12 Dollars An Hour After Tax To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

If you make 12 an hour you would take home 18 720 a year after taxes Your pre tax salary was 24 960 But after paying 25 in taxes your after tax salary would be 18 720 a year The amount you pay in taxes depends on many different factors But assuming a 25 to 30 tax rate is reasonable Additional Federal WithholdingIf you have additional withholding dollars taken from each check beyond your regular W 4 specifics enter that amount here Do not enter a dollar sign and do not use commas rates are 0 10 12 22 24 32 35 or 37 2024 Tax Rate Single of the gross pay or a percentage of the net pay For hourly

12 Dollars An Hour After Tax

12 Dollars An Hour After Tax

https://i.ytimg.com/vi/_bJ7UfMouOE/maxresdefault.jpg

30 An Hour Is How Much A Year Before After Taxes Budget Examples

https://i.pinimg.com/originals/ac/eb/7a/aceb7a293fbca7f4cbcce80d5621eec6.png

How To Make 100 In An Hour How To Make 100 Dollars An Hour

https://indiaearnmoneyonline.com/wp-content/uploads/2021/09/Earn-1000-From-Blogging.jpg

Multiply the hourly wage by the number of hours worked per week Then multiply that number by the total number of weeks in a year 52 For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52 000 Important Note on the Hourly Paycheck Calculator The calculator on this page is Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

The 12 month period for income taxes begins on January 1st and ends on December 31st of the same calendar year The federal income tax rates differ from state income tax rates Federal taxes are progressive higher rates on higher income levels At the same time states have an advanced tax system or a flat tax rate on all income After Tax Tax Add New Clear All We d love your feedback Salary Calculator Results 12 Biweekly payments per year 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax Due 1 244

More picture related to 12 Dollars An Hour After Tax

28 An Hour Is How Much A Year SpendMeNot

https://spendmenot.com/wp-content/uploads/2022/09/27-an-Hour-Is-How-Much-a-Year.jpg

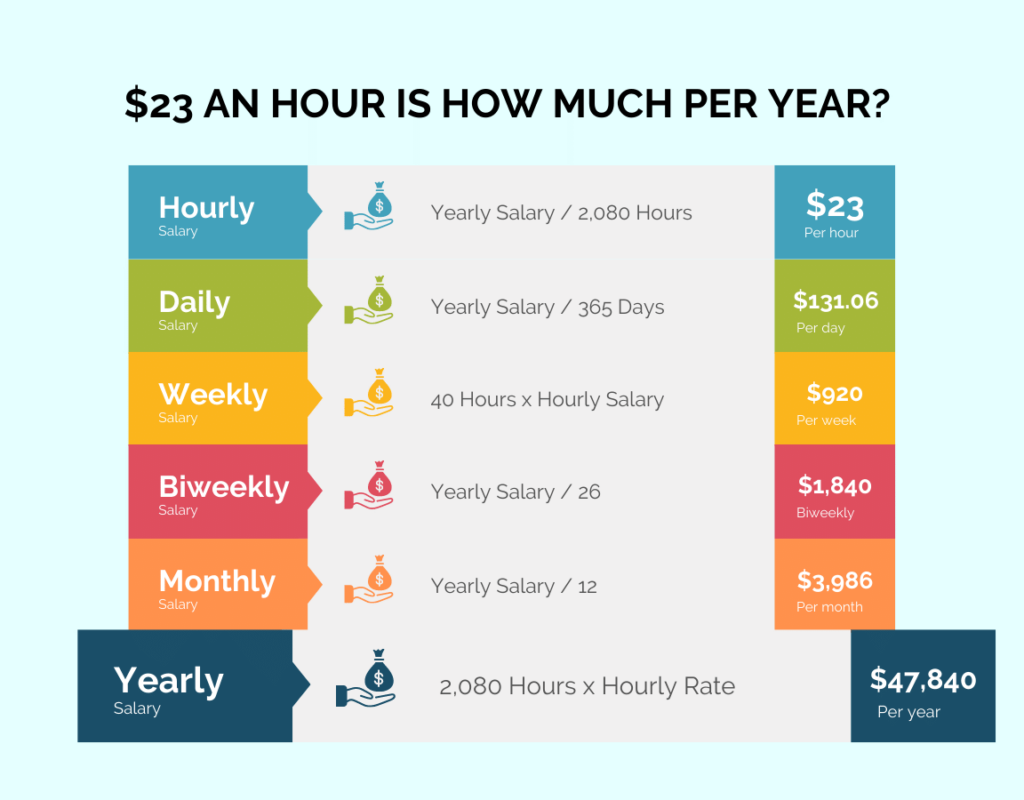

Solved The Following Graph Shows The Labor Market For Chegg

https://media.cheggcdn.com/study/16b/16b200ce-4736-486b-8f98-1b3dafc34ff5/image

Florida s Minimum Wage Increases In 2017

https://gray-wjhg-prod.cdn.arcpublishing.com/resizer/Tach3Zhm5ZIbKyu2MI6lX0qc1JY=/980x0/smart/cloudfront-us-east-1.images.arcpublishing.com/gray/DAUONNGRLZICBDTJUQ3WJEKC5U.png

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect 2013 46 992 If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750 If you earn more than that then you ll be taxed 2 on income between 750 and 2 250 The marginal rate rises to 3 on income between 2 250 and 3 750 4 on income between 3 750 and 5 250 5 on income between 5 250 and

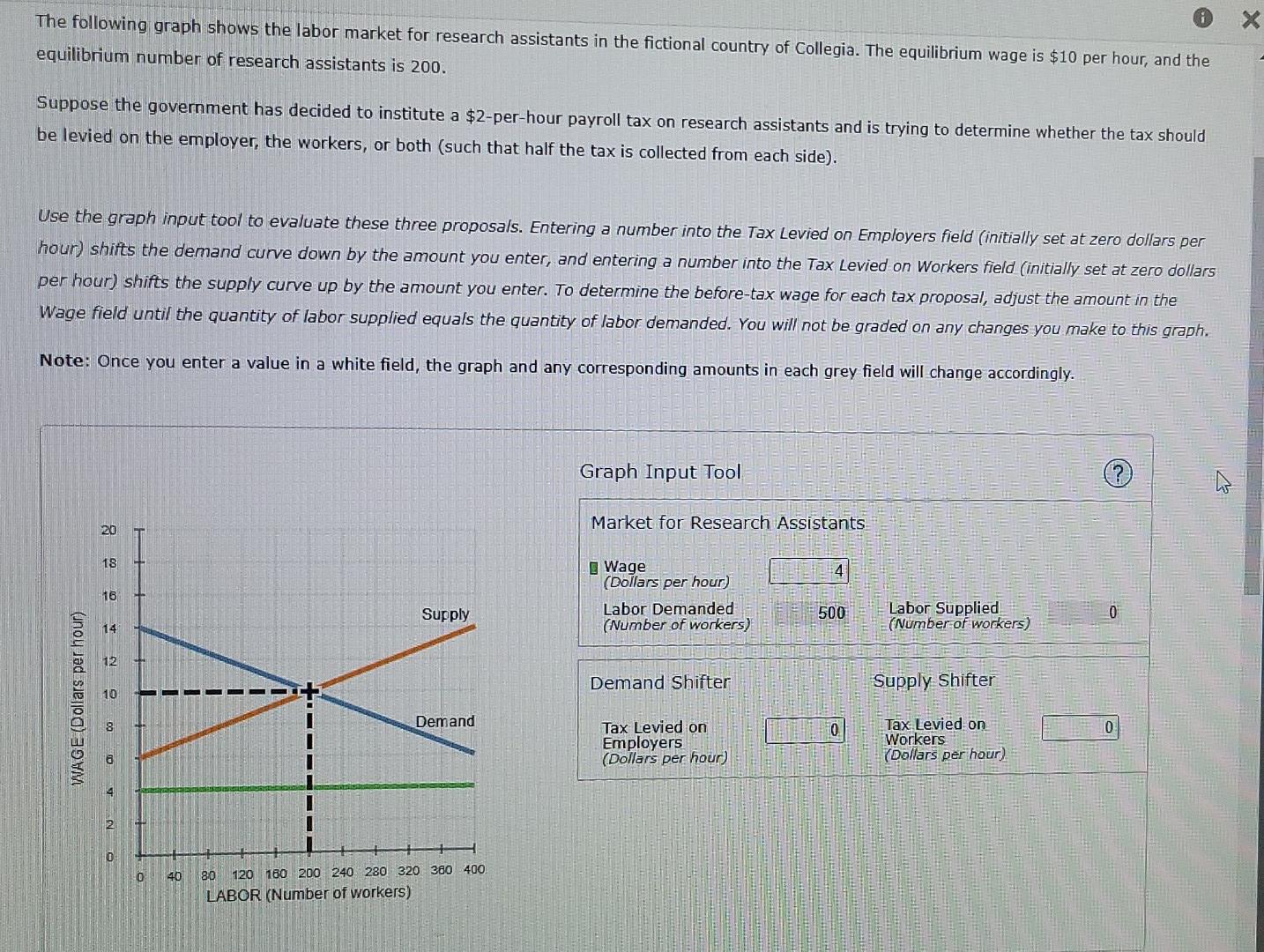

Hourly Rate Equivalent To Yearly Salary DominicTeresa

https://www.howtofire.com/wp-content/uploads/23-dollars-an-hour-1024x800.png

20 An Hour Is How Much A Year Good Financial Cents

https://www.goodfinancialcents.com/wp-content/uploads/2023/04/20-dollars-per-hour-scaled.jpg

12 Dollars An Hour After Tax - This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate There is in depth information on how to estimate salary earnings per each period below the form Method 1 Method 2 How much do you get paid How many hours per day do you work