22 An Hour After Taxes Michigan Michigan Hourly Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis

Federal Paycheck Calculator Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2021 was 70 784 9 U S states don t impose their own income tax for tax year 2022 Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 338 Social Security 3 410 Medicare 798 Total tax 11 413 Net pay 43 587 Marginal tax rate 33 9 Average tax rate 20 8

22 An Hour After Taxes Michigan

22 An Hour After Taxes Michigan

https://www.deskera.com/blog/content/images/size/w2000/2022/05/Untitled-design--78-.png

42 000 A Year Is How Much An Hour Can You Live Off It

https://logicaldollar.com/wp-content/uploads/2022/11/42000-a-year-how-much-an-hour.jpg

English Star Jude Bellingham Named Best Player In Bundesliga 2021

https://www.aljazeera.net/wp-content/uploads/2023/05/3-copy-1685356473.png?resize=1920%2C1280

Use ADP s Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest The gross pay in the hourly calculator is calculated by multiplying the hours times the rate

The tool provides information for individuals and households with one or two working adults and zero to three children In the case of households with two working adults all values are per working adult single or in a family unless otherwise noted Michigan Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in Michigan you will be taxed 10 930 Your average tax rate is 11 67 and your

More picture related to 22 An Hour After Taxes Michigan

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://qph.fs.quoracdn.net/main-qimg-e04739cbbcf836628ffc558f19035be9

Brexit And The Media Cairn info

https://www.cairn.info/vign_rev/HERM/HERM_077.jpg

A Year Ago Today And Half An Hour After The Best Photo I ll Probably

https://preview.redd.it/lnudah3z6kr51.jpg?auto=webp&s=0aadf217bf9cba363509fd834c5d64ffdfc06ddd

This is the gross pay for the pay period before any deductions including wages tips bonuses etc You can calculate this from an annual salary by dividing the annual salary by the number of pay Republican legislators and businesses went to judge Elizabeth Gleicher asking her to keep the 2023 rate of 4 05 in 2024 The state led by Attorney General Dana Nessel believes the tax cut

The Michigan Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Michigan State Income Tax Rates and Thresholds in 2024 Details of the personal income tax rates used in the 2024 Michigan State Calculator are published below the calculator Michigan Hourly Paycheck and Payroll Calculator Need help calculating paychecks Use Gusto s hourly paycheck calculator to determine withholdings and calculate take home pay for your hourly employees in Michigan

29000 A Year Is How Much A Month After Taxes New Update

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

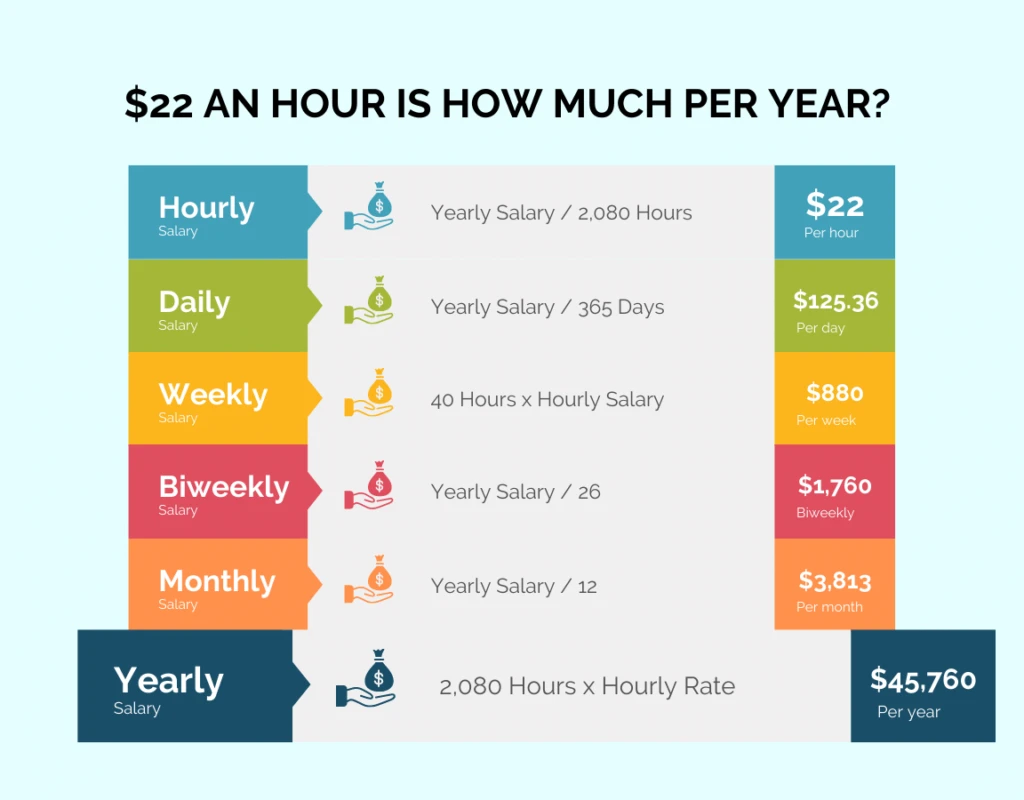

Salary Conversion Hourly To Yearly CarrickOrlando

https://www.howtofire.com/wp-content/uploads/22-dollars-an-hour-1024x800.png.webp

22 An Hour After Taxes Michigan - Michigan Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in Michigan you will be taxed 10 930 Your average tax rate is 11 67 and your