22 An Hour After Taxes Texas Income tax calculator Texas Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 Social Security 3 410 Medicare 798 Total tax 9 076 Net pay 45 925 Marginal tax rate 29 6 Average tax rate 16 5

Knowing exactly how much annual salary to expect from 22 an hour is critical knowledge for financial planning Let s explore this important question in detail 22 an Hour is How Much a Year Before and After Taxes Convert 22 Per Hour to Weekly Monthly and Yearly Salary Salary Calculator 22 an Hour is How Much a Year If you worked five days per week as an hourly employee 8 hours a day you would make 880 per weekly income Of course 22 an hour before taxes is greater than after taxes are taken out Hourly salary times number of hours per week worked your weekly paycheck 22 per hour times 40 hours per week 880 per weekly paycheck Bi weekly

22 An Hour After Taxes Texas

22 An Hour After Taxes Texas

https://michaelryanmoney.com/wp-content/uploads/2022/11/22-an-hour-is-how-much-a-year.jpg

Hoeveel Betaalt Een Werkgever Aan Loonbelasting Loonbelasting UAC Blog

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

62000 A Year Is How Much A Month After Taxes New Update Abettes

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Use ADP s Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Texas Texas Hourly Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis Switch to salary calculator Texas paycheck FAQs Texas payroll

Updated for 2023 tax year on Dec 05 2023 What was updated Tax year Job type Salary hourly wage Overtime pay State Filing status Self employed Pay frequency Additional withholdings Pre tax deduction s Post tax deduction s Select the tax es you are exempted from Federal income taxes State income taxes Local income taxes Social Security Lt Gov Dan Patrick said homeowners with an average priced home could see a savings of 1 250 1 450 annually Zillow estimated the average Texas home value at 298 424 as of Oct 31 2023

More picture related to 22 An Hour After Taxes Texas

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://qph.fs.quoracdn.net/main-qimg-e04739cbbcf836628ffc558f19035be9

A Year Ago Today And Half An Hour After The Best Photo I ll Probably

https://preview.redd.it/lnudah3z6kr51.jpg?auto=webp&s=0aadf217bf9cba363509fd834c5d64ffdfc06ddd

What Do Property Taxes Pay For In Texas Where Your Taxes Go

https://assets.site-static.com/userFiles/3705/image/prop-taxes-pay-for-header.png

Texas Salary Calculator for 2024 The Texas Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Texas State Income Tax Rates and Thresholds in 2024 Details of the personal income tax rates used in the 2024 Texas State Calculator are published Texas Income Tax Calculator 2022 2023 If you make 70 000 a year living in Texas you will be taxed 8 168 Your average tax rate is 11 67 and your marginal tax rate is 22 This marginal tax

The U S real median household income adjusted for inflation in 2021 was 70 784 9 U S states don t impose their own income tax for tax year 2022 How Your Paycheck Works Income Tax Withholding When you start a new job or get a raise you ll agree to either an hourly wage or an annual salary SB 2 88th 2nd C S the Property Tax Relief Act provides for a 0 107 reduction in a public school district s maximum compressed tax rate for the 2023 24 school year increases the amount of

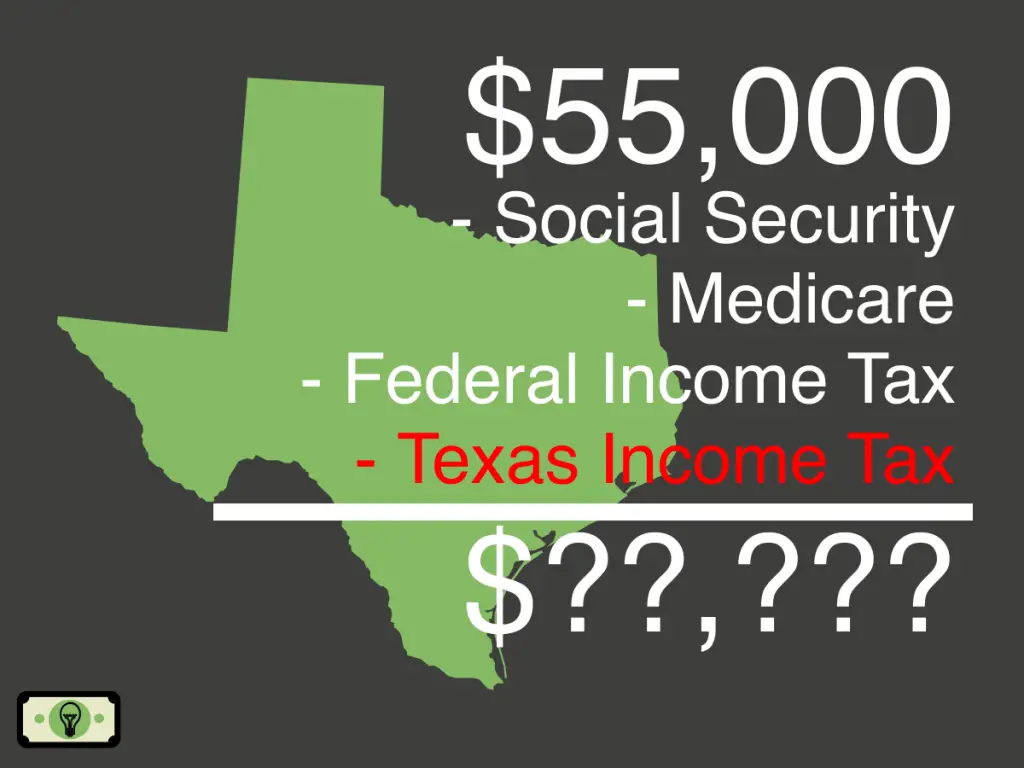

55K Salary After Taxes In Texas single 2013 Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/tx-55000-after-taxes-sm-1024x768.png

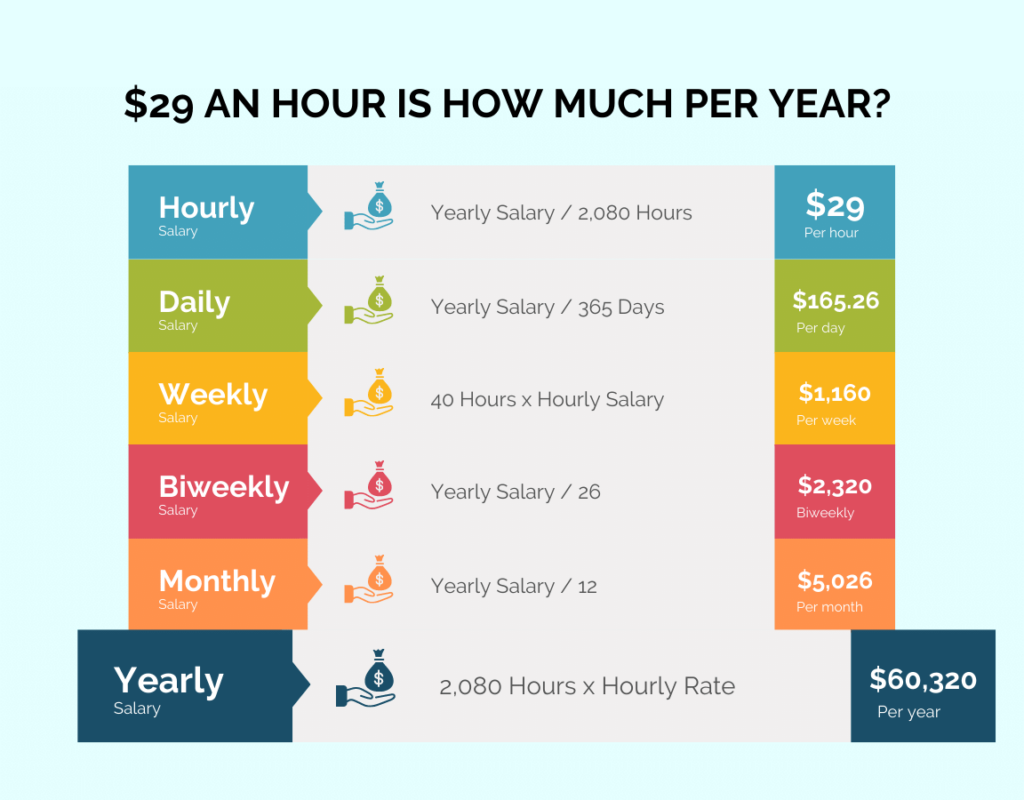

29 An Hour Is How Much A Year How To FIRE Online Library GoSpring

https://www.howtofire.com/wp-content/uploads/29-dollars-an-hour-1024x800.png

22 An Hour After Taxes Texas - The effective tax rate is different for federal taxes which is 8 15 As a result your total effective tax becomes 15 80 per year At 38 527 a year your hourly rate will be 18 52 This rate is 3 48 lower than the 22 an hour rate You earn a total take home pay of 38 527 a year