135k Salary After Taxes Texas The 135k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour This is particularly useful if you need to set aside part of your income in Texas for overseas tax payments etc

135k Salary After Tax in Texas 2022 This Texas salary after tax example is based on a 135 000 00 annual salary for the 2022 tax year in Texas using the State and Federal income tax rates published in the Texas tax tables The 135k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour The taxes that are taken into account in the calculation consist of your Federal Tax Texas State Tax No individual income tax in Texas Social Security and Medicare costs that you will be paying when earning 135 000 00

135k Salary After Taxes Texas

135k Salary After Taxes Texas

https://images.pexels.com/photos/2074110/pexels-photo-2074110.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

Kostenloses Foto Zum Thema Bucht D mmerung Drau en

https://images.pexels.com/photos/1121217/pexels-photo-1121217.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

Kostenloses Foto Zum Thema Auge Bokeh Bunt

https://images.pexels.com/photos/1595732/pexels-photo-1595732.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=650&w=940

Texas Paycheck Quick Facts 67 404 U S Census Bureau Your hourly wage or annual salary can t give a perfect indication of how much you ll see in your paychecks each year because your employer also withholds taxes from your pay Find out how much your salary is after tax Enter your gross income Per Where do you work Calculate Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 Social Security 3 410 Medicare 798 Total tax 9 076 Net pay 45 925 Marginal tax rate 29 6 Average tax rate 16 5 83 5 Net pay 16 5

Summary If you make 125 000 a year living in the region of Texas USA you will be taxed 30 290 That means that your net pay will be 94 710 per year or 7 893 per month Your average tax rate is 24 2 and your marginal tax rate is 31 7 This marginal tax rate means that your immediate additional income will be taxed at this rate Aside from income tax there s Social Security tax and Medicare tax which are also known as FICA taxes They are mandatory payroll taxes that fund the Social Security and Medicare programs Social Security tax is 6 2 of your gross income up to a certain limit 147 000 in 2022 while Medicare tax is 1 45 of your gross income with no limit

More picture related to 135k Salary After Taxes Texas

Kostenloses Foto Zum Thema Berge Drau en Gras

https://images.pexels.com/photos/1204430/pexels-photo-1204430.jpeg?auto=compress&cs=tinysrgb&dpr=3&h=750&w=1260

Kostenloses Foto Zum Thema Architektur Asphalt Autos

https://images.pexels.com/photos/1005647/pexels-photo-1005647.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=650&w=940

Kostenloses Foto Zum Thema Berg Drau en Felswand

https://images.pexels.com/photos/464409/pexels-photo-464409.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

This is the gross pay for the pay period before any deductions including wages tips bonuses etc You can calculate this from an annual salary by dividing the annual salary by the number of pay How much taxes are deducted from a 59 000 paycheck in Texas The total taxes deducted for a single filer are 812 84 monthly or 375 16 bi weekly Updated on Dec 05 2023 Free tool to calculate your hourly and salary income after federal state and local taxes in Texas

2024 US Tax Calculation for 2025 Tax Return 135k Salary Example If you were looking for the 135k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise Income tax calculator Texas Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 140 000 Federal Income Tax 24 328 Social Security 8 680 Medicare 2 030 Total tax 35 038 Net pay 104 963 Marginal tax rate 29 8 Average tax rate

Kostenloses Foto Zum Thema Attraktiv Bild Drau en

https://images.pexels.com/photos/1800433/pexels-photo-1800433.jpeg?auto=compress&cs=tinysrgb&dpr=3&h=750&w=1260

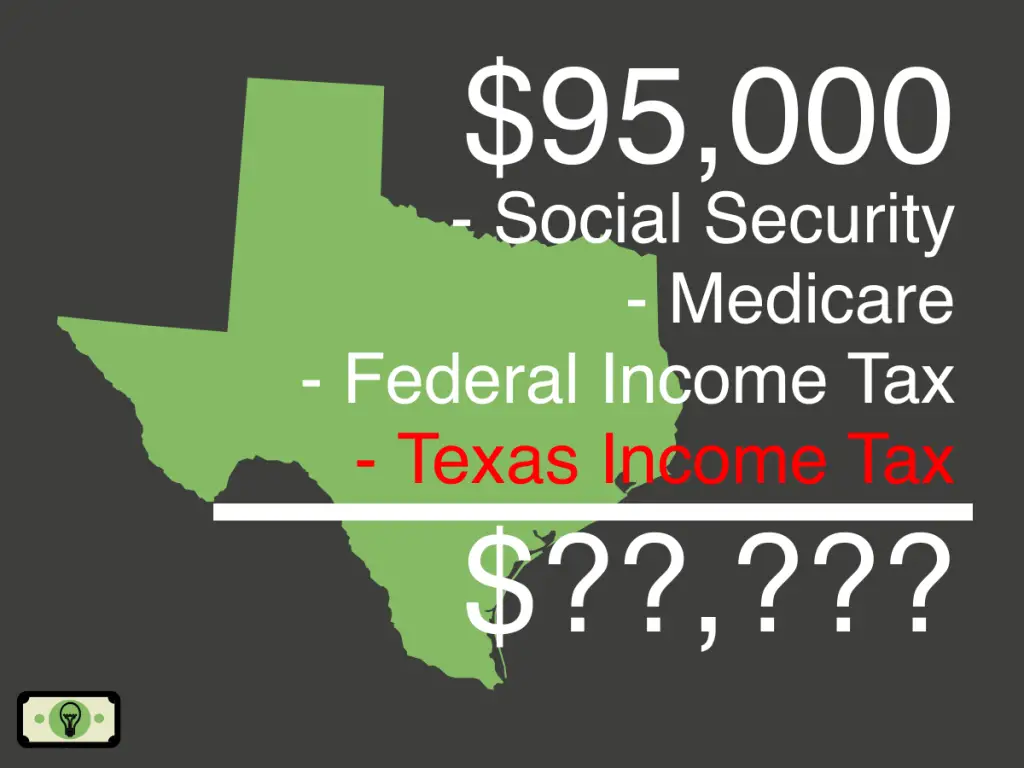

95K Salary After Taxes In Texas single 2013 Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/tx-95000-after-taxes-sm-1024x768.png

135k Salary After Taxes Texas - Summary If you make 125 000 a year living in the region of Texas USA you will be taxed 30 290 That means that your net pay will be 94 710 per year or 7 893 per month Your average tax rate is 24 2 and your marginal tax rate is 31 7 This marginal tax rate means that your immediate additional income will be taxed at this rate