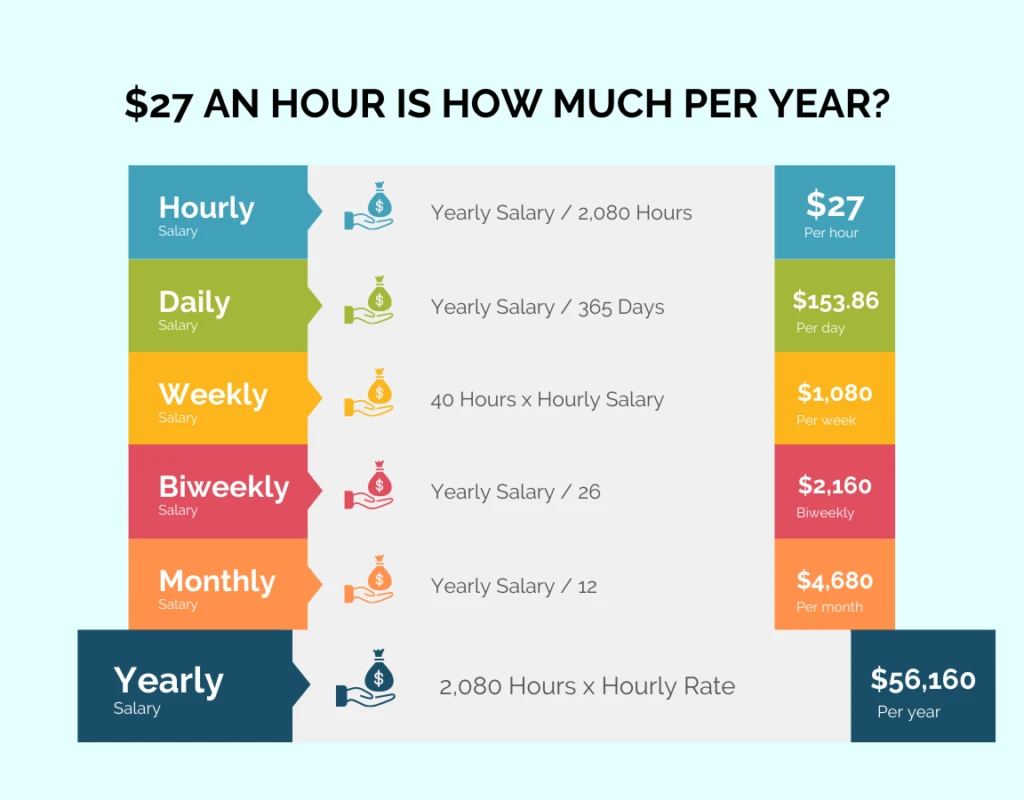

27 Per Hour Annual Salary After Tax Convert Your Hourly Wage To Salary Yearly salary 27 per hour is 56 160 per year Monthly salary 27 per hour is 4 320 per month Biweekly salary 27 per hour is 2 160 biweekly Weekly salary 27 per hour is 1080 per week Daily salary 27 per hour is 216 per day Salary after taxes 27 hr is 42 120 a year after taxes

To answer 27 an hour is how much a week divide the annual sum by 52 resulting in a weekly income of 815 77 27 an Hour is How Much a Day When examining a 27 an hour after tax income the corresponding daily earnings can be determined Take home NET daily income 163 15 assuming a 5 day work week 27 An Hour Is How Much A Year After Taxes Factoring in Federal Income Tax Considering State Income Tax Factoring in Local Taxes Accounting for FICA Taxes Social Security Medicare Total Estimated Tax Payments Calculating Your Take Home Pay Convert 27 Per Hour to Yearly Monthly Biweekly and Weekly Salary After Taxes

27 Per Hour Annual Salary After Tax

27 Per Hour Annual Salary After Tax

https://www.howtofire.com/wp-content/uploads/27-dollars-an-hour-1024x800.png.webp

27,000 After Tax 2022/2023 - Income Tax UK

https://www.income-tax.co.uk/images/27000-after-tax-salary-uk-2020.png

$27 an Hour is How Much a Year? Can I Live on it? - Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/27-per-hour-is-how-much-per-year.jpg

With 27 per hour your annual salary would be around 44 000 To understand how we got to this rough number we first need to explain how we calculate taxes We first need to estimate your taxable income by subtracting the standard deduction of 12 950 for 2022 from your total annual salary In our case that would be The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Hourly Wage

If you are paid on an hourly basis you need to input the number of hours you work and the pay rate per hour If you are paid on a salary basis you need to input your annual salary Pay Frequency You need to select your pay frequency whether you are paid daily weekly bi weekly semi monthly monthly or yearly Your pay frequency affects Summary If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

More picture related to 27 Per Hour Annual Salary After Tax

$27.50 an hour is how much a year? - Zippia

https://static.zippia.com/answer-images/2750-an-hour-is-how-much-a-year.png

$27.00 an hour is how much a year? - Zippia

https://static.zippia.com/answer-images/2700-an-hour-is-how-much-a-year.png

$27,000 a year is how much an hour? - Zippia

https://static.zippia.com/answer-images/27000-a-year-is-how-much-an-hour.png

If you make 27 per hour your Yearly salary would be 56 160 This result is obtained by multiplying your base salary by the amount of hours week and months you work in a year assuming you work 40 hours a week Article Summary A 27 an hour rate equals a gross annual income of approximately 56 160 if you work a 40 hour week for 52 weeks a year Remember that

And your annual salary when earning 27 per hour would be 56 160 annually 56 160 would be the gross annual salary with a 27 per hour wage Your gross salary is your take home pay before taxes your pre tax income 27 an Hour After Taxes 46 741 Annual income after taxes 3 895 monthly income after taxes 1 798 bi weekly income When we ran all of our numbers to figure out how much is 27 per hour is as an annual salary we used the average working day of 40 hours a week 40 hours x 52 weeks x 27 56 160 56 160 is the gross annual salary with a 27 per hour wage As of June 2023 the average hourly wage is 33 58 source

18 Dollars An Hour Is How Much A Year (Budget, taxes, jobs, & more) - Finance Over Fifty

https://financeoverfifty.com/wp-content/uploads/2022/01/18-an-hour-comparison-table-1.png

Austria | Taxing Wages 2021 | OECD iLibrary

https://www.oecd-ilibrary.org/sites/465c8844-en/images/images/Austria20_final/media/image3.png

27 Per Hour Annual Salary After Tax - Summary If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate