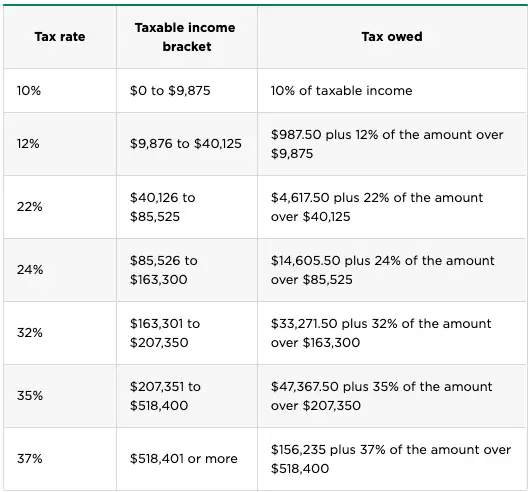

58000 A Year Is How Much An Hour After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

If you make 58 000 a year you will make 4 461 54 a month before taxes assuming you are working full time Each month after taxes you will make approximately 3 346 15 A full time worker or employee works at least 40 hours a week If you work either more or fewer hours this amount will vary slightly Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

58000 A Year Is How Much An Hour After Taxes

58000 A Year Is How Much An Hour After Taxes

https://radicalfire.com/wp-content/uploads/2022/09/58000-A-Year-Is-How-Much-An-Hour-Best-Tips-To-Maximize-Your-Earnings.jpg

33 An Hour Is How Much A Year HOWMKUH

https://i2.wp.com/www.howtofire.com/wp-content/uploads/33-an-hour-is-how-much-a-year-1200x628-1.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Let s walk through the steps to determine the after tax hourly wage from a 58000 annual salary 1 Convert the annual salary to a gross hourly wage 58000 per year Working 40 hours per week 52 weeks per year 2 080 hours 58000 2 080 hours 27 88 per hour gross pay 2 Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

What is 46 052 00 as a gross salary An individual who receives 46 052 00 net salary after taxes is paid 58 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 58 000 00 salary Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 For the 2023 tax year

More picture related to 58000 A Year Is How Much An Hour After Taxes

48 000 A Year Is How Much An Hour Budget Billz

https://budgetandbillz.com/wp-content/uploads/2022/03/48000-a-Year-is-How-Much-an-Hour-1024x576.jpg

60k A Year Is How Much An Hour Full Financial Breakdown

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/how-much-is-60000-a-year-per-hour-1-683x1024.jpg

60k A Year Is How Much An Hour Is 60k A Year Good

https://www.remoteworkcareers.com/wp-content/uploads/2022/03/60k-a-year-is-how-much-an-hour.jpg

Roughly if you make a yearly salary of 58 000 you will need to pay between 9 28k to 13 92k in taxes Let s be conservative and estimate based on the higher taxes of 13 92k We are also going to assume that you get two weeks of paid vacation per year 58 000 13920 2080 21 an hour That means that after taxes you will have an 2 Calculate the Hourly Rate Divide the annual salary by the number of working hours in a year For 58 000 year 58 000 2 080 hours approximately 27 88 hour 3 Calculate the Daily Rate Multiply the hourly rate by the number of working hours in a day Assuming an 8 hour workday 27 88 hour 8 hours day approximately 223 08 day 4

Then you would be working 50 weeks of the year and if you work a typical 40 hours a week you have a total of 2 000 hours of work each year In this case you can quickly compute the hourly wage by dividing the annual salary by 2000 Your yearly salary of 58 000 is then equivalent to an average hourly wage of 29 per hour Frequently Asked Questions 58 000 a year is how much a month If you make 58 000 a year your monthly salary would be 4 832 53 Assuming that you work 40 hours per week we calculated this number by taking into consideration your yearly rate 58 000 a year the number of hours you work per week 40 hours the number of weeks per year

58000

https://moneybliss.org/wp-content/uploads/2022/12/58000-a-year-683x1024.jpg

How Much Money Before You Have To Pay Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/50000-a-year-is-how-much-an-hour-before-after-tax.png

58000 A Year Is How Much An Hour After Taxes - Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 For the 2023 tax year