135k Salary After Taxes Florida 135 000 income tax calculator 2023 Florida salary after tax Income tax calculator Florida Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 135 000 Federal Income Tax 23 128 Social Security 8 370 Medicare 1 958 Total tax

135k Salary After Tax in Florida 2022 This Florida salary after tax example is based on a 135 000 00 annual salary for the 2022 tax year in Florida using the State and Federal income tax rates published in the Florida tax tables The 135k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour This 135 000 00 Salary Example for Florida is based on a single filer with an annual salary of 135 000 00 filing their 2024 tax return in Florida in 2024 You can alter the salary example to illustrate a different filing status or show an alternate tax year

135k Salary After Taxes Florida

135k Salary After Taxes Florida

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2018/01/mortgage-rates-january-2-GettyImages-588954686-1920x1152.jpg

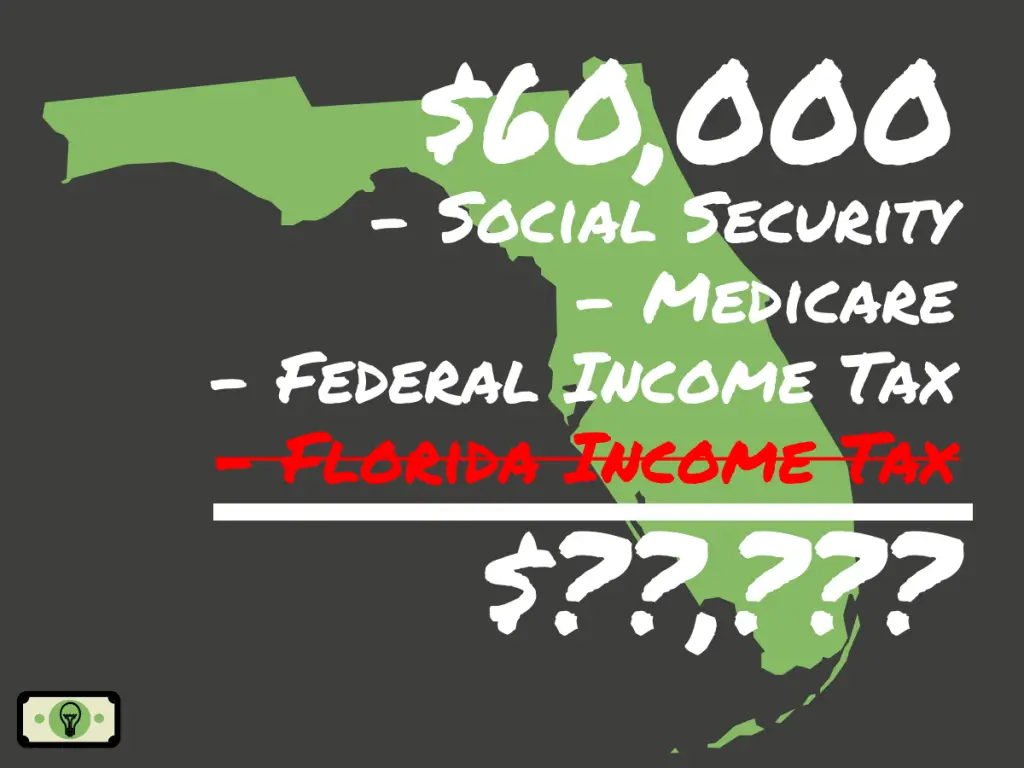

60 000 Dollars Salary After Taxes In Florida single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/09/fl-60000-after-taxes-sm-1024x768.png

Foto Der Person Die Milch In Kaffee Gie t Kostenloses Stock Foto

https://images.pexels.com/photos/2074110/pexels-photo-2074110.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

Provided you file taxes with the status single 135 000 annually will net you 102 197 a year This means you pay 32 802 92 in taxes on an annual income of 135 000 dollars In this article we will explore What is the marginal tax rate on 135 000 and What other taxes do you pay in Florida Money you contribute to a 401 k is pre tax which means the contributions come out of your paycheck before income taxes are removed The advantage of pre tax contributions is that they lower your taxable income You can also make pre tax contributions by enrolling in flexible spending accounts FSAs and health savings accounts HSAs

The taxes that are taken into account in the calculation consist of your Federal Tax Florida State Tax No individual income tax in Florida Social Security and Medicare costs that you will be paying when earning 135 000 00 Federal Paycheck Calculator Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023

More picture related to 135k Salary After Taxes Florida

Kostenloses Foto Zum Thema Bucht D mmerung Drau en

https://images.pexels.com/photos/1121217/pexels-photo-1121217.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=750&w=1260

Top 10 52000 A Year Is How Much A Month After Taxes That Will Change

https://images.squarespace-cdn.com/content/v1/55693d60e4b06d83cf793431/1658954291602-IT66OQ32WNXK3P7KU2OZ/AdobeStock_469754966.jpeg

Kostenloses Foto Zum Thema Auge Bokeh Bunt

https://images.pexels.com/photos/1595732/pexels-photo-1595732.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=650&w=940

Summary If you make 130 000 a year living in the region of Florida USA you will be taxed 31 873 That means that your net pay will be 98 128 per year or 8 177 per month Your average tax rate is 24 5 and your marginal tax rate is 31 7 This marginal tax rate means that your immediate additional income will be taxed at this rate When examining a 135 000 a year after tax income the corresponding daily earnings can be determined Take home NET daily income 349 65 assuming a 5 day work week To find out 135 000 a year is how much a day divide the annual figure by 260 52 weeks 5 days resulting in a daily income of 349 65 135 000 a Year is How Much an Hour

Summary If you make 55 000 a year living in the region of Florida USA you will be taxed 9 076 That means that your net pay will be 45 925 per year or 3 827 per month Your average tax rate is 16 5 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate 2024 US Tax Calculation for 2025 Tax Return 135k Salary Example If you were looking for the 135k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise

Kostenloses Foto Zum Thema Berge Drau en Gras

https://images.pexels.com/photos/1204430/pexels-photo-1204430.jpeg?auto=compress&cs=tinysrgb&dpr=3&h=750&w=1260

Kostenloses Foto Zum Thema Architektur Asphalt Autos

https://images.pexels.com/photos/1005647/pexels-photo-1005647.jpeg?auto=compress&cs=tinysrgb&dpr=2&h=650&w=940

135k Salary After Taxes Florida - 125 000 00 Salary Income Tax Calculation for Florida This tax calculation produced using the FLS Tax Calculator is for a single filer earning 125 000 00 per year The Florida income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in Florida for 125 000 00 with