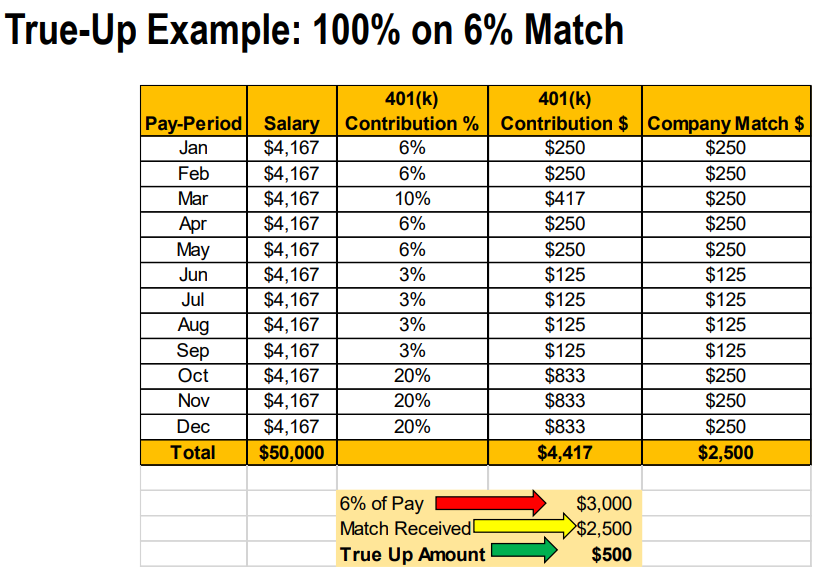

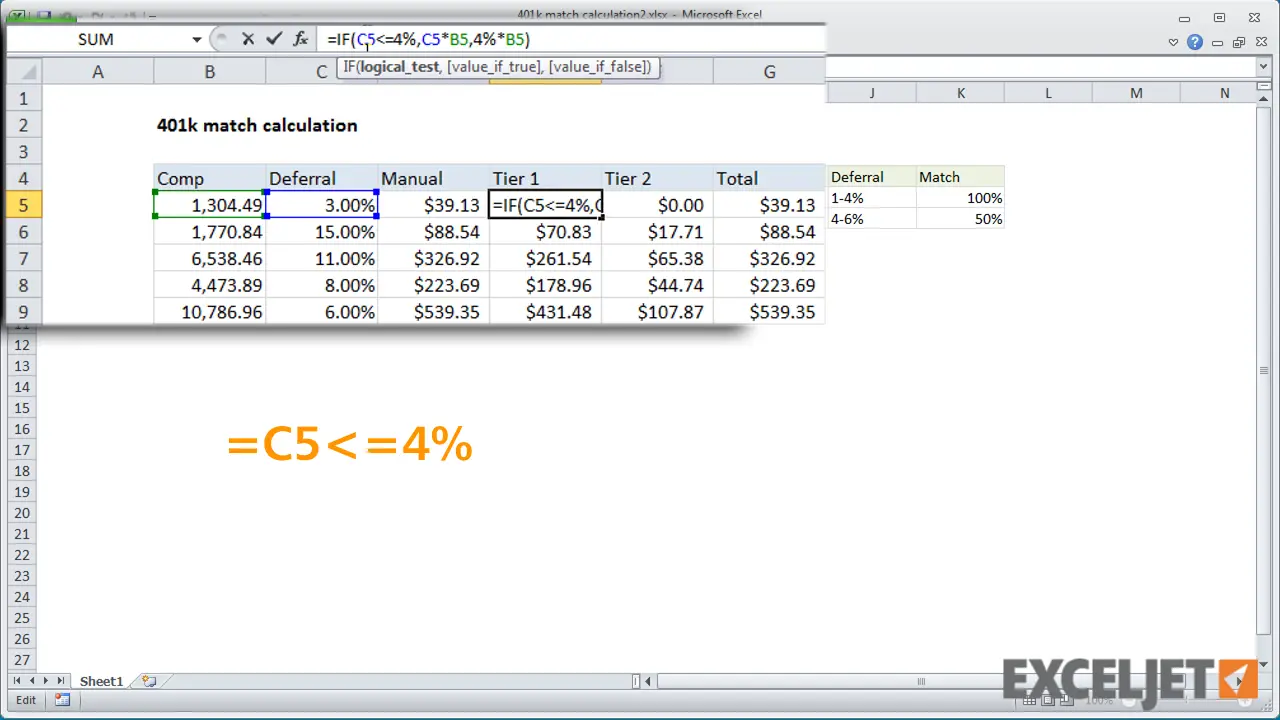

401k Match Example Employer Matching Contribution Formulas Most often employers match employee contributions up to a percentage of annual income This limit may be imposed in one of a few different ways Your

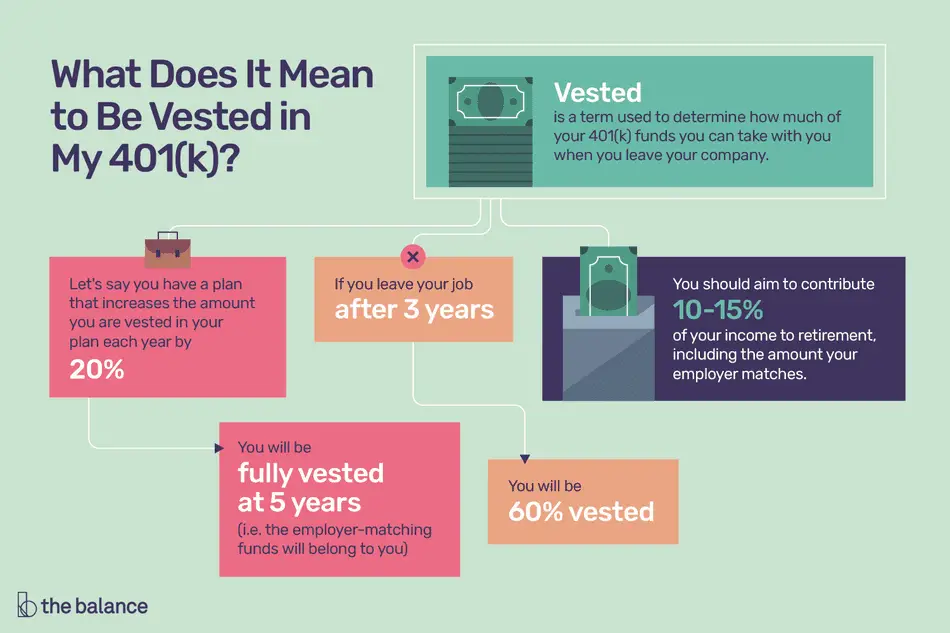

The average employer match is 4 5 of an employee s salary The 401 k plan document will set the rules for receiving a match contribution and may specify the matching formula itself These match contributions form part of an employee s total compensation package along with access to a 401 k plan and other benefits A 401 k match is money your employer contributes to your 401 k account For each dollar you save in your 401 k your employer wholly or partially matches your contribution up to a

401k Match Example

401k Match Example

https://is4fun.com/images/932014.jpeg

How To See My 401k Balance 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/how-to-estimate-how-much-your-401k-will-be-worth-at-retirement.png

Can You Move Money From 401k To Roth Ira 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/roth-ira-vs-401k-which-is-better-for-you.jpeg

By Tim Parker Updated May 13 2023 Reviewed by Thomas J Catalano Fact checked by Suzanne Kvilhaug If you work for a company that has a 401 k plan congratulations As of 2020 nearly 60 Employer Match with a 40 000 Salary Example Contribution Needed to Meet Employer Match Maximum 6 of Salary 2 400 6 of Salary 2 400 6 of Salary 2 400 Do I Qualify for 401 k Employer Match Your eligibility for employer 401 k matching depends entirely on your employer Not all employers offer a match program

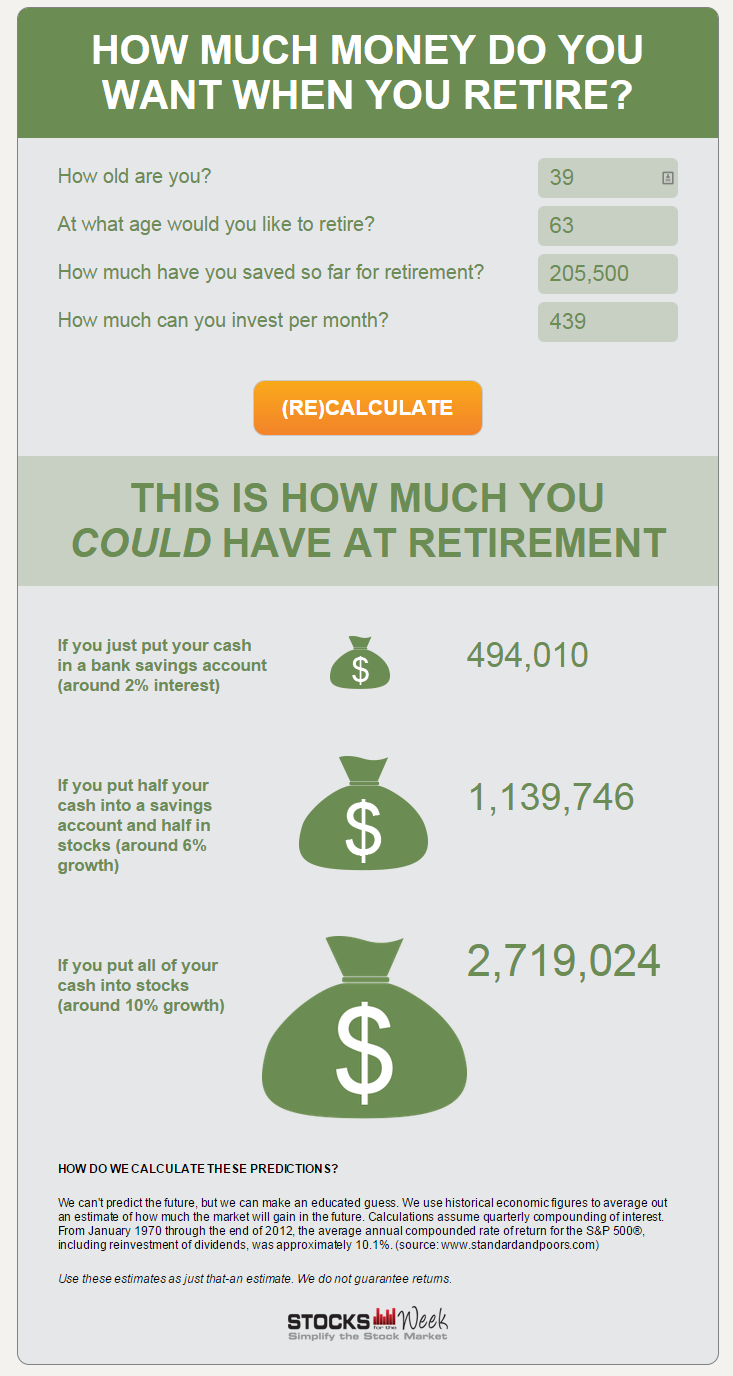

NerdWallet s free 401 k retirement calculator estimates what your 401 k balance will be at retirement by factoring in your contributions employer match your expected An example of a 401 k plan matching formula is 50 of your contributions up to 5 of your annual salary the amount of your salary that can be used in this calculation is limited see the cost of living adjustments Example 1 You contribute 1 200 from your 30 000 annual salary to your company s 401 k plan

More picture related to 401k Match Example

Caterpillar 401k Resource Planning Group

https://rpgplanner.com/wp-content/uploads/2019/08/Caterpillar-401k.png

How To Calculate Employer 401k Match 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/excel-tutorial-simplified-formula-example-401k-match.png

Employer 401 K Sponsored Retirement Plan Contribution Matching Ways

https://tehcpa.net/wp-content/uploads/2020/10/401k-employer-match-contributions-consideration-matters.png

To get the maximum amount of 401 k match you must put in 6 If you put in more say 8 your employer will still only match half of 6 of your salary because that s their max The employer can determine the matching parameters 2 Definition A 401 k match is when employers contribute money to your 401 k plan in addition to the amount you contributed Typically the total amount of employer matching contributions equals a percentage of your salary Key Takeaways

A 401 k company match is money your employer contributes to your retirement account usually based on your own contributions and capped at a certain percentage of your income Here s a A 6 employer match in a 401 k means that the employer will provide a match for up to the first 6 of your annual compensation that you contribute to the plan For example if you earn 60 000

401k Company Matching Explained YouTube

https://i.ytimg.com/vi/tFQgvQUvlTU/maxresdefault.jpg

How Does 401k Match Work 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/what-does-it-mean-to-be-vested-in-my-401k.png

401k Match Example - A 401 k match allows an employee to receive free money from their employer for contributing to their retirement plan The amount of the match can differ and the employer contribution may be a