23 Hr Salary After Taxes Salary after taxes 23 hr is 35 880 a year after taxes You may be wondering if 23 an hour is enough money to pay the bills However a lot of it comes down to where you reside For example if you live in California as a single adult with no kids the living wage is 21 24 an hour

Paycheck Calculator For Salary And Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator If you re an The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Hourly Wage

23 Hr Salary After Taxes

23 Hr Salary After Taxes

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/27625/images/PQq6Y4gcTFWrHxRuQVfW_Wages_Compared.png

Singapore Salary Guide Across Industries 2022 Are You Getting Paid Enough 2022

https://i0.wp.com/cdn-blog.seedly.sg/wp-content/uploads/2021/06/30145905/Are-You-Paid-Enough_-Salary-Guide-Across-Industries-in-Singapore-2022.png

How To Calculate Salary After Taxes Bright Hub

https://img.bhs4.com/f8/2/f8224911a7b8cb8b1a52e3a6b9a3ff2f228e432c_large.jpg

This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Income Tax Calculator Budget Calculator Before Tax vs After Tax Income How much are your employees wages after taxes This powerful tool does all the gross to net calculations to estimate take home pay in all 50 states For more information see our salary paycheck calculator guide

How Your Paycheck Works What is gross pay Gross pay amount is earnings before taxes and deductions are withheld by the employer The gross pay in the hourly calculator is calculated by multiplying the hours times the rate To answer 23 an hour is how much a week divide the annual sum by 52 resulting in a weekly income of 702 56 23 an Hour is How Much a Day When examining a 23 an hour after tax income the corresponding daily earnings can be determined Take home NET daily income 140 51 assuming a 5 day work week

More picture related to 23 Hr Salary After Taxes

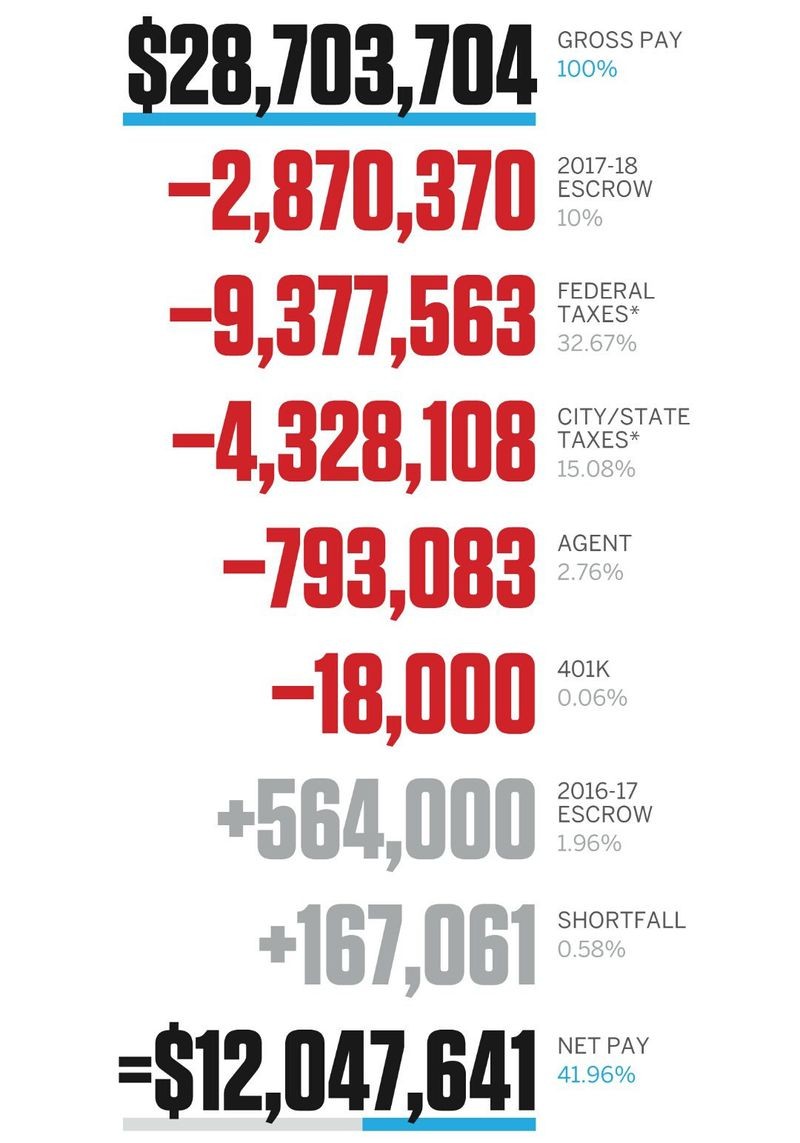

After Taxes Kyle Lowry s Net Salary Explained

http://cdn.chatsports.com/thumbnails/1359-80574-original.jpeg

Median Annual Net Income Of Every State After Taxes Cost Of Living And Local Rent MapPorn

https://i.redd.it/ylsil73ywr381.png

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

https://www.businessinsider.in/photo/67908629/how-much-money-you-take-home-from-a-100000-salary-after-taxes-depending-on-where-you-live.jpg

Paycheck Calculator Hourly Salary Tax year 2023 Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2023 tax year on Dec 05 2023 What was updated Tax year Job type Salary hourly wage Overtime pay State Filing status Self employed Pay frequency Additional withholdings How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04

With some simple calculations you can determine that 23 an hour is approximately 47 840 per year assuming a full time schedule However after taxes and deductions your take home pay will be less We ll provide an hourly calculator to help do the math plus tips on negotiating your hourly wage and setting a realistic budget 23 an Hour is How Much a Year Before and After Taxes Lucy September 19 2023 Converting an hourly wage to annual earnings is key for budgeting and financial planning In this article we ll break down the potential yearly income from 23 per hour based on standard full time and part time schedules

How Much Federal Tax Is Taken Out Of My Paycheck In Illinois Book Chronicle Ajax

https://www.theladders.com/wp-content/uploads/5c5dc26ca265163f2564e603-960-809.jpg

Average Monthly Salary After Taxes By Country Kaggle

https://storage.googleapis.com/kaggle-datasets-images/new-version-temp-images/default-backgrounds-60.png-2986379/dataset-card.png

23 Hr Salary After Taxes - To answer 23 an hour is how much a week divide the annual sum by 52 resulting in a weekly income of 702 56 23 an Hour is How Much a Day When examining a 23 an hour after tax income the corresponding daily earnings can be determined Take home NET daily income 140 51 assuming a 5 day work week