42 000 A Year Is How Much An Hour After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted How much is 42 000 a Year After Tax in the United States In the year 2024 in the United States 42 000 a year gross salary after tax is 35 507 annual 2 691 monthly 618 92 weekly 123 78 daily and 15 47 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 42 000 a year

42 000 A Year Is How Much An Hour After Taxes

42 000 A Year Is How Much An Hour After Taxes

https://i2.wp.com/www.howtofire.com/wp-content/uploads/33-an-hour-is-how-much-a-year-1200x628-1.png

48 000 A Year Is How Much An Hour Budget Billz

https://budgetandbillz.com/wp-content/uploads/2022/03/48000-a-Year-is-How-Much-an-Hour-1024x576.jpg

How Much Money Before You Have To Pay Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/50000-a-year-is-how-much-an-hour-before-after-tax.png

An individual who receives 35 731 00 net salary after taxes is paid 42 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security per month per week per day and per hour etc Answer is 21 68 assuming you work roughly 40 hours per week or you may want to know how much 42k a year is per month Another useful way to change the size of your paycheck is to make pre tax contributions This is money that comes out of your paycheck before income taxes are removed The result is that it lowers how much of your pay is actually subject to taxes Accounts that take pre tax money include 401 k and 403 b plans

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to 42 000 A Year Is How Much An Hour After Taxes

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

40 000 A Year Is How Much An Hour Is It A Comfortable Salary My

https://myfinancediary.com/wp-content/uploads/2021/07/is-40k-a-good-salary-in-2021-1-768x1152.jpg

68000 A Year Is How Much An Hour Real Updatez

https://realupdatez.com/wp-content/uploads/2023/02/68000-an-hour-is-how-much-1.png

This is useful if you want to know 42 5k a years is how much an hour Answer is 21 94 assuming you work roughly 40 hours per week or you may want to know how much 42 5k a year is per month after taxes Answer is 2 862 86 in this example remember you can edit these figures to produce your own detailed tax calculation To make 42 000 per year after taxes are taken out you would need a salary of about 52 000 per year or 25 per hour 42 000 per year breaks down to 20 19 per hour Annual 2080 hours 161 52 per day Hourly x 8 hours 807 69 per week Annual 52 weeks 1 615 38 biweekly Weekly x 2

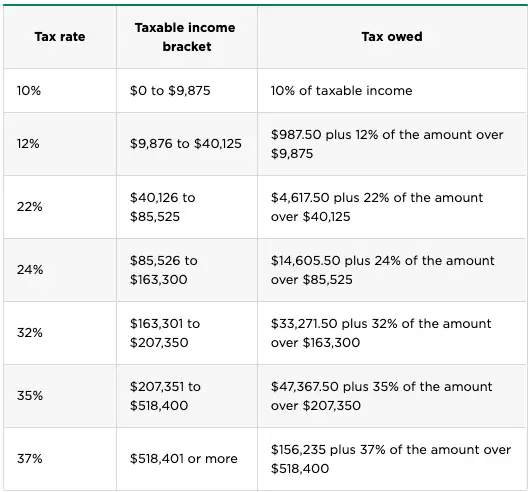

If you make 42 000 a year you will make 3 230 77 a month before taxes assuming you are working full time Each month after taxes you will make approximately 2 423 08 A full time worker or employee works at least 40 hours a week If you work either more or fewer hours this amount will vary slightly 31500 2 080 hours 15 14 per hour after taxes Based on this estimate a 42000 annual salary equates to approximately 15 14 per hour after taxes This means this employee gets around 5 05 less per hour after accounting for taxes Let s take a closer look at how taxes impact your net hourly pay Key Taxes on Hourly Earnings

50k A Year Is How Much An Hour Is It Enough To Live On After Taxes

https://www.moneyforthemamas.com/wp-content/uploads/2021/08/50000-a-year-is-how-much-an-hour-683x1024.jpg

40 000 A Year Is How Much An Hour Is It A Comfortable Salary My

https://myfinancediary.com/wp-content/uploads/2021/07/how-much-is-40000-per-hour-683x1024.jpg

42 000 A Year Is How Much An Hour After Taxes - 2013 65 907 2012 64 632 Like most states Virginia also collects a state income tax Taxpayers fall into one of four income brackets depending on income level The top tax rate of 5 75 applies to taxable income over 17 000 so most taxpayers will be paying that rate on at least some of their income Virginia s income tax brackets apply