20 An Hour After Taxes In Texas 58 Texas anti DEI law along with several laws on taxes are among the 30 laws that go into effect on Jan 1 2024

Texas voters overwhelmingly approved the biggest property tax rebate in history this November The most talked about part of the Senate Bill 2 which permanently raises of the homestead exemption on local school taxes from 40 000 to 100 000 per year went into effect immediately after it was approved by Texas voters but Article 4 of the Income tax calculator Texas Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 Social Security 3 410 Medicare 798 Total tax 9 076 Net pay 45 925 Marginal tax rate 29 6 Average tax rate 16 5

20 An Hour After Taxes In Texas

20 An Hour After Taxes In Texas

https://ofl.ca/wp-content/uploads/2022.11.14-PR-FallEconomicStatement-01-1024x576.png

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

13 Dollars An Hour 40 Hours A Week After Taxes Marx Langdon

https://qph.fs.quoracdn.net/main-qimg-e04739cbbcf836628ffc558f19035be9

SB 2 88th 2nd C S the Property Tax Relief Act provides for a 0 107 reduction in a public school district s maximum compressed tax rate for the 2023 24 school year increases the amount of Income you earn that s in excess of 200 000 single filers 250 000 joint filers or 125 000 married people filing separately is also subject to a 0 9 Medicare surtax Your employer will not match this surtax though Any premiums that you pay for employer sponsored health insurance or other benefits will also come out of your paycheck

Texas Salary Calculator for 2024 The Texas Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Texas State Income Tax Rates and Thresholds in 2024 Details of the personal income tax rates used in the 2024 Texas State Calculator are published The franchise tax exemption under SB 3 will double the exemption threshold from 1 23 million to 2 47 million in gross receipts removing approximately 67 000 additional businesses from paying

More picture related to 20 An Hour After Taxes In Texas

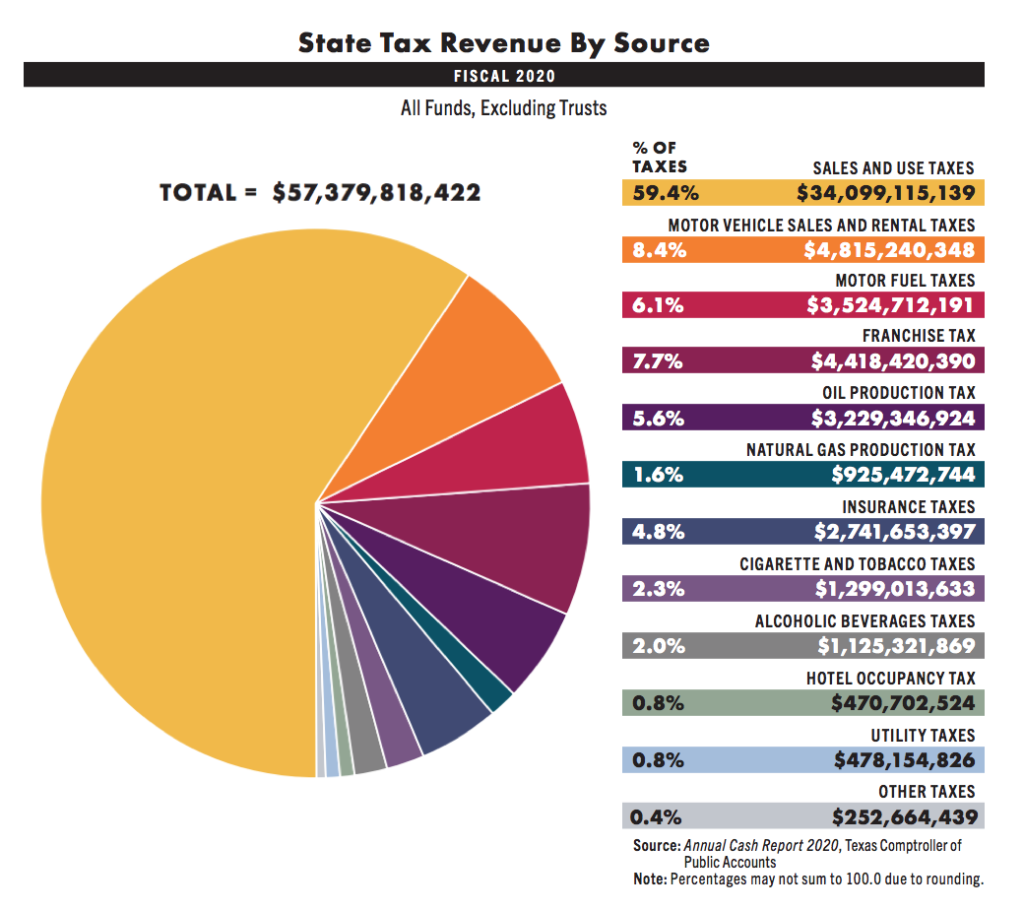

What Are The Tax Rates In Texas Texapedia

https://www.honestaustin.com/wp-content/uploads/2020/02/Texas-Tax-Revenue-by-Source-2020-1024x911.png

Why Are Texas Property Taxes So High Home Tax Solutions

https://www.hometaxsolutions.com/wp-content/uploads/2019/09/property-tax-texas-increase.jpg

Do You Need To File Taxes As A Small Business Owner Camino Financial

https://img.caminofinancial.com/wp-content/uploads/2019/09/25155936/iStock-508151968-1024x724.jpg

Lt Gov Dan Patrick said homeowners with an average priced home could see a savings of 1 250 1 450 annually Zillow estimated the average Texas home value at 298 424 as of Oct 31 2023 Estimated tax payments are typically due April 15 June 15 Sept 15 and Jan 15 each year though they can be moved to the following business day if the deadline falls on a weekend or holiday For the 2024 tax year you ll need to submit your estimated tax payments by April 15 June 17 Sept 16 and Jan 15 2025 Newsletter

This allows you to review how Federal Tax is calculated and Texas State tax is calculated and how those income taxes affect the salary after tax calculation on a 20 00 during the 2024 tax year and historical tax years supported by the Texas salary example tool State Tax Changes Taking Effect January 1 2024 Thirty four states will ring in the new year with notable tax changes including 15 states cutting individual or corporate income taxes and some cutting both Generally state tax changes take effect either at the start of the calendar year January 1 or the fiscal year July 1 for most states

29 000 A Year Is How Much An Hour Zippia

https://static.zippia.com/answer-images/29000-a-year-is-how-much-an-hour.png

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Revenu Net Apr s Imp ts NIAT

https://www.investopedia.com/thmb/Q5ir-NHCLUsmqJvAAh9FImZ64CU=/1247x0/filters:no_upscale():max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg

20 An Hour After Taxes In Texas - Texas Salary Calculator for 2024 The Texas Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Texas State Income Tax Rates and Thresholds in 2024 Details of the personal income tax rates used in the 2024 Texas State Calculator are published