13 An Hour Salary After Taxes They essentially mean the same thing just phrased slightly differently 13 an hour is 27 040 annually This result is found by multiplying 13 x 40 x 52 to get the final annual amount In the equation the 13 stands for 13 dollars an hour 40 means 40 hours a week and 52 stands for 52 weeks in a year

An hourly wage of 13 per hour equals a yearly salary of 27 040 before taxes assuming a 40 hour work week After accounting for an estimated 24 41 tax rate the yearly after tax salary is approximately 20 440 51 On a monthly basis before taxes 13 per hour equals 2 253 33 per month To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

13 An Hour Salary After Taxes

13 An Hour Salary After Taxes

https://static.zippia.com/answer-images/1350-an-hour-is-how-much-a-year.png

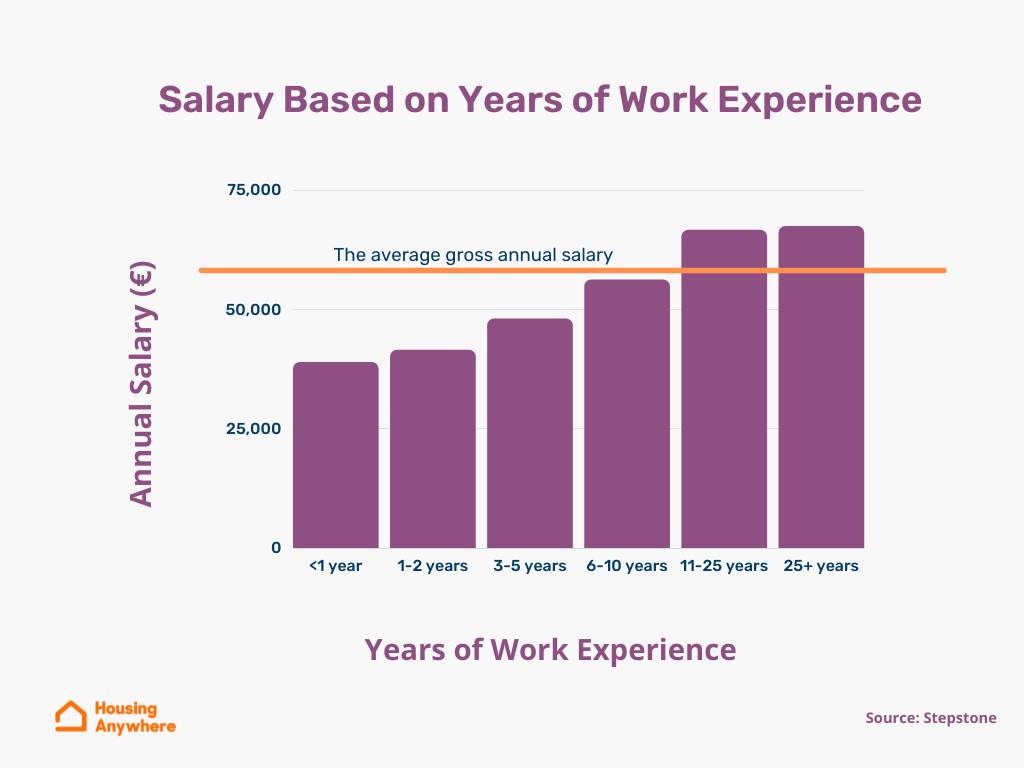

Your Guide to Average Salaries and Minimum Wage in Germany (2022–2023)

https://images.ctfassets.net/qr8kennq1pom/7e9qV7t6aptTlqSQZ50l9E/3217dedcfadf91e1378300a1c9549a85/Germany_Average_Salaries_2021.png?fm=jpg&fl=progressive&q=70

After tax - UK Salary Tax Calculator

https://www.income-tax.co.uk/wp-content/uploads/2021/02/36000-after-tax-salary-uk-2020.png

So how much FICA taxes do you pay for a 13 an hour yearly salary Take a look 6 2 for Social Security tax or 1 676 48 1 45 for Medicare tax or 392 08 That would be a total of 2 068 56 for FICA taxes And when this amount is also deducted from your salary you re left with 23 486 14 How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04

In this case you would make a 40 hours x 52 weeks operation which gives you 2 080 hours a year Now you only need to multiply 2 080 hours for 13 an hour and you get 27 040 a year People working overtime taking on extra work or receiving tips need to add them to the total number Adding those extra work hours or tips can drastically Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total

More picture related to 13 An Hour Salary After Taxes

$16.50 an hour is how much a year? - Zippia

https://static.zippia.com/answer-images/1650-an-hour-is-how-much-a-year.png

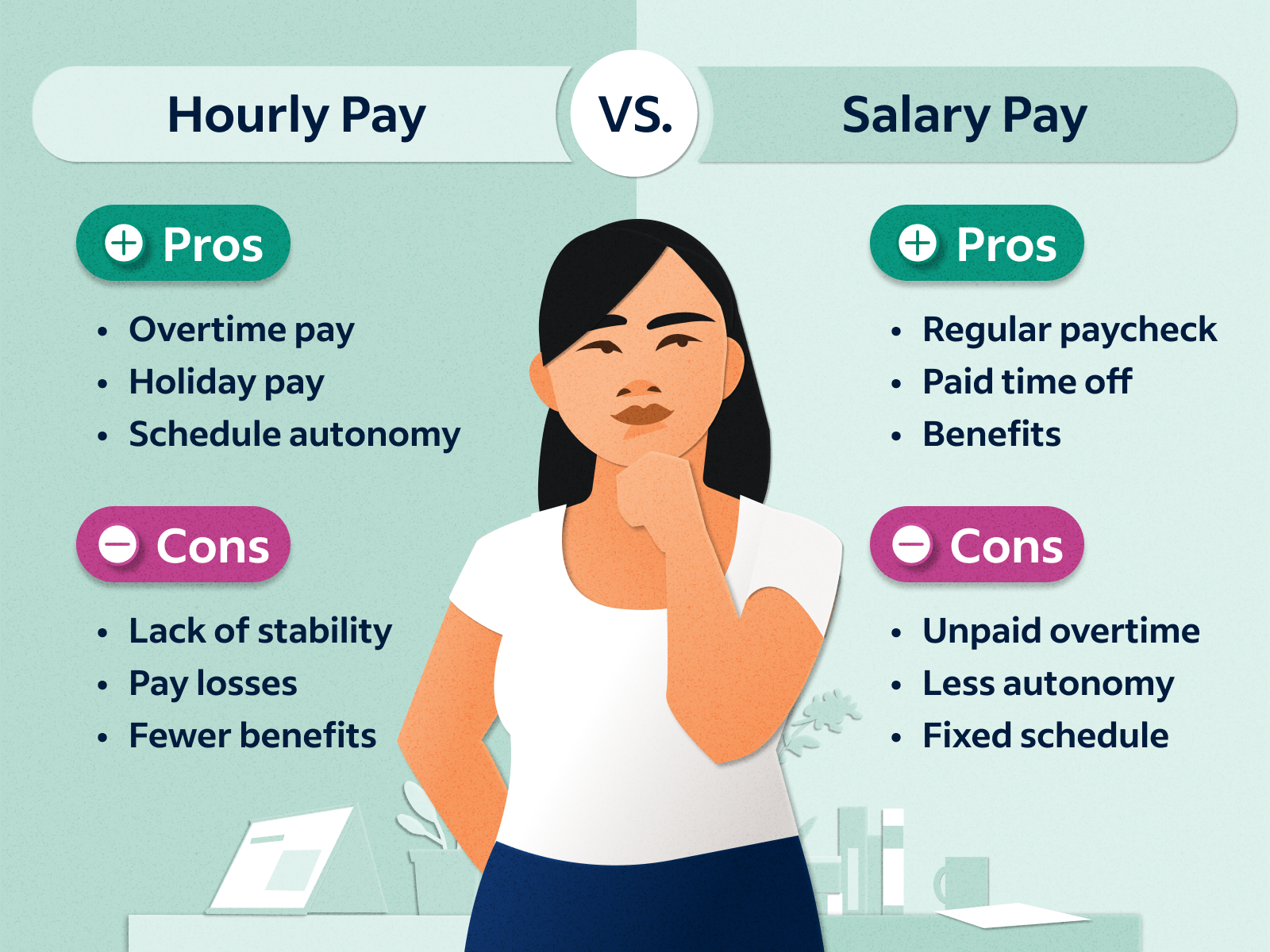

Hourly to Salary Calculator: How To Convert Your Wages | Indeed.com

https://images.ctfassets.net/pdf29us7flmy/4pFOfwO8DKsTBzi6ny4dyg/5792c4141a3b12cccbf29e3310995b7f/hourly-vs-salary-new.png

Hourly Wage Calculator | Salary Calculator 2021/22 - Wise

https://lienzo.s3.amazonaws.com/images/d2586503dc017a561b5aa94202bf32f4-little-people-with-calculator.png

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major In the year 2023 in the United States 13 an hour gross salary after tax is 23 560 annual 1 790 monthly 411 76 weekly 82 35 daily and 10 29 hourly gross based on the information provided in the calculator above

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator A 13 per hour annual salary is about 27 040 provided you work 40 hours a week You can usually expect to be paid time and half if you work over 40 hours a week When calculating your monthly salary if you are paid an hourly wage be sure to subtract your meal breaks Everyone is responsible for paying federal income taxes on their entire

How much 50% E13 TV-L pay per month in Germany for PhD student? - Quora

https://qph.cf2.quoracdn.net/main-qimg-3a4e8116ffefadfc63c7b4a8a29d33c3-lq

$42,000 a year is how much an hour? - Zippia

https://static.zippia.com/answer-images/42000-a-year-is-how-much-an-hour.png

13 An Hour Salary After Taxes - So how much FICA taxes do you pay for a 13 an hour yearly salary Take a look 6 2 for Social Security tax or 1 676 48 1 45 for Medicare tax or 392 08 That would be a total of 2 068 56 for FICA taxes And when this amount is also deducted from your salary you re left with 23 486 14