15 Per Hour Monthly Salary After Taxes To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

15 Per Hour Monthly Salary After Taxes

15 Per Hour Monthly Salary After Taxes

https://uploads-ssl.webflow.com/56b26b90d28b886833e7a055/57ca19588bb9d6ee1a1ed827_pexels-photo-58728.jpeg

Minimum Wage In US Nebraska Among States That Voted For Higher Rate

https://d.ibtimes.com/en/full/3198288/efforst-raise-us-minimum-wage-15-hour-have-not-advanced-congress-more-companies-are-still.jpg

Annual Salary To Hourly Income Conversion Calculator

https://calculator.me/img/salary-raise.png

When examining a 15 an hour after tax income the corresponding daily earnings can be determined Take home NET daily income 93 98 assuming a 5 day work week To find out 15 an hour is how much a day divide the annual figure by 260 52 weeks 5 days resulting in a daily income of 93 98 Is 15 an Hour a Good Salary Convert 15 Per Hour to Yearly Monthly Biweekly and Weekly Salary After Taxes 15 Per Hour to Yearly Monthly Biweekly Weekly and Week Salary After Taxes Table

Estimate the after tax pay for hourly employees by entering the following information into a hourly paycheck calculator Hourly rate Gross pay and pay frequency Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to 15 Per Hour Monthly Salary After Taxes

Salary Slip Format Rewaminds

https://newdocer.cache.wpscdn.com/photo/20190827/77628f8f47614c8ca37c85581e680d82.jpg

Illinois 8 25 Starting Pay Will Increase To 10 An Hour In 2020 TMA

https://tmanews.com/wp-content/uploads/2019/09/15343.jpg

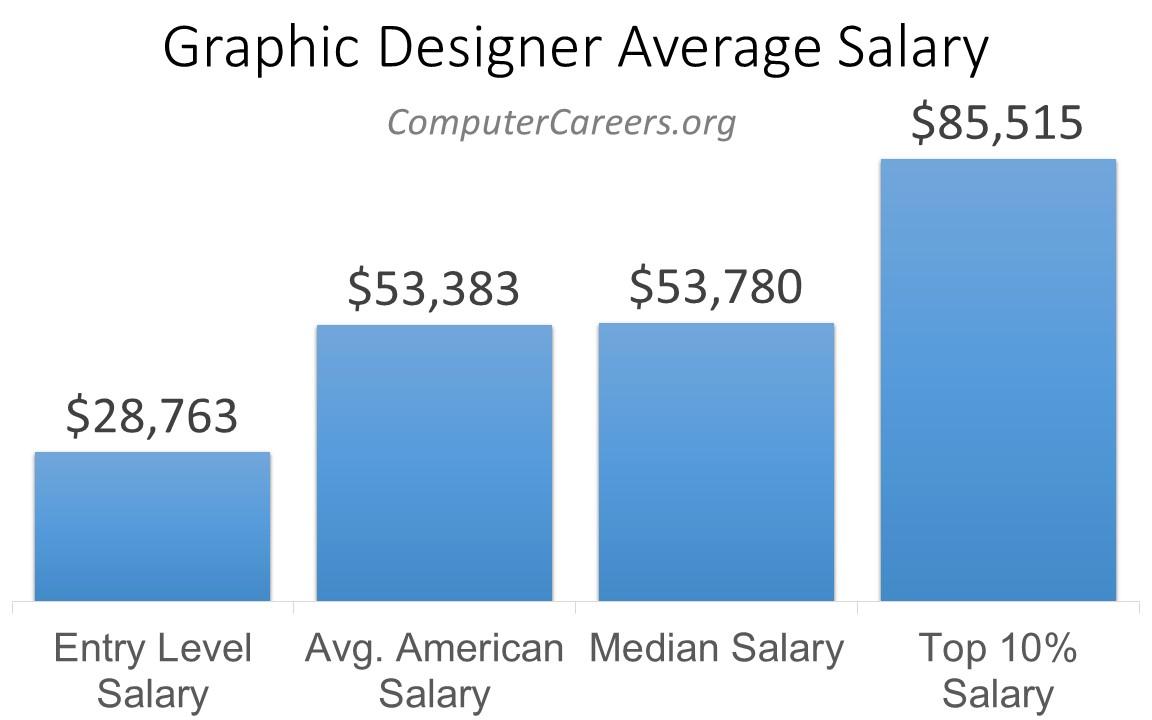

Graphic Designer Salary In 2023 ComputerCareers

https://cdn.computercareers.org/wp-content/uploads/Graphic-Designer-Average-Salary.jpg

Massachusetts income tax rate 5 00 9 00 Median household income 96 505 U S Census Bureau Number of cities that have local income taxes How Your Massachusetts Paycheck Works The size of your paycheck will depend of course on your salary or wages Arizona Paycheck Quick Facts Arizona income tax rate 72 581 U S Census Bureau Number of cities that have local income taxes Like every other state employers in Arizona withhold federal income and FICA taxes from your paychecks That money goes to the IRS who then divvies it up into Social Security Medicare and of course your annual

15 per hour is 2 400 per month Biweekly salary 15 per hour is 1 200 biweekly Weekly salary 15 per hour is 600 per week Daily salary 15 per hour is 120 per day Salary after taxes 15 hr is 23 400 a year after taxes You may be wondering if 15 an hour is enough money to pay the bills However a lot of it comes down to where you reside 15 an hour budget Is 15 dollars an hour good By the end of this post you ll be an expert on everything and hourly rate of 15 an hour including jobs that pay 15 an hour a sample budget for 15 dollars an hour salary and whether or not it s enough to live off of because in the end that s the only thing that matters

Hourly To Annual Salary Calculator Usa JouryAllisa

https://scrn-cdn.omnicalculator.com/finance/[email protected]

The Minimum Wage Crisis Today s Economy

https://sites.psu.edu/civicissue2019/files/2019/02/cwsd.php-23fxcjs.jpeg

15 Per Hour Monthly Salary After Taxes - Factoring in Federal Income Tax Considering State Income Tax Factoring in Local Taxes Accounting for FICA Taxes Social Security Medicare Total Estimated Tax Payments Calculating Your Take Home Pay Convert 15 5 Per Hour to Yearly Monthly Biweekly and Weekly Salary After Taxes