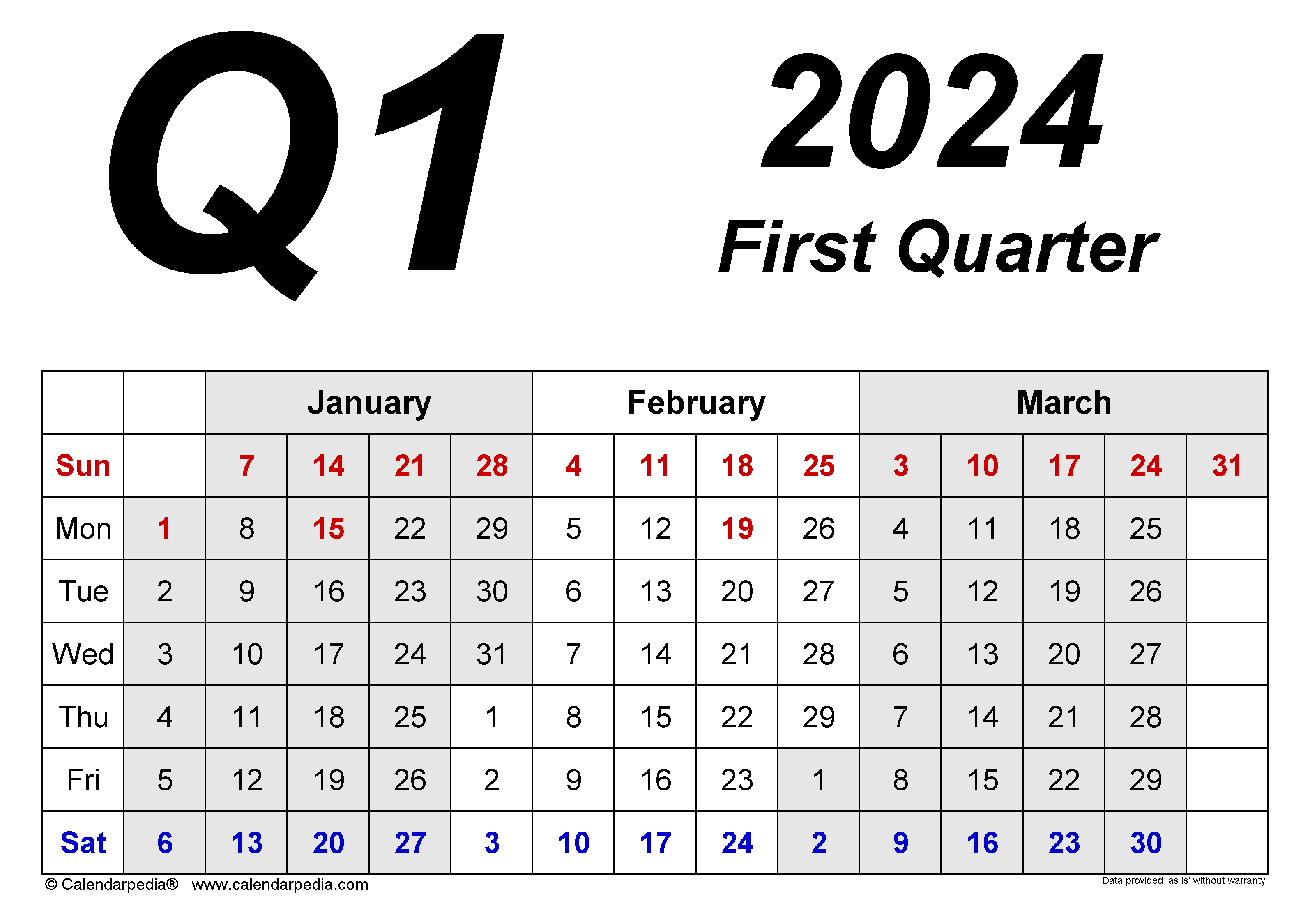

55000 A Year How Much A Month After Tax After Tax Income In the U S the concept of personal income or salary usually references the before tax amount called gross pay For instance it is the form of income required on mortgage applications is used to determine tax brackets and is used when comparing salaries Pay on a specified day once a month Quarterly Pay 4 times a

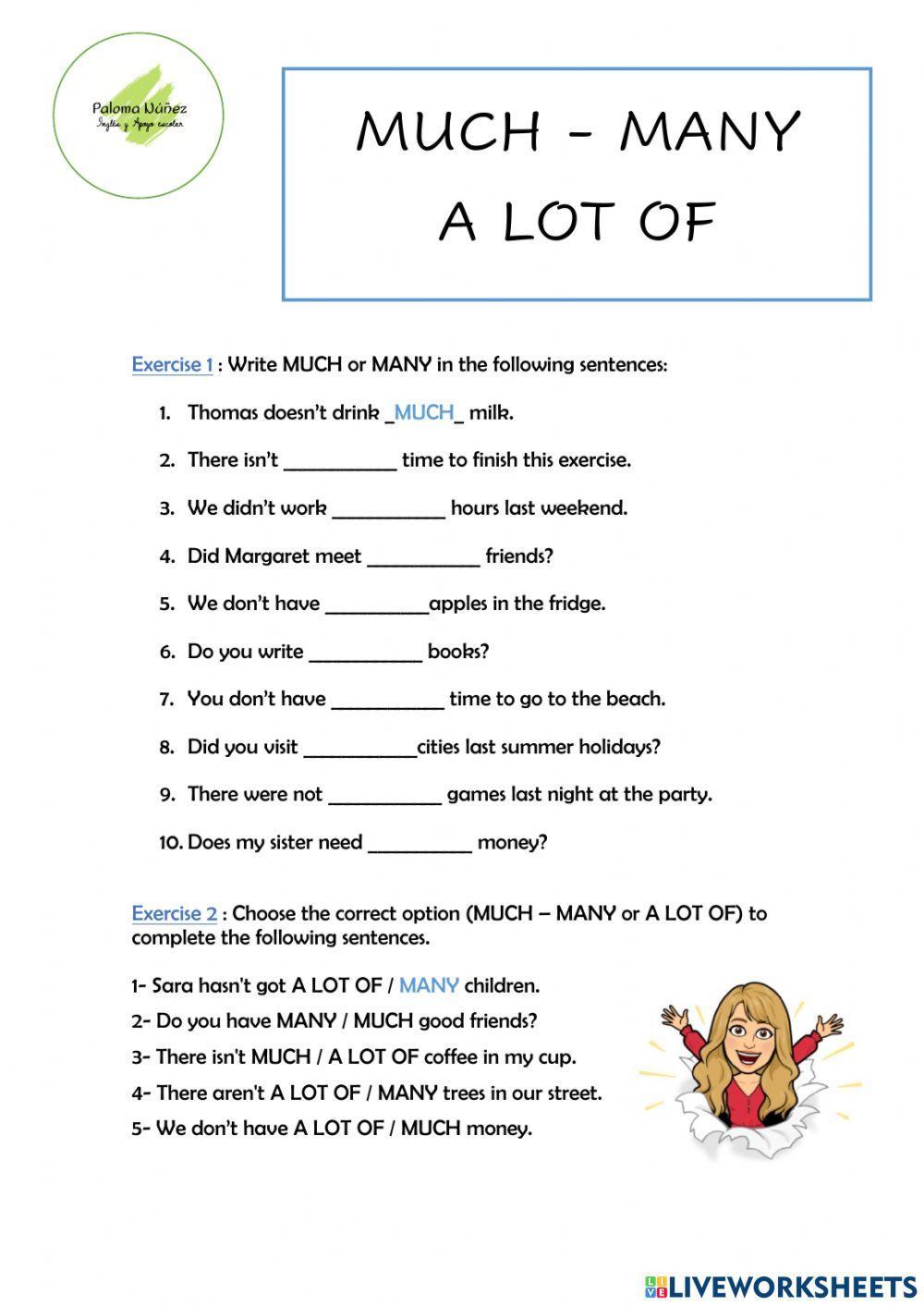

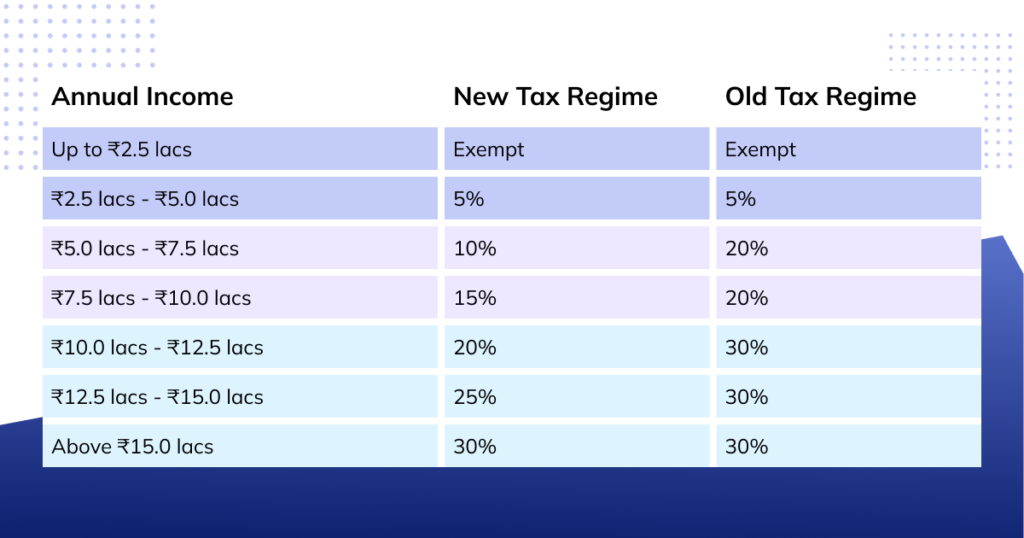

55 000 yearly is how much per month If you make 55 000 per year your Monthly salary would be 4 583 This result is obtained by multiplying your base salary by the amount of hours week and months you work in a year assuming you work 40 hours a week A salary of 55 000 per year is equivalent to 55 00012 4 583 33 frac 55 000 12 4 583 33 So before taxes and deductions you earn about 4 583 33 per month Federal Income Tax on 55 000 The U S tax system is progressive meaning different portions of income are taxed at different rates For 2024 the tax brackets for single filers are

55000 A Year How Much A Month After Tax

55000 A Year How Much A Month After Tax

https://www.liveworksheets.com/sites/default/files/styles/worksheet/public/def_files/2021/8/6/108061532411106547/108061532411106547001.jpg?itok=u5NbyaSy

Rhodes Freight Services S20RFS M20 Lenham Heath 28 07 2020 Flickr

https://live.staticflickr.com/65535/52858903349_b815dfbf48_b.jpg

Form 16 Meaning Eligibility Benefits More Razorpay Payroll

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Before reviewing the exact calculations in the 55 000 00 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example Answer is 28 39 assuming you work roughly 40 hours per week or you may want to know how much 55k a year is per month after taxes Answer 55 000 00 After Tax then multiplying that daily amount to provide a monthly salary that changes each month depending on how many days there are in the month 28 29 30 or 31 US Salary Tax Calculation for 2025 Tax Year based on annual salary of 55 000 00 California State Tax Calculation Annual Income for 2025 55 000 00

55000 a year is How Much a Month After Taxes Based on the average combined tax rate of 25 we will directly calculate your after tax monthly salary Your Monthy Salary Before Taxes 4583 33 Your Monthy Salary After Taxes 4583 33 4583 33 25 3437 5 55 000 a year is 2 115 38 biweekly before taxes and approximately 1 586 54 after taxes Paying a tax rate of 25 and working full time at 40 hours a week you would earn 1 586 54 after taxes To calculate how much you make biweekly before taxes you would multiply the hourly wage for 55 000 a year 26 44 by 80 hours to get 2 115 38

More picture related to 55000 A Year How Much A Month After Tax

Joe Rogan

https://i.pinimg.com/originals/3f/58/87/3f5887d58840477379034031825f3cf3.jpg

BOKEN SHA Sake Bar Domestika

https://cdn.domestika.org/c_fit,dpr_auto,f_auto,q_80,t_base_params,w_820/v1706748764/content-items/014/906/796/03-original.jpg?1706748764

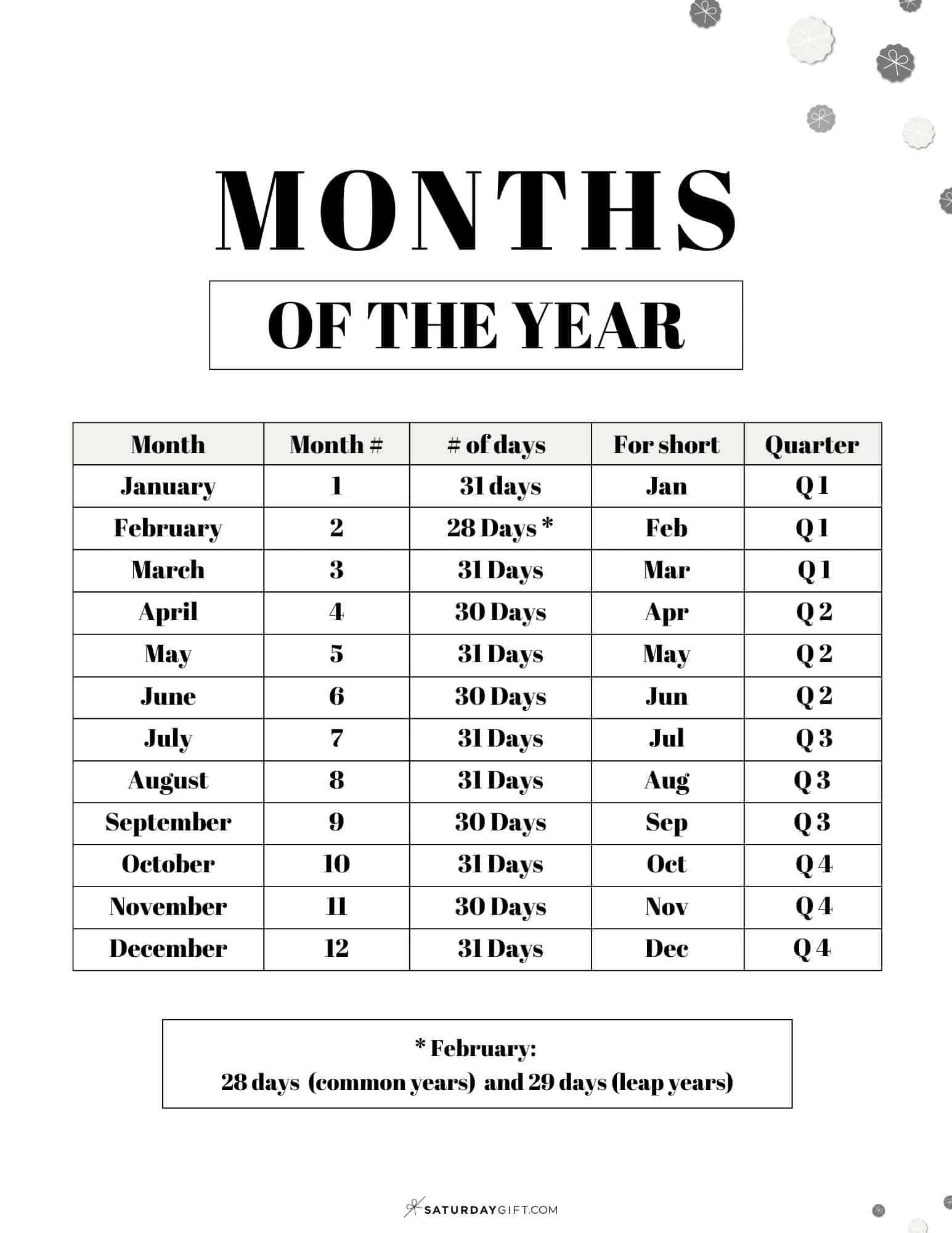

How Many Months Until March 1 2025 Raya Hana

https://www.saturdaygift.com/wp-content/uploads/List-of-months-months-of-the-year-list-SaturdayGift.jpg

If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate If you make 55 000 a year living in the region of California USA you will be taxed 11 676 That means that your net pay will be 43 324 per year or 3 610 per month Your average tax rate is 21 2 and your marginal tax rate is 39 6 This marginal tax rate means that your immediate additional income will be taxed at this rate

[desc-10] [desc-11]

Ssdi Tax Calculator LeopoldoNiamh

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Deadline For 1702q 3rd Quarter 2025 Imran Gemma

https://www.calendarpedia.com/images-large/quarterly/quarterly-calendar-template-2024.png

55000 A Year How Much A Month After Tax - 55000 a year is How Much a Month After Taxes Based on the average combined tax rate of 25 we will directly calculate your after tax monthly salary Your Monthy Salary Before Taxes 4583 33 Your Monthy Salary After Taxes 4583 33 4583 33 25 3437 5