100 000 Salary Bi Weekly After Taxes Take home salary for single filers 69 808 Take home salary for married filers 76 301 Oregon residents pay the highest taxes in the nation with single filers earning 100 000 a year paying 30 96 of their income and joint filers paying 24 22 The effective tax rate for single filers is a steep 8 28

We used a paycheck calculator to find out take home pay for a 100 000 salary in the largest US cities based on 2020 tax rates Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

100 000 Salary Bi Weekly After Taxes

100 000 Salary Bi Weekly After Taxes

https://i.pinimg.com/originals/cd/a9/55/cda9556d0c209c22a6227a4fefc6375d.jpg

Financial Literacy Reading A Pay Stub Financial Literacy High

https://i.pinimg.com/originals/6b/3d/dd/6b3ddd40fc610dd5715ed1587d02625b.jpg

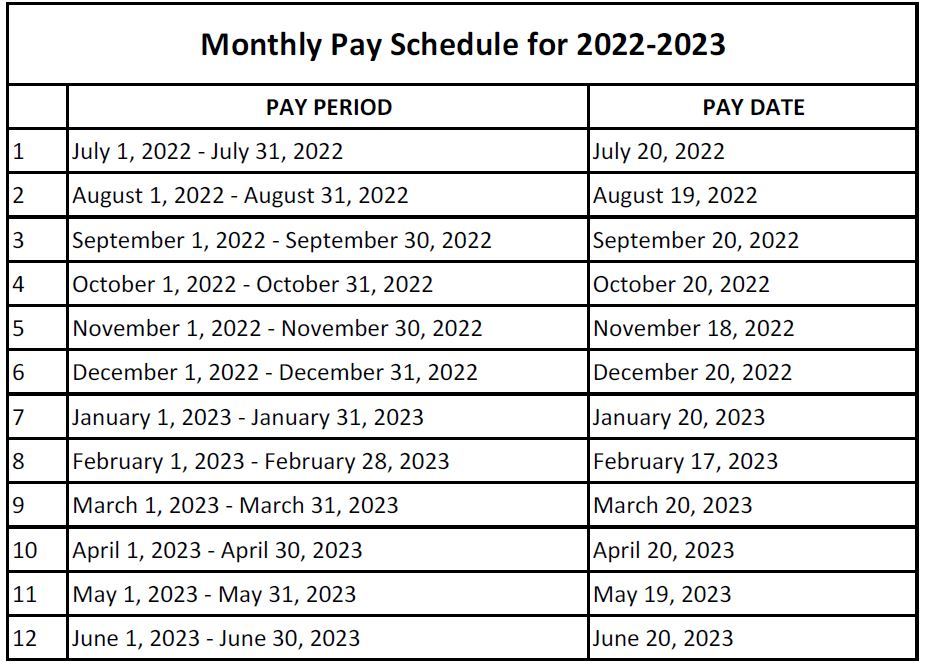

Ttec Payroll Calendar

https://i.pinimg.com/originals/73/e5/19/73e519320e03e1a2db0330e552482dd1.jpg

Here s a breakdown of what a single filer making a 100 000 salary will take home with bi weekly paychecks in the top 25 U S cities New York 2 540 Los Angeles 2 603 GOBankingRates used an in house income tax calculator to find both the effective and marginal tax rate on income of 100 000 in every state total gross bi weekly paycheck the after income

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status The table below details how Federal Income Tax is calculated in 2024 The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2024 Federal Tax Calculation for 100k Salary Annual Income 2024 100 000 00

More picture related to 100 000 Salary Bi Weekly After Taxes

Ultimate Check Stub Template For Download Monday Blog

https://res.cloudinary.com/monday-blogs/w_1044,h_573,c_fit/fl_lossy,f_auto,q_auto/wp-blog/2022/02/image4-1.png

How Far A 100 000 Salary Goes In America s 50 Largest Cities

https://s.yimg.com/uu/api/res/1.2/Sw0s4ucvOntGSE5tOgOwgQ--~B/aD0xMDgwO3c9MTkyMDthcHBpZD15dGFjaHlvbg--/http://media.zenfs.com/en-US/video/gobankingrates_644/c5ec7b93674bf3d86a2156b030117a19

Adjunct Letter Non Represented

https://s2.studylib.net/store/data/015384515_1-70b873fb68d63fc68e49de22ad41a6e1-768x994.png

As the new year kicks off some workers could see a slightly bigger paycheck thanks to tax bracket changes from the IRS The IRS in November unveiled the federal income tax brackets for 2024 2024 income tax brackets for filers who are married filing jointly Taxable income Federal tax rate 23 200 or less 10 23 201 94 300 2 320 plus 12 of income over 23 200 94 301

For example assume a hypothetical taxpayer who is married with 150 000 of joint income in 2024 and claiming the standard deduction of 29 200 They would owe the following taxes 10 of the first 23 200 2 320 12 of the next 71 100 8 532 22 of the remaining 26 500 5 830 If the 401 k plan allows for it workers may add post tax contributions beyond the 23 000 limit for 2024 up to 69 000 provided their salary is more than that threshold That goes up to as

State Of Arkansas Pay Period 2023 Pay Period Calendars 2023

https://www.bgsu.edu/content/dam/BGSU/payroll/Images/STRS-2022-2023-monthly-pay-calendar.jpg/jcr:content/renditions/kraken-large.jpg

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

100 000 Salary Bi Weekly After Taxes - GOBankingRates used an in house income tax calculator to find both the effective and marginal tax rate on income of 100 000 in every state total gross bi weekly paycheck the after income