55 000 Salary To Hourly After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

55 000 Salary To Hourly After Taxes

55 000 Salary To Hourly After Taxes

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/dave-ramsey-budget-percentages-for-50000-salary-512x1024.jpg

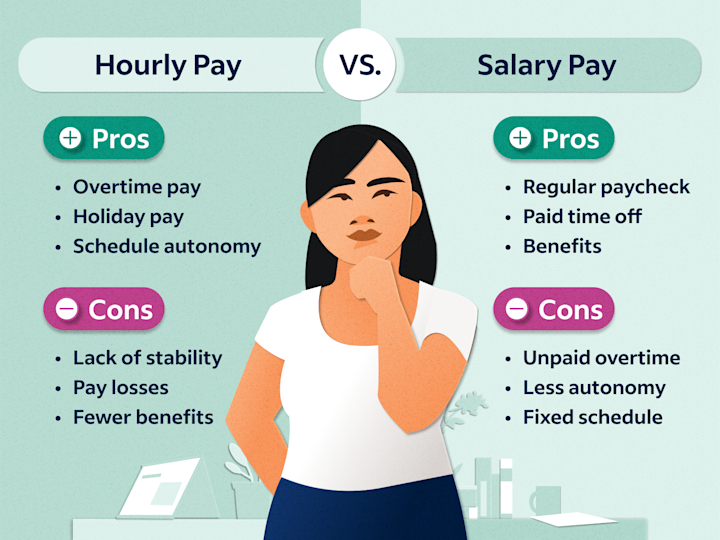

Differences Between Wages Vs Salaries Plus Pros And Cons Indeed

https://images.ctfassets.net/pdf29us7flmy/4pFOfwO8DKsTBzi6ny4dyg/5792c4141a3b12cccbf29e3310995b7f/hourly-vs-salary-new.png?w=720&q=100&fm=jpg

BEL Recruitment 2022 Last Date Salary Up To Rs 55 000 Apply Quick

https://examsdaily.in/wp-content/uploads/2022/10/BEL-Recruitment-2022-Last-Date-Salary-Up-1.jpg

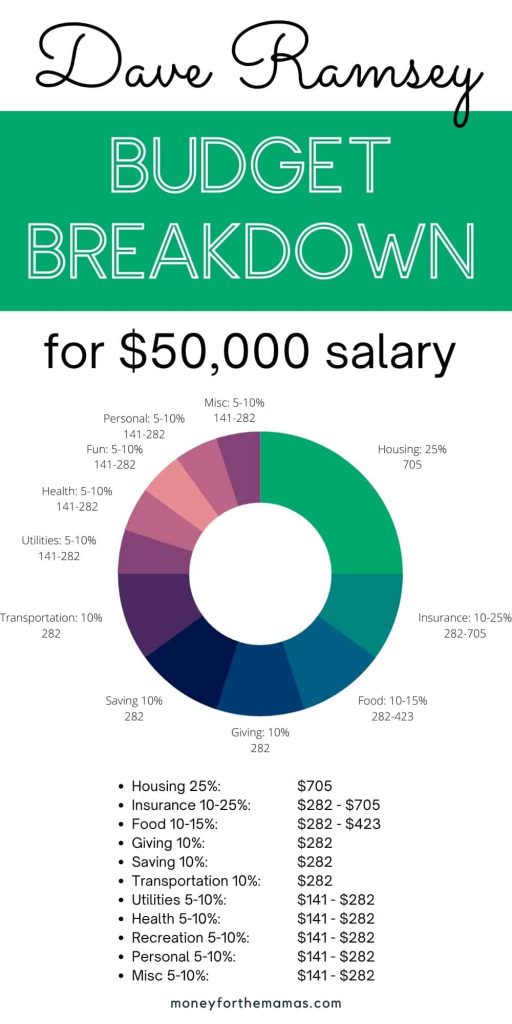

For this purpose let s assume some numbers the annual salary in our case is 50 000 and we work 40 hours per week Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 24 04 per hour Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 28 85 Weekly paycheck to hourly rate Before versus after tax income When using this salary to hourly calculator to calculate your hourly rate based on the desired yearly salary you want you should always consider the difference between pre tax and after tax salary and hence hourly Make sure you account for all applicable local and state taxes imposed on labor Yes however

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get A free calculator to convert a salary between its hourly biweekly monthly and annual amounts Related Take Home Pay Calculator Income Tax Calculator Age A person closer to their peak income years which is 40 55 will generally have higher salaries Men aged 45 to 54 had the highest annual earnings at 73 008 and women earned

More picture related to 55 000 Salary To Hourly After Taxes

Salary To Hourly After Taxes ConnallNara

https://i.pinimg.com/originals/5c/62/2a/5c622a11ef8e29375d81a446c2ebfb98.jpg

Going Hourly To Salary Calculate Pay Taxes Tips More

https://millennialmoney.com/wp-content/uploads/2021/04/hourly-to-salary-1.jpg

Determine Hourly Rate From Yearly Salary AarviZenish

https://i2.wp.com/scrn-cdn.omnicalculator.com/finance/[email protected]

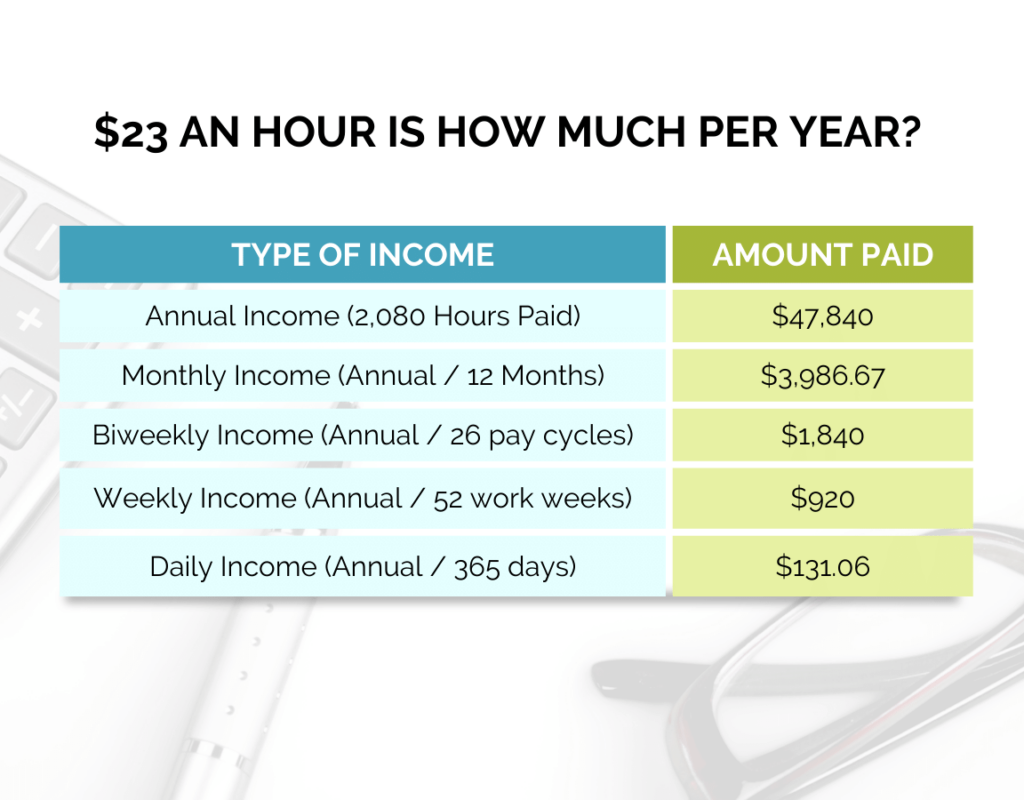

Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay If you have an annual salary of 55 000 it equates to a monthly pre tax salary of 4 583 33 weekly pay of 1 057 69 and an hourly wage of 26 44 per hour These figures are pre tax and based upon working a 40 hour week for 52 weeks of the year

1 Convert the annual salary to a gross hourly wage 55000 per year Working 40 hours per week 52 weeks per year 2 080 hours 55000 2 080 hours 26 44 per hour gross pay 2 Identify the main taxes that are deducted from each paycheck and typical tax rates Federal income tax 10 to 37 Social Security tax 6 2 The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

Translate Annual Salary To Hourly KerrynBalqees

https://www.howtofire.com/wp-content/uploads/23-an-hour-salary-1024x800.png

Comparing Pros And Cons Hourly Pay Vs Annual Salary Infographic

https://graphicspedia.net/wp-content/uploads/2019/05/Comparing-Pros-and-Cons-Hourly-Pay-Vs-Annual-Salary-Infographic.jpg

55 000 Salary To Hourly After Taxes - Before versus after tax income When using this hourly to salary calculator to learn how much your hourly rate is as an yearly salary you should always consider the difference between pre tax and after tax annual salary and hence hourly Make sure you account for all applicable local and state taxes imposed on labor Yes however illogical