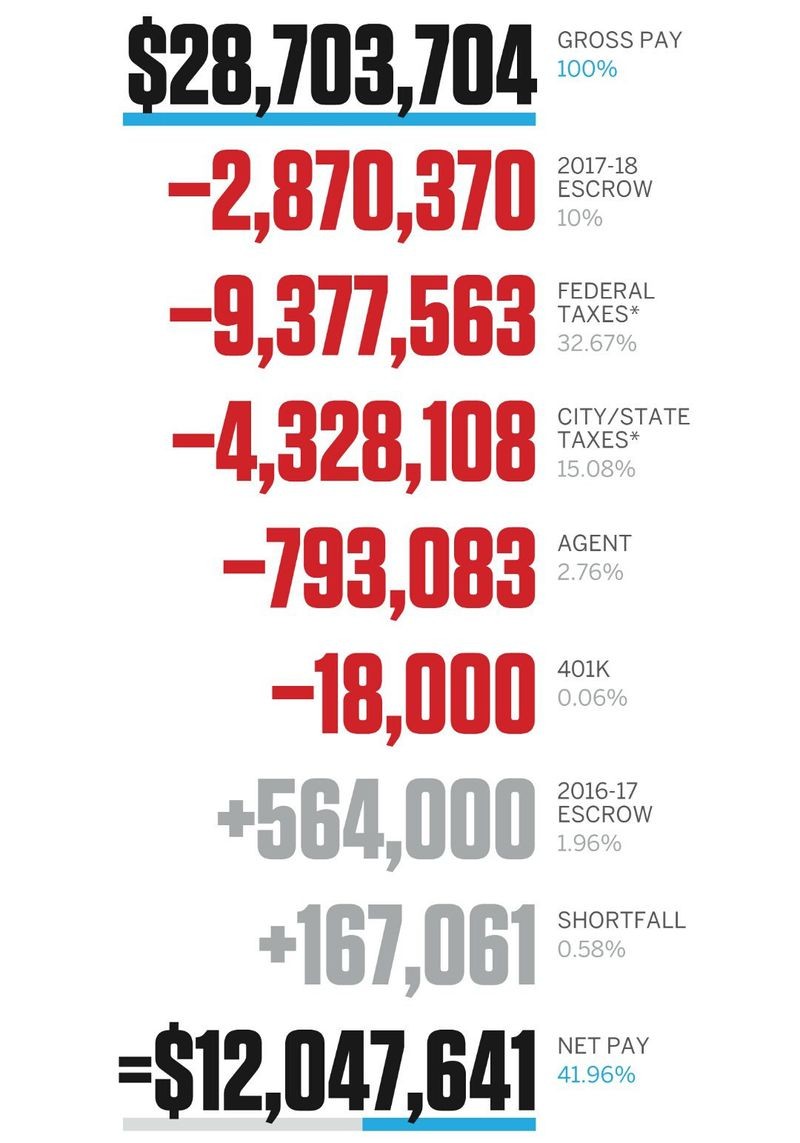

21 An Hour Salary After Taxes Salary after taxes 21 hr is 32 760 a year after taxes You may be wondering if 21 an hour is enough money to pay the bills However a lot of it comes down to where you reside For example if you live in California as a single adult with no kids the living wage is 21 24 an hour So if you re making 21 an hour you re earning

An hourly wage of 21 per hour equals a yearly salary of 43 680 before taxes assuming a 40 hour work week After accounting for an estimated 24 72 tax rate the yearly after tax salary is approximately 32 883 90 On a monthly basis before taxes 21 per hour equals 3 640 per month An hourly calculator lets you enter the hours you worked and amount earned per hour and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered You can use this tool to see how changing your paycheck affects your tax results

21 An Hour Salary After Taxes

21 An Hour Salary After Taxes

http://cdn.chatsports.com/thumbnails/1359-80574-original.jpeg

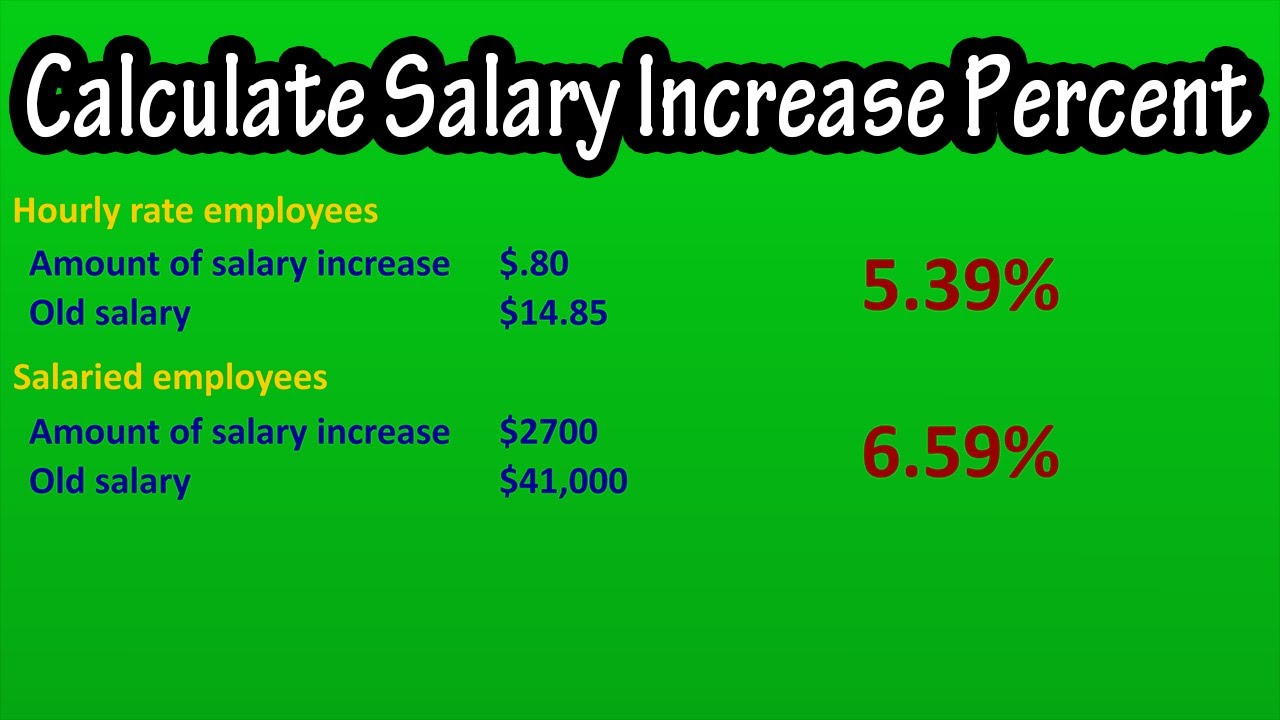

How To Calculate Find Salary And Hourly Pay Increase Percentage

https://i.ytimg.com/vi/zxc6xliw8Nk/maxresdefault.jpg

McDonald s In The United States Is Willing To Pay 21 An Hour For

https://s.hdnux.com/photos/01/22/31/75/21602166/4/rawImage.jpg

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get Annual salary Annual salary Gross income Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to 21 An Hour Salary After Taxes

20 An Hour Is How Much A Year Can I Live On It Money Bliss

https://moneybliss.org/wp-content/uploads/2021/09/20-per-hour-is-how-much-per-year.jpg

30 An Hour Is How Much A Year Is It Enough Freedomeer

https://freedomeer.com/wp-content/uploads/2022/08/30-dollars-an-hour-featured.png

Denver International Airport TSA Hosts Hiring Event This Week 21 Hour

https://denver.cbslocal.com/wp-content/uploads/sites/15909806/2018/04/tsa-snacks-5pkg-transfer_frame_438.png?resize=1138

How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 The formula of calculating annual salary and hourly wage is as follow Annual Salary Hourly Wage Hours per workweek 52 weeks Quarterly Salary Annual Salary 4 Monthly Salary Annual Salary 12 Semi Monthly Salary Annual Salary 24 Biweekly Salary Annual Salary 26

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income 2 518 210 97 48 9 68 1 21 Social Security 4 301 358 165 83 16 54 2 07 assuming full time employment and a 40 hour work week However each state sets its own minimum hourly wage so long as it exceeds the federal Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect

21 An Hour Is How Much A Year Howcanpay

https://howcanpay.com/wp-content/uploads/2023/01/21-An-Hour-How-Much-A-Year-1024x598.png

21 An Hour Is How Much A Year Can I Live On It Money Bliss

https://moneybliss.org/wp-content/uploads/2020/05/77.jpg

21 An Hour Salary After Taxes - How much is 21 an Hour After Tax in the United States In the year 2024 in the United States 21 an hour gross salary after tax is 36 976 annual 2 802 monthly 644 4 weekly 128 88 daily and 16 11 hourly gross based on the information provided in the calculator above