33000 A Year With 2 Dependents How to fill out the tax refund calculator Our tax refund calculator takes the guesswork out of trying to figure out your refund amount Simply answer a few questions about your filing status and claim any dependents you might have Next enter your 2023 federal and state withholding information along with your total income including any losses

Enter your filing status income deductions and credits into the income tax calculator below and we will estimate your total taxes for 2016 Based on your projected withholdings for the year we The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison File Status

33000 A Year With 2 Dependents

33000 A Year With 2 Dependents

https://cck-law.com/wp-content/uploads/2019/06/VA-pay-chart-infographic-2019-1200px-1.jpg

33000 A Year Is How Much An Hour Full Financial Analysis Savoteur

https://savoteur.com/wp-content/uploads/2022/06/33000-a-year-1.jpg

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)

10 Regular Withholding Allowances Worksheet A Worksheets Decoomo

https://i2.wp.com/www.investopedia.com/thmb/l2iRWfj7XhkvntrgU8jKsIpdwso=/849x849/smart/filters:no_upscale()/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg

Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates brackets and other information for your 2023 taxes which you ll file in 2024 Details Federal Withholding Your Tax Return Breakdown Total Income Adjustments You are a U S citizen or resident alien all year and have a valid SSN You lived in the U S for more than six months You are more than 19 years of age You are not claimed as a dependent on anyone else s return Your investment income is not above 11 600 for 2024

More picture related to 33000 A Year With 2 Dependents

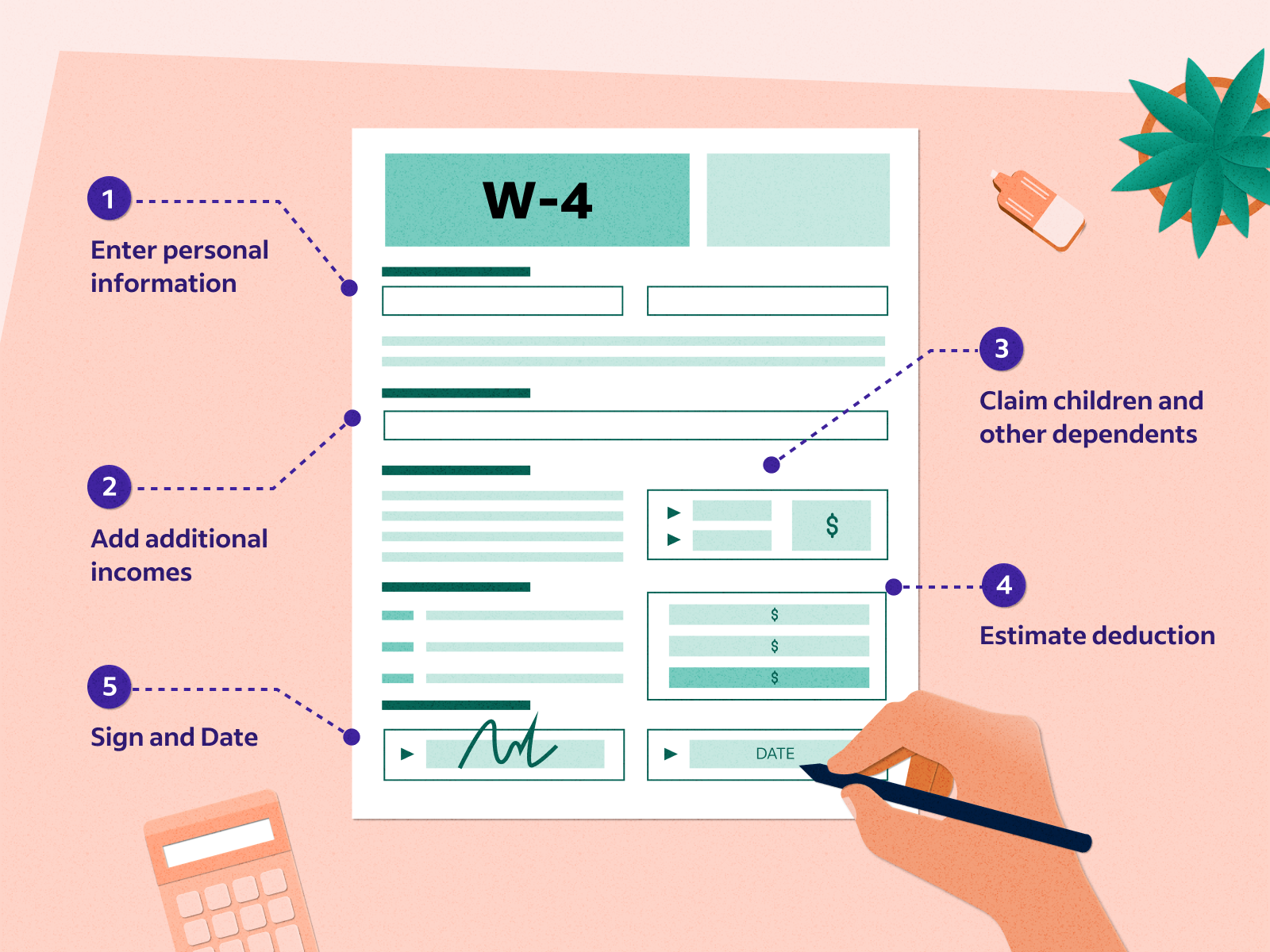

How To Fill Out W4 Tax Form In 2022 FAST UPDATED YouTube

https://i.ytimg.com/vi/ipgcjaZMu_Y/maxresdefault.jpg

How Much Is 100 Army Disability Logan Eugene s Blog

https://www.disabilitytalk.net/wp-content/uploads/if-i-work-and-receive-tdiu-are-there-any-va.png

2023 Federal Tax Form W 4 Printable Forms Free Online

https://images.ctfassets.net/pdf29us7flmy/6GT6YXCluwzDgvG3phx4vi/9ea2eec04b782460c39ebf21ed98053d/w-4-what-to-claim.png

33000 33 000 00 Tax Calculator 2024 25 2024 tax refund calculator with 33 000 00 tax medicare and social security tax allowances US Salary Tax Calculation for 2024 Tax Year based on annual salary of 33 000 00 California State Tax Calculation Annual Income for 2024 33 000 00 Number of Dependents 0 Number of Child Tax claims The aim of this 33 000 00 salary example is to provide you detailed information on how income tax is calculated for Federal Tax and State Tax We achieve this in the following steps The salary example begins with an overview of your 33 000 00 salary and deductions for income tax Medicare Social Security Retirement plans and so forth

Expert does your taxes An expert does your return start to finish The limit for couples filing jointly is 110 000 for the 2012 tax season If one spouse earns less than 55 000 it might be worth it to have that spouse claim the child as a dependent so that she can also claim the credit Depending on your circumstances it might make more sense to choose head of household instead of married filing separately

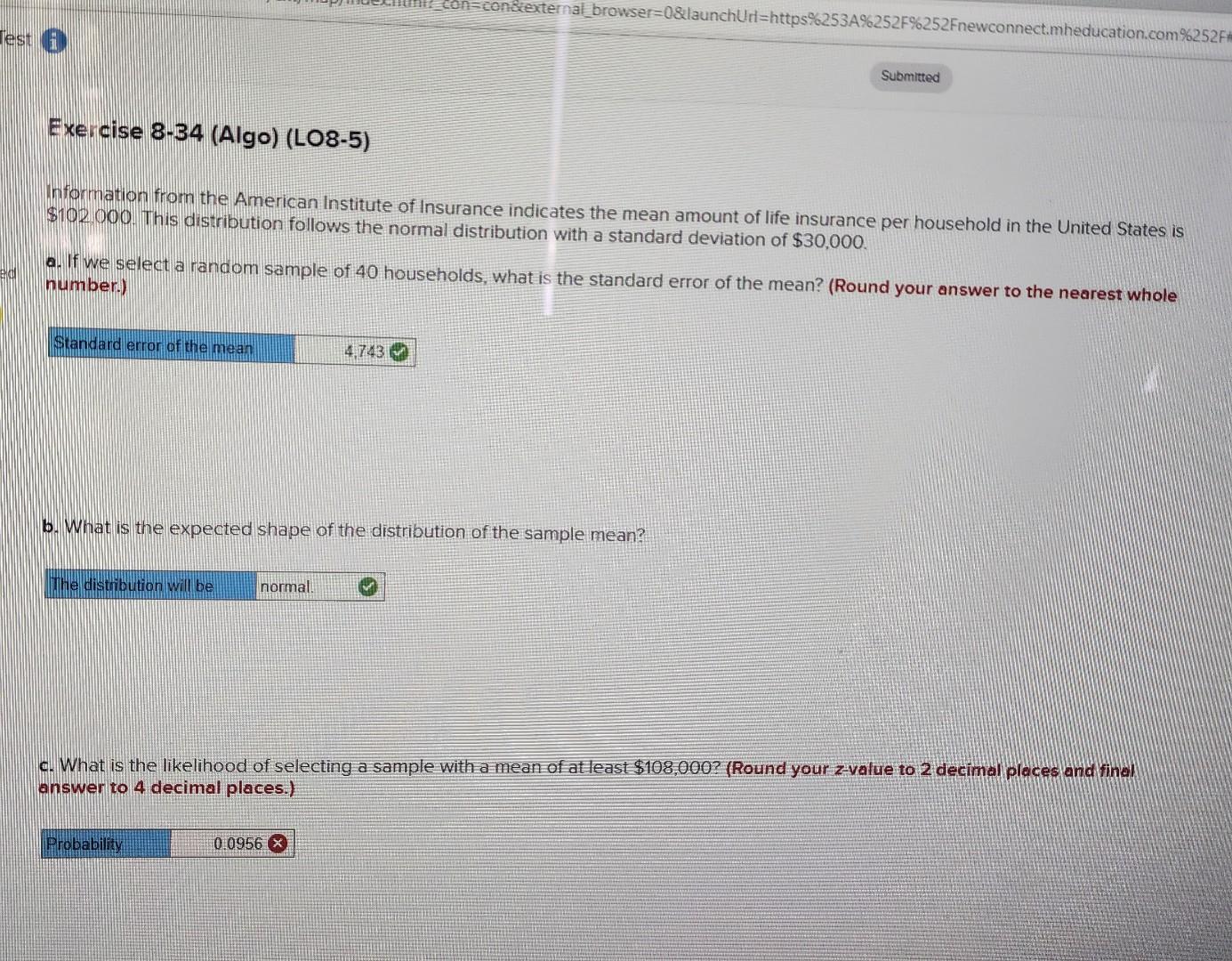

Solved Information From The American Institute Of Insurance Chegg

https://media.cheggcdn.com/study/11f/11fe2a19-5096-4ef0-ad67-7ae18f7f11c8/image.jpg

Oregon W 4 Allowances

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

33000 A Year With 2 Dependents - Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates brackets and other information for your 2023 taxes which you ll file in 2024 Details Federal Withholding Your Tax Return Breakdown Total Income Adjustments