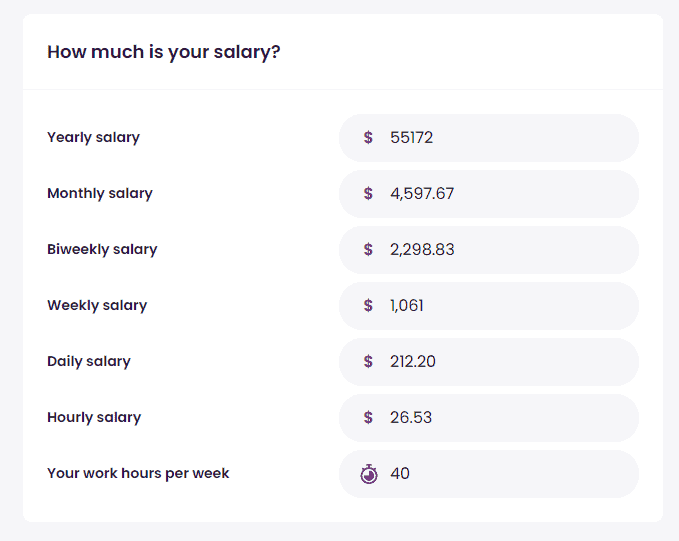

65000 Salary To Hourly After Tax Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted What is a 65k after tax 65000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax refund calculations 53 886 50 net salary is 65 000 00 gross salary

65000 Salary To Hourly After Tax

65000 Salary To Hourly After Tax

https://moneybliss.org/wp-content/uploads/2021/11/65000-a-year-1-683x1024.jpg

Hourly Rate Of 65000 Salary DinyarRubhan

https://moneybliss.org/wp-content/uploads/2021/11/pp-5-47.jpg

Salary To Hourly After Taxes ConnallNara

https://i.pinimg.com/originals/5c/62/2a/5c622a11ef8e29375d81a446c2ebfb98.jpg

Annual salary 65000 25 estimated tax rate 65000 x 0 25 16250 in annual taxes 4 Determine the after tax hourly wage Gross hourly pay 31 25 hour Annual taxes on gross salary 16 250 Net annual salary 65000 16250 48750 48750 2 080 hours 23 44 per hour after taxes The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

2013 46 992 If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750 If you earn more than that then you ll be taxed 2 on income between 750 and 2 250 The marginal rate rises to 3 on income between 2 250 and 3 750 4 on income between 3 750 and 5 250 5 on income between 5 250 and In the year 2024 in the United States 65 000 a year gross salary after tax is 52 960 annual 3 999 monthly 919 69 weekly 183 94 daily and 22 99 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 65 000 a year after tax in the United States Yearly

More picture related to 65000 Salary To Hourly After Tax

Hourly Income After Tax Calculator RomanaElita

https://i.pinimg.com/736x/9b/02/fd/9b02fd59c59e0b7adaca925104d32a0e.jpg

Hourly Rate Of 65000 Salary DinyarRubhan

https://www.nea.org/sites/default/files/styles/1520wide/public/2022-04/6 - Teacher-pay-percentages_0.jpg?itok=7bHHlHhv

Salary To Hourly Pay Wage Conversion Calculator DannyRagnar

https://i.pinimg.com/originals/1f/87/71/1f877170cbd45b670f06b771f2e26f9d.jpg

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 Earning 65 000 a year means you re making 31 25 per hour Factors such as insurance PTO and taxes can affect how much of your income you take home though and can increase or decrease your hourly pay Our in house research team and on site financial experts work together to create content that s accurate impartial and up to date

Summary If you make 65 000 a year living in Australia you will be taxed 12 892 That means that your net pay will be 52 108 per year or 4 342 per month Your average tax rate is 19 8 and your marginal tax rate is 34 5 This marginal tax rate means that your immediate additional income will be taxed at this rate To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

Yearly To Hourly Wage Calculator Uk CALCULATORUK DFE

https://i2.wp.com/www.wikihow.com/images/f/f7/Calculate-Your-Real-Hourly-Wage-Step-13.jpg

Hourly Rate Of 65000 Salary BaldurMayzie

https://thepennymatters.com/wp-content/uploads/2021/11/also-65000-a-year-is-how-much-an-hour.png

65000 Salary To Hourly After Tax - Annual salary 65000 25 estimated tax rate 65000 x 0 25 16250 in annual taxes 4 Determine the after tax hourly wage Gross hourly pay 31 25 hour Annual taxes on gross salary 16 250 Net annual salary 65000 16250 48750 48750 2 080 hours 23 44 per hour after taxes