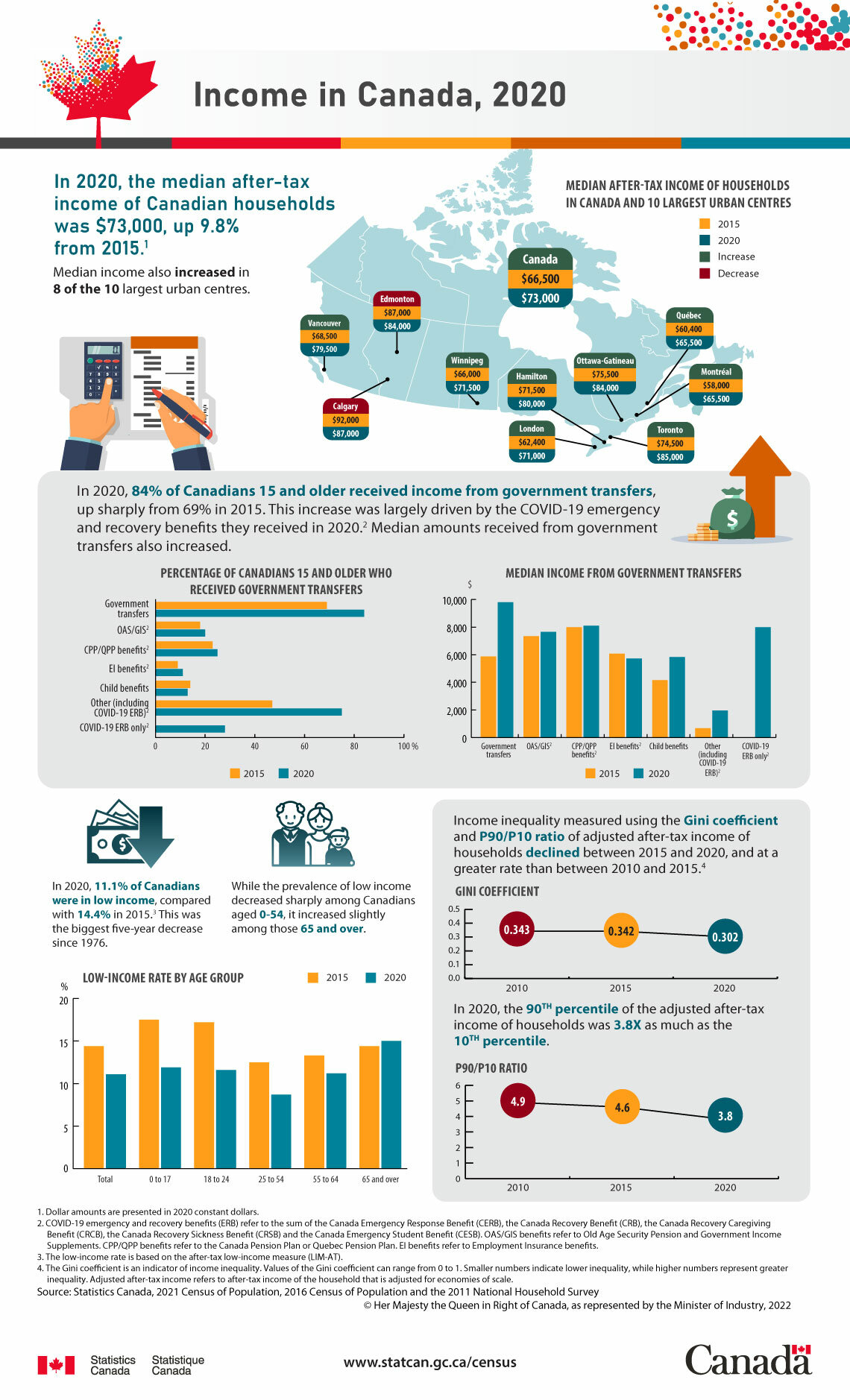

Median After-Tax Income in Canada: This Is How Much Canadians Earned in 2020 | To Do Canada

https://www.todocanada.ca/wp-content/uploads/11-627-m2022040-eng.jpg

80k Salary After Tax in Ontario in 2024 This Ontario salary after tax example is based on a 80 000 00 annual salary for the 2024 tax year in Ontario using the income tax rates published in the Ontario tax tables The 80k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour If you live in Ontario and earn a gross annual salary of 76 004 or 6 334 per month your monthly take home pay will be 4 758 This results in an effective tax rate of 25 as estimated by our Canadian salary calculator Please note that all figures on this page are expressed in Canadian dollars CAD

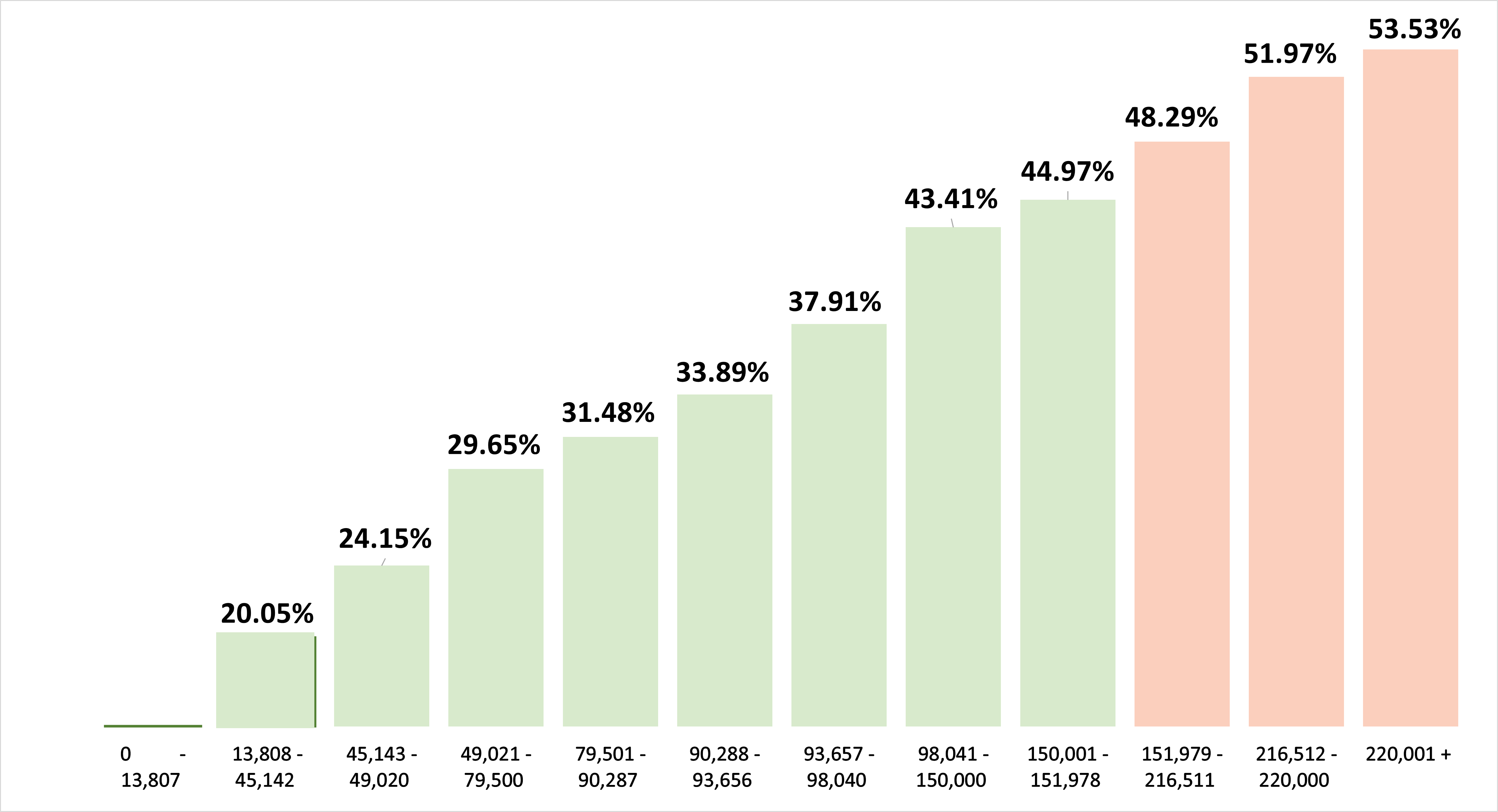

The tax rates for Ontario in 2024 are as follows Amounts earned up to 51 446 are taxed at 5 05 Amounts above 51 446 up to 102 894 are taxed at 9 15 Amounts 102 894 up to 150 000 the rate is 11 16 Earnings 150 000 up to 220 000 the rates are 12 16 80k Salary After Tax in Ontario in 2022 This Ontario salary after tax example is based on a 80 000 00 annual salary for the 2022 tax year in Ontario using the income tax rates published in the Ontario tax tables The 80k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour

More picture related to 80 000 Salary After Taxes Ontario

![OC] How much money do you get to spend in each country for a Gross Salary equivalent of $100,000 (USD) : r/dataisbeautiful oc-how-much-money-do-you-get-to-spend-in-each-country-for-a-gross-salary-equivalent-of-100-000-usd-r-dataisbeautiful](https://preview.redd.it/aky6nsz3vt491.png?auto=webp&s=e0391bf8e246aa2893681cb5b5e35d106f0aabd3)

OC] How much money do you get to spend in each country for a Gross Salary equivalent of $100,000 (USD) : r/dataisbeautiful

https://preview.redd.it/aky6nsz3vt491.png?auto=webp&s=e0391bf8e246aa2893681cb5b5e35d106f0aabd3

Personal Income Tax Brackets – Ontario 2021 - MD Tax

http://mdtax.ca/wp-content/uploads/2022/02/Picture2.png

Ontario Income Tax Calculator | WOWA.ca

https://wowa.ca/static/img/opengraph/ontario-tax-calculator.png

One of the most common tax credits is the basic personal amount which is a non refundable credit that every resident can easily claim For 2024 the basic personal amount in Ontario is 12 399 This means that you can multiply this amount by 5 05 and subtract it from your income tax The tax rates in Ontario range from 5 05 to 13 16 of income and the combined federal and provincial tax rate is between 20 05 and 53 53 Ontario s marginal tax rate increases as your income increases so you pay higher taxes on the level of income that falls into a higher tax bracket Learn more about Ontario s marginal taxes

Calculate your monthly take home pay in 2024 that s your 2024 monthly salary after tax with the Monthly Ontario Salary Calculator A quick and efficient way to compare monthly salaries in Ontario in 2024 review income tax deductions for monthly income in Ontario and estimate your 2024 tax returns for your Monthly Salary in Ontario Calculate your annual take home pay in 2021 that s your 2021 annual salary after tax with the Annual Ontario Salary Calculator A quick and efficient way to compare annual salaries in Ontario in 2021 review income tax deductions for annual income in Ontario and estimate your 2021 tax returns for your Annual Salary in Ontario

Median household income AFTER taxes. EU and Northern America (Canada/USA). : r/MapPorn

https://preview.redd.it/ha9u3e17g1491.png?auto=webp&s=7034e8964db49bb3fdfa85b6975a2e9efe09da37

Income Tax Rates for the Self-Employed 2020 | 2021 TurboTax® Canada Tips

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

80 000 Salary After Taxes Ontario - What is 80 000 a year after taxes in Ontario Calculate your take home pay with CareerBeacon s income tax calculator for the 2021 tax year