105k Salary After Taxes Nyc New York income tax rate 4 00 10 9 Median household income 81 386 U S Census Bureau Number of cities that have local income taxes How Your New York Paycheck Works When you start a job in the Empire State you have to fill out a

105 000 income tax calculator 2024 New York salary after tax Income tax calculator New York Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 105 000 Federal Income Tax 15 948 State Income Tax 5 595 Social Security 6 510 Medicare The taxes that are taken into account in the calculation consist of your Federal Tax New York State Tax Social Security and Medicare costs that you will be paying when earning 105 000 00

105k Salary After Taxes Nyc

105k Salary After Taxes Nyc

https://image.cnbcfm.com/api/v1/image/102289145-147265650.jpg?v=1575490548

Salary Of 105k Needed For Comfortable Lifestyle In UK R FIREUK

https://external-preview.redd.it/OCNeDvSvs6xsGsQcvfQ6r0zzDoejyrAzTOytZkjknMI.jpg?auto=webp&s=fc2e9f63d9820377da627400d2da62723e24966b

Salary Free Of Charge Creative Commons Wooden Tile Image

https://www.thebluediamondgallery.com/wooden-tile/images/salary.jpg

How much taxes are deducted from a 65 000 paycheck in New York State The total taxes deducted for a single filer living in New York City are 1424 47 monthly or 657 45 bi weekly If he lives elsewhere in the state the total taxes will be 1250 72 monthly or 577 26 bi weekly Updated on Dec 05 2023 Income tax calculator New York Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 571 Social Security 3 410 Medicare 798 SDI State Disability Insurance 31 20

The state income tax rate in New York is progressive and ranges from 4 to 10 9 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate To find out 105 000 a year is how much a day divide the annual figure by 260 52 weeks 5 days resulting in a daily income of 279 85 105 000 a Year is How Much an Hour When analyzing a 105 000 a year after tax salary the associated hourly earnings can be calculated Take home NET hourly income 34 98 assuming a 40 hour work week

More picture related to 105k Salary After Taxes Nyc

Salary Free Of Charge Creative Commons Highway Sign Image

https://www.picpedia.org/highway-signs/images/salary.jpg

Should I Ask About Salary At My Interview Much As Salary

https://i.ytimg.com/vi/MVnoMcQnmtc/maxresdefault.jpg

How Much To Counter Offer Salary Maximize Pay With 2 Examples

https://paydestiny.com/media/2022/03/How-Much-to-Counter-Offer-Salary-Feature.001.jpeg

Use ADP s New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Important note on the salary paycheck calculator The calculator on this page is provided through the ADP 105 000 00 After Tax This income tax calculation for an individual earning a 105 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration

Summary If you make 100 000 a year living in the region of New York USA you will be taxed 28 124 That means that your net pay will be 71 876 per year or 5 990 per month Your average tax rate is 28 1 and your marginal tax rate is 38 1 This marginal tax rate means that your immediate additional income will be taxed at this rate Income tax calculator New York Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 150 000 Federal Income Tax 26 728 State Income Tax 9 041 Social Security 9 114 Medicare 2 175 SDI State Disability Insurance 31 20

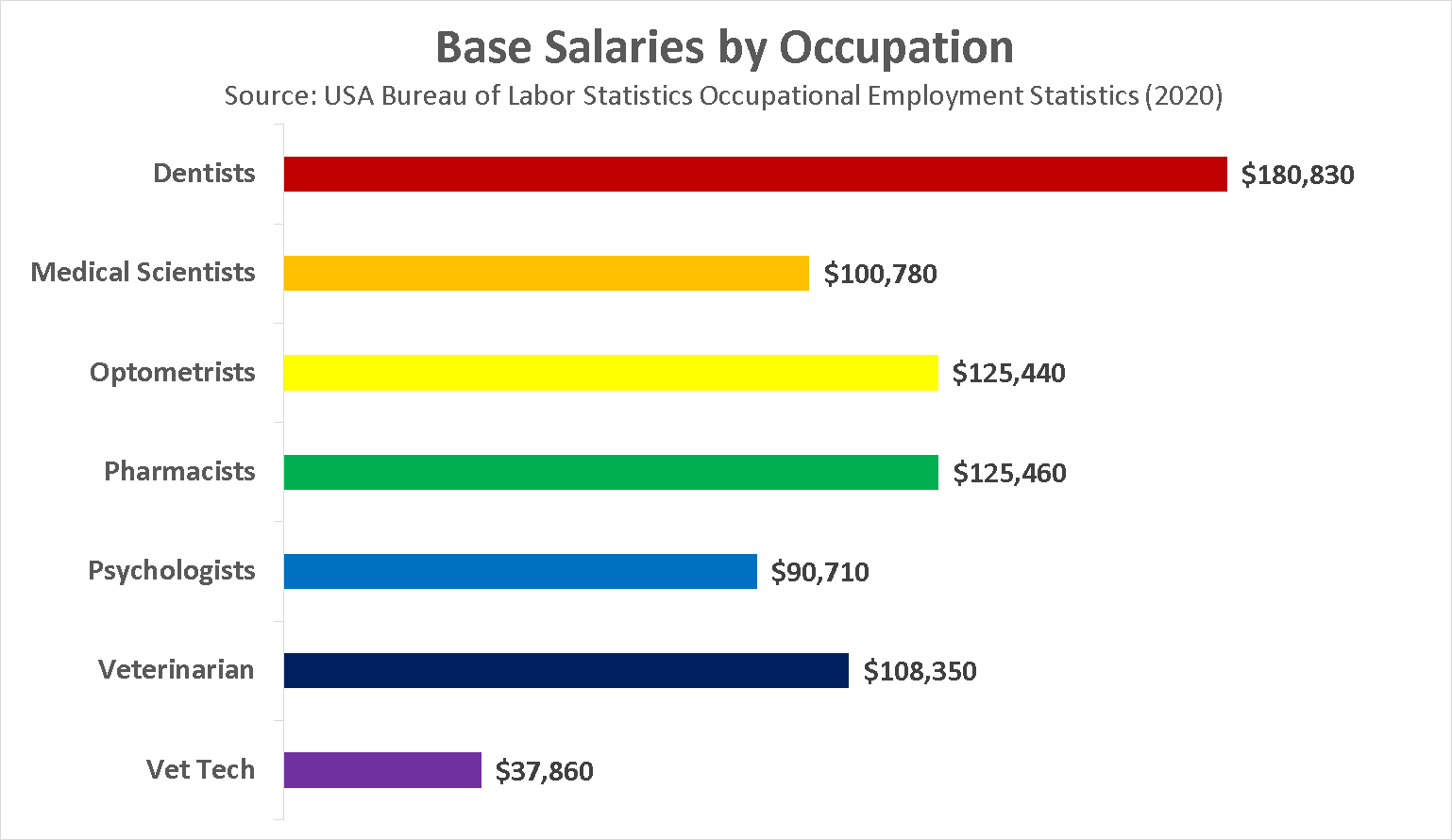

Become A Veterinarian In 2021 Salary Jobs Education

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/27625/images/PQq6Y4gcTFWrHxRuQVfW_Wages_Compared.png

Salary Free Of Charge Creative Commons Typewriter Image

https://www.thebluediamondgallery.com/typewriter/images/salary.jpg

105k Salary After Taxes Nyc - How much taxes are deducted from a 65 000 paycheck in New York State The total taxes deducted for a single filer living in New York City are 1424 47 monthly or 657 45 bi weekly If he lives elsewhere in the state the total taxes will be 1250 72 monthly or 577 26 bi weekly Updated on Dec 05 2023