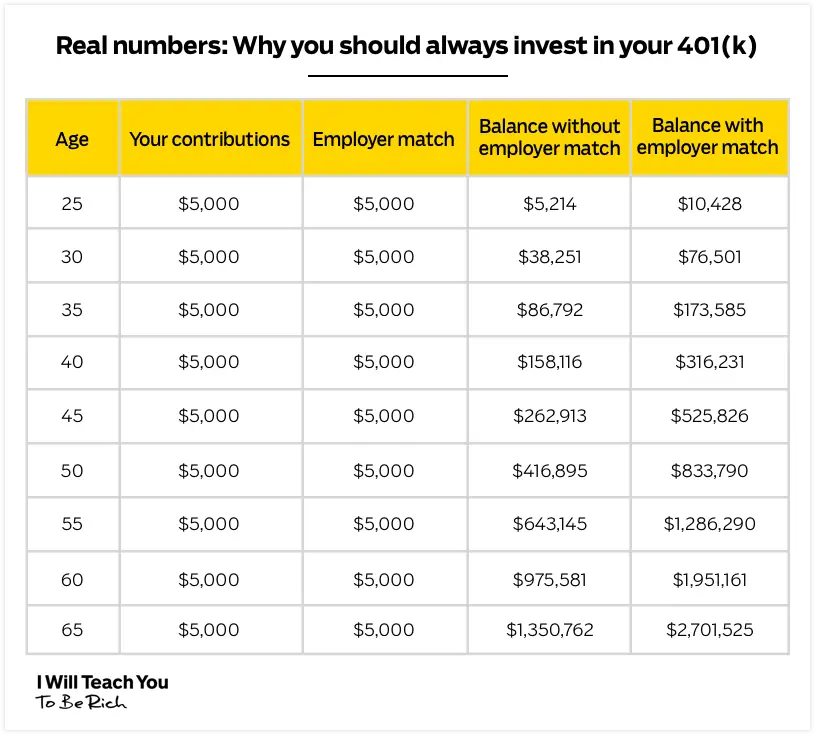

401k How Does Employer Match Work Some may match say 25 of your contribution If you contribute that same 5 of your your employer will only be contributing 1 25 of your salary to your 401 k Here too there s likely to be a cap on contributions Check out the table below for to see what your 401 k match contributions could look like based on a 40 000 salary

A 401 k match is money your employer contributes to your 401 k account For each dollar you save in your 401 k your employer wholly or partially matches your contribution up to a certain A 401 k match is when an employer puts money in an employee s retirement account based on what the employee contributes Match formulas vary but a common setup is for employers to contribute 1 for every 1 an employee contributes up to 3 of their salary then 50 cents on the dollar for the next 2 of an employee s salary

401k How Does Employer Match Work

401k How Does Employer Match Work

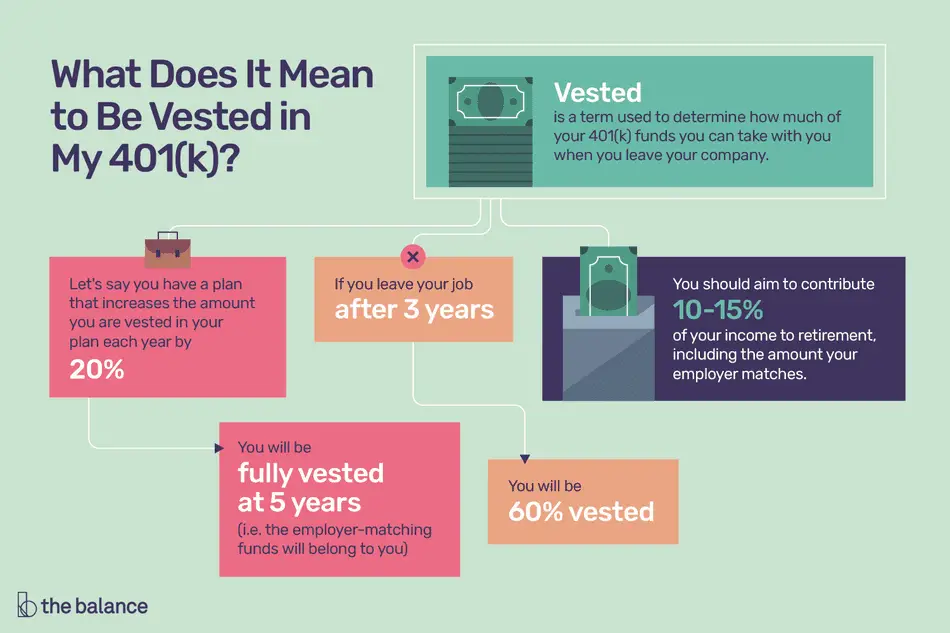

https://www.401kinfoclub.com/wp-content/uploads/what-does-it-mean-to-be-vested-in-my-401k.png

How Does 401k Match Work 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/how-a-401k-works-the-single-best-way-to-grow-your-money.png

Everything You Need To Know About Employer Match 401k Plans

https://slavic401k.com/wp-content/uploads/2022/02/Employer-Matching-Table.png

This contribution limit includes deferrals that you elect to be withheld from your and invested in your 401 k on a pre tax basis Here s a look at the annual 401 k contribution limits For tax year 2024 filed by April 2025 the limit is 23 000 Savers who are age 50 or older can make up to 7 500 in catch up contributions for a total The main rules around 401 k matches revolve around contribution limits Though employers typically set their own rules around their maximum contribution amounts employer matching contributions in 2024 cannot exceed 46 000 The total employee and employer contribution limit into a 401 k in 2024 is 69 000 76 500 if you re age 50 or

Roth 401 k Basics Roth 401 k is a qualified retirement plan that lets employees choose to defer salary And instead of receiving the money when it s earned you can place it in a tax advantaged retirement account Employers can also choose to match employee contributions which can significantly increase the size and growth of a What does a 6 401 k match mean If an employer offers a 6 401 k match it means the employer will match an employee s 401 k contribution of up to 6 of the employee s annual compensation Let s say an employee earns 60 000 per year and contributes 6 of that salary 3 600 to their 401 k With a 6 match the employer would

More picture related to 401k How Does Employer Match Work

How To Rollover My Fidelity 401k 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/fidelity-made-my-401k-rollover-so-easy-youtube.jpeg

Does Employer Match Count Towards 401k Limit Belonging Wealth Management

https://belongingwealth.com/wp-content/uploads/2018/03/aga-putra-125108-unsplash-1536x1536.jpg

What Is A 401k Rollover 401kInfoClub

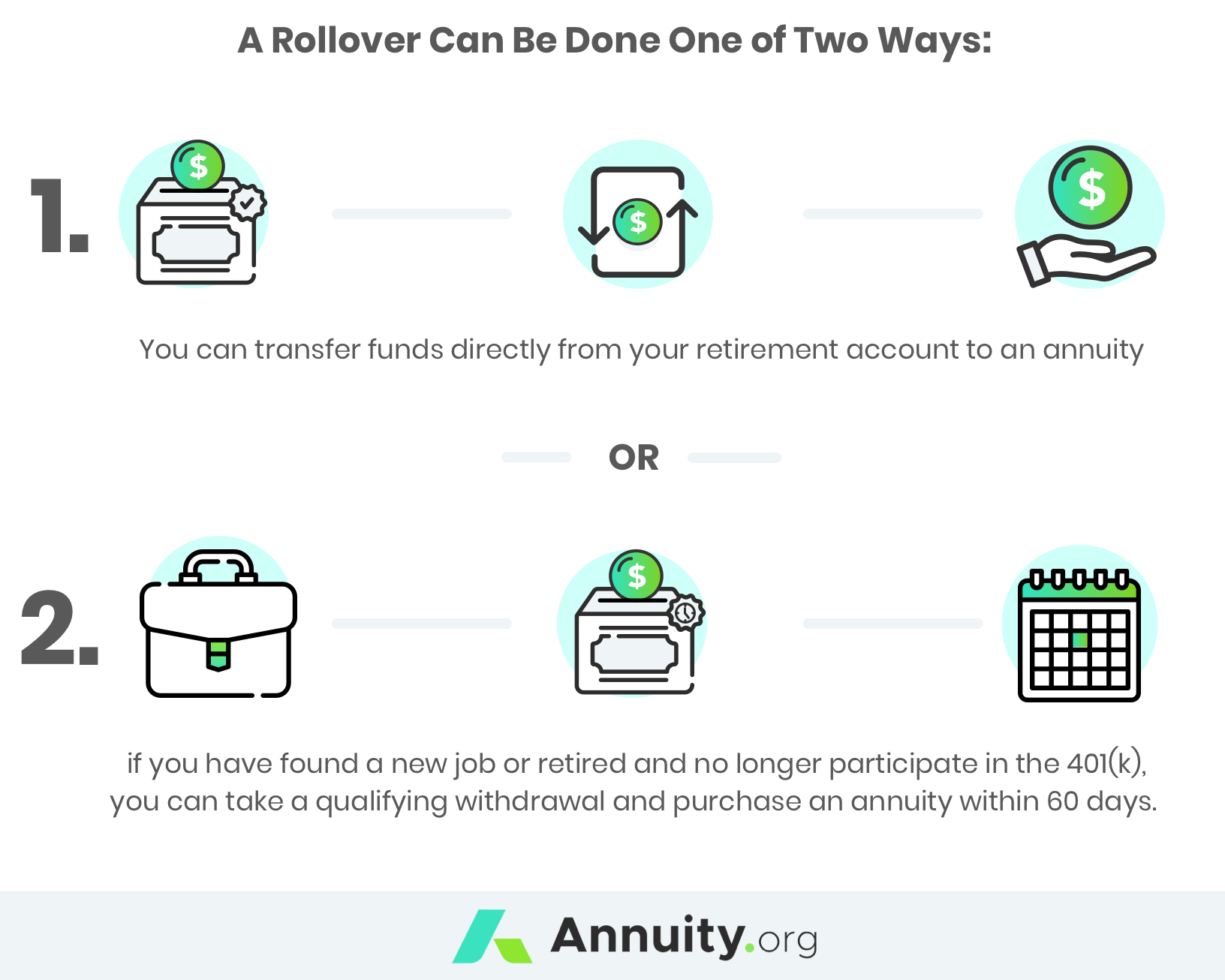

https://www.401kinfoclub.com/wp-content/uploads/roll-over-ira-or-401k-into-an-annuity-rollover-strategies.png

This means the company matches a portion of what the employee contributes such as 0 50 for every 1 the employee puts into their 401 k Regardless of the matching structure your employer will The average employer 401 k match is at an all time high at 4 7 This means that on average companies will match 4 7 of an employee s salary toward their retirement Employee deferrals to 401 k plans vary greatly But on average employees contribute 8 8 yearly

In 2023 the IRS limits employees personal 401 k contributions to 22 500 a year 30 000 if you re over 50 Employer match contributions don t count toward the personal contribution limit but there is a limit for combined employee and employer contributions As of 2023 it s either 100 of your salary or 66 000 73 500 if you 1 Partial matching A partial match means that your employer will match part of the money you put into your 401 k up to a certain amount A common partial match provided by employers is 50 of what you contribute up to 6 of your salary So what this means in practical terms is that if you earn 80 000 per year your contributions that

How To Rollover 401k From Previous Employer To New Employer

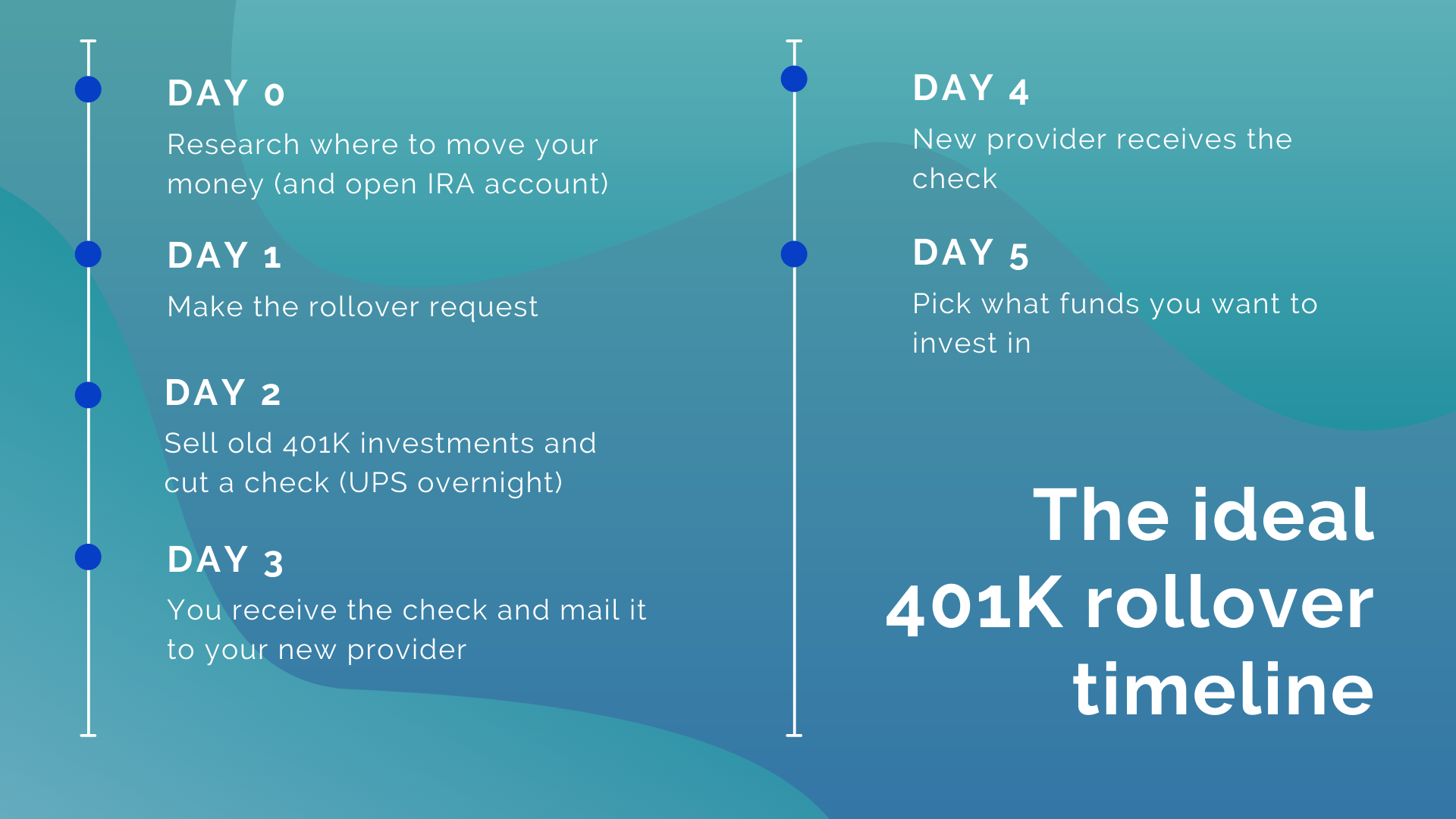

https://www.401kinfoclub.com/wp-content/uploads/the-complete-401k-rollover-guide-retire.png

How 401k Works After Retirement 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/what-makes-a-401k-different-how-401k-plans-work.gif

401k How Does Employer Match Work - This contribution limit includes deferrals that you elect to be withheld from your and invested in your 401 k on a pre tax basis Here s a look at the annual 401 k contribution limits For tax year 2024 filed by April 2025 the limit is 23 000 Savers who are age 50 or older can make up to 7 500 in catch up contributions for a total