28 Per Hour Annual Salary After Tax Yearly salary before taxes at 28 per hour 58 240 Divided by 12 months per year 58 240 12 4 853 33 per month The monthly salary based on a 40 hour work week at 28 per hour is 4 853 33 before taxes After applying the estimated 27 16 tax rate the monthly after tax salary would be Monthly before tax salary 4 853 33

7 516 289 145 28 91 3 61 State Tax 221 2 650 102 51 10 19 1 27 Social Security 373 4 481 172 86 17 24 2 15 translating to approximately 4 715 per month after taxes and The table below lists the minimum wage in each state including the hourly rate and the resulting annual salary for a full time worker In the year 2025 in the United States 28 an hour gross salary after tax is 48 344 annual 3 656 monthly 840 85 weekly 168 17 daily and 21 02 hourly gross based on the information provided in the calculator above

28 Per Hour Annual Salary After Tax

28 Per Hour Annual Salary After Tax

https://www.howtofire.com/wp-content/uploads/28-dollars-an-hour-1024x800.png.webp

$28 an Hour is How Much a Year? Good income? - Money Bliss

https://moneybliss.org/wp-content/uploads/2021/12/28-per-hour-is-how-much-per-year.jpg

28,000 After Tax 2022/2023 - Income Tax UK

https://www.income-tax.co.uk/images/28000-after-tax-salary-uk-2020.png

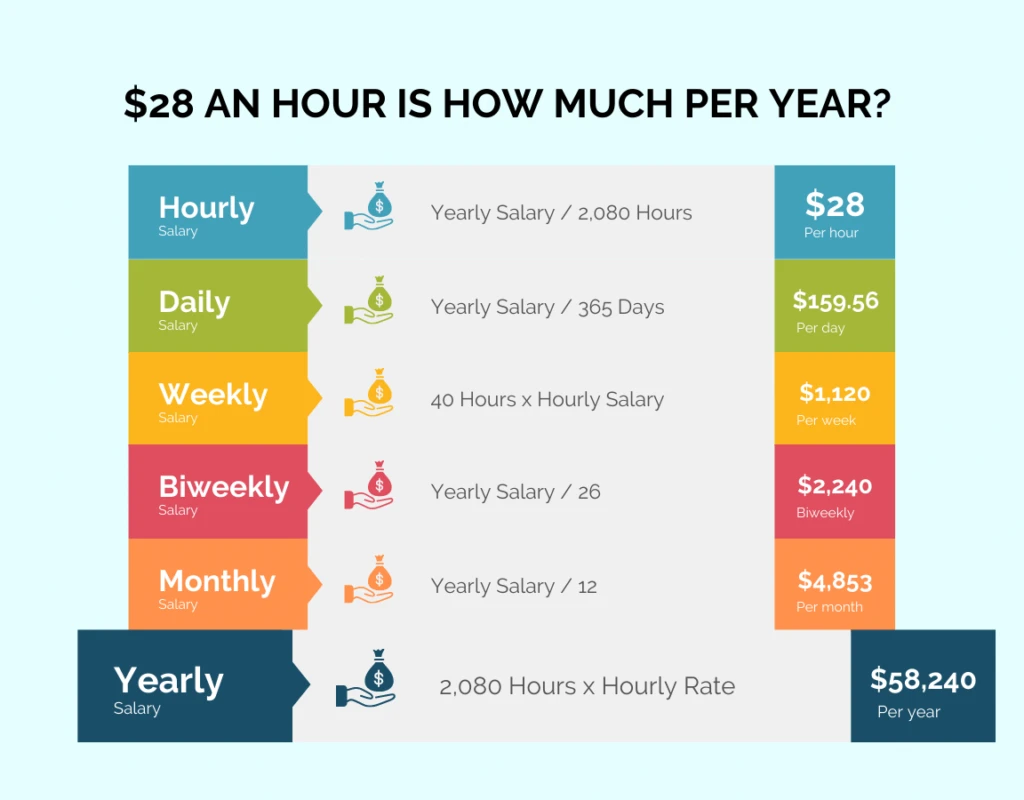

To calculate the annual salary before taxes the formula is simple Annual Salary Hourly Rate Hours per Week Weeks per Year For 28 an hour assuming a standard full time schedule of 40 hours per week and 52 weeks per year the math looks like this 28 40 hours 52 weeks 58 240 If you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre tax will be 15 40 52 31 200 28 per hour 58 240 4 853 33 1 120 29 per hour 60 320 5 026 67 1 160 30 per hour 62 400 If you re paid an hourly wage of 18 per hour your annual salary will equate

28 an Hour is How Much a Year After Taxes If you make 28 an hour you would take home 43 680 a year after taxes Your pre tax salary was 58 240 But after paying 25 in taxes your after tax salary would be 43 680 a year The amount you pay in taxes depends on many different factors But assuming a 25 to 30 tax rate is reasonable The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page

More picture related to 28 Per Hour Annual Salary After Tax

$28.50 an hour is how much a year? - Zippia

https://static.zippia.com/answer-images/2850-an-hour-is-how-much-a-year.png

$28,000 a year is how much an hour? - Zippia

https://static.zippia.com/answer-images/28000-a-year-is-how-much-an-hour.png

18 Dollars An Hour Is How Much A Year (Budget, taxes, jobs, & more) - Finance Over Fifty

https://financeoverfifty.com/wp-content/uploads/2022/01/18-an-hour-comparison-table-1.png

A 28 per hour annual salary is about 58 240 provided you work 40 hours a week You can usually expect to be paid time and half if you work over 40 hours a week When calculating your monthly salary if you are paid an hourly wage be sure to subtract your meal breaks Everyone is responsible for paying federal income taxes on their entire Paycheck Calculator Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2025 tax year on Feb 14 2025

[desc-10] [desc-11]

$28.75 an hour is how much a year? - Zippia

https://static.zippia.com/answer-images/2875-an-hour-is-how-much-a-year.png

28 Dollars an Hour Is How Much a Year? Is $28/Hr Good? - Dollarsanity

https://dollarsanity.com/wp-content/uploads/2021/02/28-an-hour-is-how-much-a-year.jpg

28 Per Hour Annual Salary After Tax - The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page